MTI expands funding options

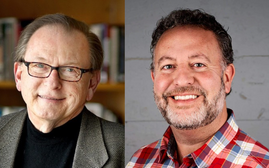

Photo/Tim Greenway

Executive Director Betsy Biemann and the MTI team have developed new financing options for Maine's tech companies

Photo/Tim Greenway

Executive Director Betsy Biemann and the MTI team have developed new financing options for Maine's tech companies

Maine Technology Institute, the nonprofit that for 12 years has worked to nurture technology-based startups, is widening its focus, offering new resources and money to help companies develop their businesses as well as their innovations.

Last week, MTI unveiled a restructured funding mechanism, including a new category specifically designed to help fledgling entrepreneurs test technology ideas. The new category, called TechStart, is intended to serve as an introduction to MTI’s other financing programs: seed grants, business development loans and equity capital funding.

The reorganization emerged following an internal review of MTI’s services and mission on the nonprofit’s 10th anniversary. The intent, says Executive Director Betsy Biemann, is to position MTI to better respond to needs within Maine’s business community and encourage job growth. The limited availability of investment money

for tech startups was a recurring theme discovered during the organization’s self-evaluation — a situation intensified by the current investment climate — and became a priority for directors and staff, says Biemann.

“All of these are updates to core programs,” she says. “They help us make better choices on what we fund.”

Since 2000, MTI has funded nearly 1,300 technology projects through $106 million in financial support, which has leveraged an additional $173 million from other sources. TechStart will fall under a group of revised services, called the Business Innovation Funding Program, which Biemann expects will help first-time entrepreneurs as well as experienced entrepreneurs. The program still requires a competitive application process and 1:1 matching funds and is available only to businesses within Maine’s seven technology clusters: biotechnology; composites and advanced materials; environmental technologies; forest products and agriculture; information technology; marine technology and aquaculture; and precision manufacturing.

Here’s how the Business Innovation Funding Program breaks down:

- TechStart grants, up to $5,000, awards made monthly to help new businesses plan, conduct market research, prepare proposals for federal Small Business Innovation Research grants and other business fundamentals. Early-stage and existing companies are eligible, as well as universities and nonprofit research institutions.

- Seed grants, up to $25,000, awards made quarterly to fund early-stage R&D, such as prototype development and testing, and intellectual property filings. Eligibility is the same as TechStart.

- Equity capital, up to $200,000, awarded quarterly to select MTI companies to achieve benchmarks needed for further private investment.

- Development loans, available for three purposes, for up to $500,000. The loans are conditional, with payments triggered by sales revenues or fees and intended for later-stage R&D work.

Accompanying this new grant-and-loan structure is a new financing product, the business development matching grant. The grant can be used to accelerate a range of standard business practices such as management training, developing a board of directors and recruiting strategic partners and investors.

“We hope to play more of a part in business attraction to Maine,” says Biemann. “We hope businesses will see the incentives, the infrastructure to grow a company in Maine and that it can compete for early-stage money.”

The business-acceleration matching grant is tied to federal SBIR funding, which is used exclusively for funding R&D. The hope is by offering the MTI grant as a sidecar to SBIR, growing technology businesses will be able to take care of business as well as develop their specific technology.

“Sometimes scientists don’t make the best business people,” says Biemann. “[The matching grant] could help someone developing a technology who realizes it could be used in a number of markets. Which market do I go for? Or help them answer whether to go for a patent or a trademark.”

The revised funding structure was clearly necessary for MTI to continue its mission, says Steve Smith, a partner of private venture firm Masthead Venture Partners and a member of the MTI board.

“Venture capitalists are very wary these days,” he says, “especially around early-stage companies. It’s extremely tough. There’s a lot of capital chasing later-stage companies. It’s that gap that MTI fills — getting companies to that later-stage point where they can attract venture capital.”

Biemann says good jobs with high wages, usually associated with technology companies, are key as Maine attempts to recover from the recession.

“[Our changes] better position innovative companies to access captial and grow, and that benefits everyone,” she says.

Comments