Research driven | Supporters argue that increased state investment in R&D will pay off in a big way — if it's allowed to happen

Rather than chasing tech jobs around the country, Durdag decided to stay in Maine. It took a few months, but his networking paid off in 2002 when the Maine Technology Institute helped Durdag get in touch with Biode Inc., a Westbrook-based company that had started in the late 80s as a research-and-development outfit funded by national agencies like the Department of Defense. Biode had just begun commercializing its line of high-tech sensors that measure the viscosity of fluids like oil or house paint, and Durdag's market experience helped him step in as chief operating officer. "I believed in the product, I believed in the technology and I thought it would work," says Durdag.

But since then, Durdag says the trip into the market has been anything but a smooth ride. Most technology companies, he says, struggle to keep the business going between the development and commercialization stages of their product, whether it's a technology company building a new piece of software or a biotech firm developing a new drug. Between those stages is a period Durdag calls the "valley of death," one that's endemic among technology-related industries. The reason, he says, is there's typically a lack of funding available to companies stuck in this particular developmental purgatory. "It's very common, but it's also a missing piece in Maine: How do you help companies avoid the valley of death?" asks Durdag. "How can we give them the resources to be able to get to the market?"

Though Durdag praises the state's infrastructure for funding research and development, he argues that some wide gaps in the system ˆ such as a lack of grant programs for near-to-market companies ˆ are acting as a barrier to development objectives like job growth and wage increases. But the fundamental problem, he says, is that there simply isn't enough money being pumped into the state's funding infrastructure.

Most Maine policymakers agree that increasing R&D spending is a sound investment for economic development. After all, the theory goes, more money flowing into state grant programs, university labs and research centers means more highly skilled ˆ and highly paid ˆ workers flowing into the Maine job market. Despite that rosy picture, the reality is considerably more complicated. For starters, bringing the state's R&D activity up to the national average will require an additional annual state expenditure of tens of millions of dollars. Where that money will come from is anyone's guess, though the most plausible answer is through a bond package like the one voters approved by a wide margin last November that earmarked $20 million in state funds for R&D initiatives.

That was last year: According to legislators, it'd be easier to untangle the state's knotted health care system than to get a bond issue on the ballot this year. What's more, there are plenty of questions about whether such funding would actually produce the desired result of more and better jobs. It's quite possible a company that's received millions in funding from state and local investors could be snapped up by an out-of-state business. Or worse, the company could flame out before it makes a dime or hires even one worker. So those who support boosting the state's R&D activity are faced not only with the challenge of digging up millions in funding, but also in convincing policymakers and the general public to support an initiative that might not bear fruit for a dozen years ˆ if ever.

That's a tough proposition among Augusta lawmakers, a group many say suffers from a collective case of political myopia when it comes to long-range economic planning initiatives.

Durdag feels that some of the onus is on companies like Biode to help convince policymakers and voters that increasing the state's R&D activity is a worthwhile pursuit. To that end, he's worked with Sen. Lynn Bromley, a South Portland Democrat who chairs the Joint Standing Committee on Business, Research and Economic Development, to discuss strategies to increase the visibility of this issue. The recommendations worked up by the pair range from calling for Gov. John Baldacci to convene a Blaine House summit on R&D this summer to an expansion of the Maine Technology Institute and the Small Enterprise Growth Fund to allow larger investments in later-stage companies.

He's also hoping to convince a state that seems reluctant to throw additional money at high-risk emerging technology companies to accept the inevitable failures that come with benefits of those investments. "In Maine, there's a sense of conservativeness about how to provide that kind of funding," Durdag says. "It's not an issue in places like California or North Carolina, because they've essentially done this kind of thing before. And they know that out of 20 companies, 10 will go bust and three will make it. And those three that make it will create jobs over and over and over again."

Political capital

Securing state money is the key to boosting Maine's R&D activity, supporters say. Although the bulk of funding for the state's existing R&D activity comes from private sources, state money is a very powerful tool in leveraging private-sector and federal funding. For example, the wording of the $20 million R&D bond package passed last November all but assured voters that, if passed, it would result in an additional $44 million in federal and private funds. The Maine Biomedical Research Fund also has used $42 million in state funding to attract more than $275 million in private and federal funding since it was established by the Legislature in 2000, according to the Office of Innovation.

Still, Maine lags the national average for many funding categories: Only 65.6% of the state's R&D activity was in the private sector, according to the Office of Innovation, compared to a national average of 84.1%. "In Maine, not only is our total R&D number low, but we're particularly low for private-sector R&D activity," says Janet Yancey-Wrona, director of the Office of Innovation.

Yancey-Wrona's office in November released a blueprint for boosting the state's R&D activity. The 2005 science and technology action plan sets a goal of more than doubling the state's current R&D activity, which stands at roughly $430 million, to $1 billion, or three percent of the Gross State Product, by 2010. Among that $1 billion is a call to double the state's share of R&D investment to $120 million by 2010. "The reason we need to increase R&D spending is because it's what fuels innovation, and innovation correlates to regional economies that are competitive," says Yancey-Wrona.

Supporters of Yancey-Wrona's plan recently have begun to emerge en masse. Baldacci in his January State of the State address cited the need to increase Maine's investment in R&D, and the issue has been the basis of talks between people like Durdag and Bromley. Although there aren't any vocal detractors of the plan to boost R&D spending, some lawmakers are still waiting to see what all the fuss is about. Rep. H. Sawin Millett, a Republican from Waterford, says he'd be happy to support more R&D spending, but only if there's data that supports the claim that such spending will spark job creation and other economic stimuli. He also says any bond for R&D increases would have to wait until 2007 at the earliest. Last year's bond, he says, was negotiated as a biennial package. "Show me the evidence and I'll be there with you," says Millett. "I'm a good supporter as long as I can see the evidence that we're getting a good return on our investment."

Although a few studies have shown the correlation between R&D investment and economic growth in Maine ˆ including a report released last August by the Department of Economic and Community Development noting that wages and employment in companies receiving R&D funding are growing "much faster" than the state average ˆ people like Millett may have to wait for some time to see a substantial return from any widespread R&D initiative, says Mark Kaplan, a partner at Portland-based CEI Ventures, the venture capital arm of Coastal Enterprises Inc. in Wiscasset. "More [support for R&D] is better and time is our friend in making progress," he says. "I don't think you can change things overnight."

And that's a serious problem, according to many state policymakers. To be sure, nobody expects the Maine economy to do an immediate about-face if an R&D initiative received a big infusion of cash. But Maine's lawmakers may not be willing to bet their political capital on an economic development initiative that could take 10 or 20 years to pay off. "It takes a lot of leadership to have this conversation," says Bromley. "It takes a lot of guts and some of us will not be left standing. But some of us will take that leap and others will not."

Sen. Dana Dow, a Republican from Waldoboro, says his thoughts on the R&D spending issue fall somewhere between the expected Republican and Democratic ideologies. Dow in 1977 founded a furniture business, Dow Furniture, in Waldoboro, and since then has expanded his company a number of times to accommodate growth. The key to running his business, he says, has been knowing when to invest. He draws a parallel to the R&D issue, and says that Maine's policymakers need to take a long-term view. "There's too much opposition to bonds right now," he says. "The state isn't a business, but it's got to start acting more like a business. You can't grow a business if you don't invest in it."

Finding a focus

By all accounts, Maine has made strides since the Legislature helped develop the state's current R&D investment infrastructure, including MTI and the Maine Biotechnology Research Fund. In 1999, Maine ranked 48th in the nation for federal R&D funding as a percentage of gross state product. By 2004, the state jumped to 10th, according to the Office of Innovation. And the office's action plan notes that MTI since 2000 has funded nearly 500 projects that have in turn created more than 600 new jobs. Meanwhile, the Maine Biotechnology Research Fund has created more than 500 jobs that each pay an average annual salary of $62,500 ˆ well above the state's per capita income of $30,556, according to the Office of Innovation.

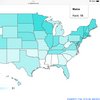

But Maine still has plenty of work to do. The Office of Innovation's action plan notes that the state still lags much of the country in a number of key areas, including academic R&D spending and higher education. An annual economic report card from The Corporation for Enterprise Development, an economic development think tank in Washington, D.C., recently ranked Maine dead last in both R&D expenditures among its universities and in the number of science and engineering graduate students enrolled in its academic institutions.

Based on the improvements Maine has made in the last decade, however, many hope the current call for increased attention to the state's R&D activity will be a catalyst to improve these other numbers. "I would say part of the problem is that there hasn't been a focused championing of this plan," says Durdag, who adds that the Office of Innovation's science and technology action plan should serve as a framework for a campaign to increase Maine's R&D dollars.

Durdag also says a big benefit of more R&D spending would be an increase in the number of high-tech companies coming into the marketplace, from medical research firms to developers of marine technology. A larger community of such companies would be good news in Maine, which he says lacks a unified voice of advocacy for the private sector.

What's more, a larger community of tech-related firms would help soften the inevitable blow of a few companies leaving Maine, whether through an acquisition or plain old market attrition. "There's certainly a risk of companies moving out of state," says Durdag. "But once you have a critical mass ˆ a community with a certain amount of momentum behind it ˆ the nucleus will stay here."

Venture capital investment also plays an important role in building up the number of companies in the marketplace, but Kaplan of CEI Ventures says he hasn't seen an avalanche of deals fall onto his desk. During the last 12 months, he says CEI Ventures has invested in just a handful of companies, including Looks Gourmet Food Company in Whiting, Red Zone Wireless in Rockland and Orono's Stillwater Scientific. (Kaplan did not disclose the size of those deals, and also noted that CEI Ventures had made some follow-on investments in some companies already in the firm's portfolio.)

Though Kaplan says the relatively small deal flow isn't worrisome, he'd be happy to see more ˆ and more qualified ˆ companies looking for late-stage financing. In fact, he says pumping more companies through the development pipeline would increase the chances of creating businesses that successfully navigate what Durdag refers to as the valley-of-death stage. "The number of projects increasing doesn't increase [any one] company's likelihood of success, but by sheer volume you're going to have more successes," Kaplan says.

In creating that critical mass, Durdag hopes Biode will serve as a model for how R&D investment can benefit emerging companies. Durdag says the company has supplemented its revenue from sales to companies such as General Electric, Halliburton and paint manufacturer Sherwin Williams with private and public funding, including roughly $600,000 in MTI grants and more than $1.5 million from angel investors, which he declined to name Thanks to the availability of that funding, Biode by the end of the year should be standing on firm financial ground, Durdag says. Though the company still won't be profitable, Durdag expects Biode this year to reach sales of $1 million. "We're passing through the valley of death and the goal is to get into the city by the end of the year," according to Durdag. "But that has it's own set of challenges."

Comments