Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

This and that: Stats from around Maine

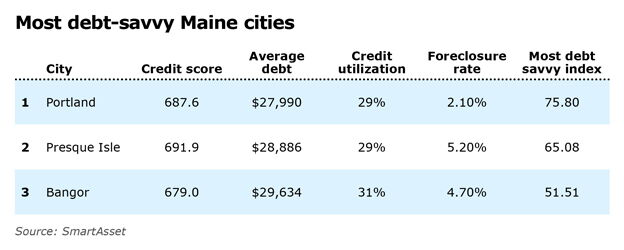

Several recent surveys by financial technology company SmartAsset showed Portland is the most debt-savvy among Maine's cities, Belfast is the most tax-friendly to retirees and Kennebec County invested in the most municipal bonds to support its economy.

Portland residents scored high marks, as did those in Presque Isle and Bangor. (See chart.)

SmartAsset also compiled a Retirement Tax Friendliness Index taking into account property, income, fuel, sales and Social Security tax data.

Belfast came out on top with a 33.43 score on tax friendliness, with $6,634 in income tax paid, 1.3% in property tax, $835 in sales tax, $315 in fuel tax and no amount taxed for Social Security.

In overall tax friendliness, Skowhegan was second, followed by Waterville, Ellsworth, Gorham, Kennebunk, Brunswick, Old Orchard Beach, Orono and Augusta.

SmartAsset looked at how the tax policies of each city would impact a retiree with a $50,000 income. Its hypothetical retiree is getting $15,000 in Social Security benefits, $10,000 from a private pension, $15,000 from retirement savings like a 401(k) or IRA and $10,000 in wages. Among other factors, it also estimated that 35% of take-home pay is spent on taxable goods.

In a separate study, the market researcher found that Cumberland County residents are getting among the highest annual Social Security payments in Maine. In this study, Sagadahoc County ranked top on SmartAsset's 67.27 annual Social Security index. The cost of living was $19,718, and residents got annual Social Security payments of $18,262.

Investing in economies

Turning toward local economies, Kennebec County invested the most among Maine counties.

The rankings were made according to local business establishment growth, GDP growth, new building permits issued and municipal bond investment. Kennebec invested $44,251 in municipal bonds per capita, had 3.3 new building permits per 1,000 homes, $24 million GDP growth and minus 0.7% business growth.

Its municipal bond figure greatly outpaced the other counties. Cumberland, for example, which ranked second overall, had $868 per capita municipal and investment.

Following Kennebec were Cumberland, Penobscot, York, Sagadahoc, Hancock, Knox, Franklin, Oxford and Lincoln.

SmartAsset noted there are several ways individuals, governments and businesses can invest money in a county or region, but its study aimed to capture the places receiving the most incoming investments in business, real estate, government and the local economy as a whole. It looked at the change in the number of businesses established in each location over a three-year period to shows whether or not people are starting new business ventures.

The total municipal bond debt raised by a county over the last five years was divided by the population to give the per capita look at investment in local government.

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments