Winslow co. benefits from expanded SBA programs

When Bob Jacobs, owner of Jacobs Glass Inc. in Winslow, set out to expand the window and glazing company he'd purchased in 2004, he faced two challenging business problems.

The first involved building a strong commercial portfolio, particularly in restoration and renovation work that required expertise beyond the residential window-and-patio-door replacements done by his affiliated company, Windows Plus. But to break into those higher-risk, higher-reward jobs he had to solve the second problem: lining up capital to cover the expenses of those bigger jobs, where payments might be delayed a month or two after expenses were incurred.

On both counts, Jacobs credits the U.S. Small Business Administration's office in Maine with providing the help his company needed to grow from four to 16 people in three years.

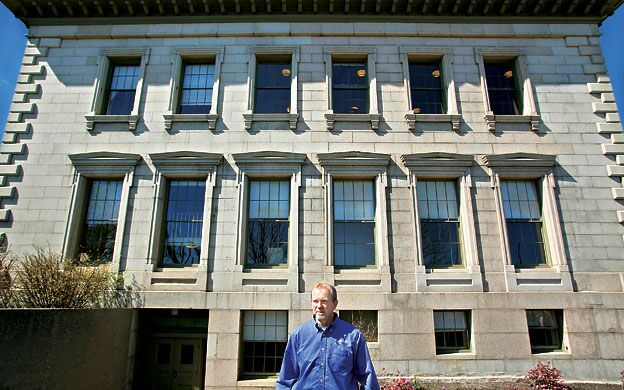

"We've established our credibility in the whole realm of window restoration work," Jacobs says, citing subcontracting work completed in 2011 on the Gilman Place apartment project in Waterville, the 2012 Edward T. Gignoux U.S. Courthouse project in Portland and the recent completion of Phase 1 improvements to the Old Bath Customs House.

Jacobs' company is being held up as a success story by Maine's SBA office, which in FY 2012 oversaw 321 loans totaling $68.8 million made with lending partners whose financial backing is leveraged or guaranteed by a variety of SBA programs. In the first six months of FY 2013, which ended March 30, the Maine office has overseen 167 loans totaling $37.17 million — a 22% increase over the same period last year. The increasing use reflects a streamlined application process for many SBA loans and revamped programs to address commercial capital needs.

Jacobs ladder

Jacobs says the Maine SBA office, working with Northeast Bank, helped refinance his business through the America's Recovery Capital program, a temporary loan program created by the 2009 Recovery Act. Companies seeking an ARC loan were expected to be profitable but facing a need for additional capital to help them get through the economic downturn or expand — or both.

The $35,000 loan Jacobs received was 100% guaranteed by SBA, and it helped free up capital that Jacobs Glass needed to take on work as a subcontractor for the $10 million Developers Collaborative conversion of the former Gilman Street School in Waterville into 35 apartments. At that time he had four employees.

Jacobs says the job involved removing 188 windows on the side of the 1913 school facing Gilman Street, taking them back to his shop and then steaming them to pry out the glazing. That enabled his crews to check the condition of the wood and use a special epoxy for restoring any damaged or weathered frames. The window restoration work had to meet exacting historic preservation standards, he says, to pass muster with developers Kevin Bunker, Richard Berman and Jim Hatch, who were using state and federal historic tax credits as part of the project's financing.

"We hired a good finish carpenter," Jacobs says. "This job gave us a great start of understanding the requirements of the National Park Service for the National Register of Historic Places [in which Gilman Place is now listed]."

Doing research into best practices, Jacobs says, led him to Bagala Window Works in Falmouth, the maker and sole distributor of a special steam stripper that safely removes lead-based paints and asbestos-filled glazing compound from historic windows.

"It's a fairly tight glazing community here in Maine," he says. "It's good to have that camaraderie."

In addition to the restoration work completed on the front of the Gilman Street School, Jacobs Glass replaced other windows in the building. By the end of the job, he says, his company had doubled from four to eight employees. Completed in May 2011 and renamed Gilman Place, the Waterville apartment complex was the winner of the 2011 Maine Preservation Honor Award.

Jacobs says that project is what set the stage for his next big job, involving outside restoration work on the 1911 Edward T. Gignoux U.S. Courthouse in Portland, this time as a subcontractor for CCB Inc. of Westbrook. Once again, he says, the SBA was instrumental in helping him land the work.

He found the job through FedBizOpps.gov, an online clearinghouse of federal contracting opportunities that includes listings set aside for small businesses. What enabled him to sign on as a subcontractor with CCB, though, was securing a $150,000 line of credit tied to that project through the SBA's CAPLines Program, a special type of 7(a) general small business loan designed to help small businesses meet short-term and cyclical working capital needs. Once again, Northeast Bank agreed to be the Maine SBA office's lending partner.

"Working capital is the primary thing when you bid on a project of that size," Jacobs says. "You get paid for the work completed, but you need the working capital to pay for the labor and materials involved in completing that work. The key ingredient is to find a bank willing to work with SBA. "

Jacobs says he started the Gignoux federal courthouse project in early 2012, completing the installation of security glazing and restoring 14 historic windows in September, a full six months ahead of schedule.

"This project was important for us," he says. "It was high profile, high security. "

With three major restoration projects under his belt, Jacobs says he's created a commercial division for his company and is actively bidding on additional federal projects. He doubled his company's employment in 2012, going from eight to 16, and landed a historic restoration job involving the windows and doors on three sides of the first and second floors of the Old Bath Customs House.

"The reason I have that track record is that we were able to get funding when we needed it," he says. "And that leads to the work. Any small business going through tough times or looking to grow should get in touch with the SBA."

The lending partnership

Marcel Blais, COO of the community banking division of Northeast Bank, says being designated a "Preferred Lender" by the SBA speeds up the turnaround time on some types of business loans guaranteed by the federal agency.

"It allows us to actually make a decision without having to run it through the SBA," he says. "We've always had a really good relationship with SBA. We don't find them too hard to work with; we understand what they're looking for."

The SBA's guaranteed loan programs, he says, give banks a higher comfort level in making the kind of working capital loans established businesses often need to grow.

"Jacobs Glass had an opportunity to expand the business; we knew he had the experience," Blais says. "Through our partnership with SBA we were able to help Jacobs Glass get to that next level. If the bank and SBA weren't there to do that, he might not have been able to move forward."

Marilyn Geroux, who recently took over as director of Maine's SBA office, agrees. She says Jacobs' story is typical of the many small businesses in Maine who've benefited from financing or business advice programs offered by the federal agency.

"I've been here a long time," she says. "My passion has always been working with our small businesses here in Maine. I want them to know they can come here with any business issue, especially getting access to capital."

And those local SBA efforts, she says, have been helped by streamlining initiatives launched by U.S. SBA Administrator Karen Mills, who in a recent Mainebiz interview said the SBA took out nearly 100 pages of paperwork that lenders and borrowers previously had to fill out for loans under $350,000 in the agency's Small Loan Advantage program, enabling lenders to cut processing times by as many as four business days.

The federal SBA also is in the midst of changing its definition of "small business" as part of a comprehensive and ongoing review of the size standards under the North American Industry Classification System to determine eligibility for SBA financing and many federal procurement programs.

In some cases, the standards had been in place since the late 1970s and early 1980s. For companies that meet the federal government's size guidelines to qualify as a small business, the designation can help them expand into the federal marketplace.

Diane Sturgeon, lender relations specialist for the Maine SBA office, says with roughly 97% of Maine businesses being "small" for most of the NAICS designations, the new size standards won't have a huge impact in Maine.

As Jacobs' example illustrates, though, being aware of the size standards and tapping into the federal government's various listings for upcoming contracts can greatly expand a company's networking potential. A few ways of doing that:

- By registering a business profile with the System for Award Management, the primary database that federal agencies use to locate contractors. Agencies can search for a particular business using various criteria, including capabilities, size, location, experience and ownership.

- The SBA maintains the Dynamic Small Business Search database, based on the small business profile submitted through SAM, as another tool contracting officers use to identify potential small business contractors for upcoming contracting opportunities. Small businesses can also use DSBS to identify other small businesses for teaming and joint venturing.

- Federal business opportunities for contractors are listed at FedBizOpps.gov: Federal Business Opportunities. Federal agencies are required to use this site to communicate available procurement opportunities and their vendor requirements to the public and interested potential vendors for all contracts valued over $25,000.

Geroux and Sturgeon say the Maine SBA office has a number of financial partners — including banks, credit unions and certified development lenders, such as Coastal Enterprises Inc. — that are familiar with the various loan programs and what it takes to qualify for them. There are two basic categories: 7(a) general business loans that can be used for a wide range of purposes, including providing long-term working capital to pay operational expenses, for purchasing equipment, refinancing existing business debt; and 504 loans, which provide financing for major fixed assets such as equipment or real estate.

Sturgeon says the top three programs being used in Maine are:

- Small Loan Advantage Program: This program allows selected lenders to obtain 7(a) guarantees on loans they propose to provide to eligible and creditworthy small businesses that meet all the requirements of a basic 7(a) loan through an alternative application process. It allows lenders to get a pre-qualification indication from the SBA that the applicant is a safe credit risk and warrants full consideration for financing. Small Loan Advantage is structured to encourage existing SBA lenders to make lower-dollar loans, with a maximum loan size of $350,000. SBA guarantees 85% for loans up to $150,000 and 75% for loans greater than $150,000.

- Express Program: A type of 7(a) loan that features an accelerated turnaround time for SBA review; a response to an application will be given within 36 hours. The maximum loan amount is $350,000 with a maximum SBA guaranty of 50%. Lenders and borrowers can negotiate the interest rate. Rates can be fixed or variable.

- Microloan Program: Provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers start up and expand. The average microloan is about $13,000. Microloans can be used for working capital, inventory or supplies, furniture or fixtures and machinery or equipment.

The CAPLines program tapped by Jacobs Glass, Sturgeon adds, is a good example of how SBA has revamped some programs to make them more responsive to businesses' needs.

"CAPLines has been around for a long time," she says, acknowledging that prior to the new policies launched in October 2011 it had seldom been used due to the complicated rules related to monitoring and servicing the loans.

Now it functions more like a conventional line of credit, and is being tapped more frequently to help small businesses meet short-term and cyclical working capital needs while reducing a lender's risk.

The SBA's Maine office posted a 14% increase in total loans at the end of March compared to the same period last year, and the dollar total increased by 22%, from $30.43 million in 2012 to $37.17 million loaned by March 30.

"We work with almost all the lenders in Maine," says Geroux. "We're trying to be more visible … We want people to know we're here to help everybody."

Comments