Paper goods | Is the glass half empty, half full or has it fallen completely off the table for Maine's paper industry?

Maine’s paper industry today is not your father’s paper industry. The paper plantation, where corporate giants ran fully integrated operations — owning land, transportation networks and mills — is gone.

So are the giant corporate monoliths themselves, each churning out pulp and paper for the same giant market.

Today’s paper mills are technologically specialized and niche-market focused, as high-tech and cutting edge as any biotech manufacturer or alternative energy producer. And they are facing unprecedented challenges in rising energy prices, shrinking rural populations and increased competition. The consensus among several mill managers and industry insiders we interviewed for this series is that it will take a combination of new products, capital and reduced costs to help them prosper.

To succeed in this new era of innovation and marketing, producers must constantly seek new markets, says Donna Cassese, managing director for the Sappi mill in Westbrook. Sappi is the world’s leading supplier of “release paper,” which is used in the creation of fashionable leather jackets, polyurethane car dashboards and Nike soccer cleats, to provide the texture found in these products. “In addition to our ongoing product development, we’re constantly interacting with and seeking out new customers,” says Cassese.

Mill managers of more traditional product lines agree. Verso Paper, a longtime supplier of standard lightweight coated paper from mills in Bucksport and Jay, recently diversified its product line to include four different grades of specialty paper, opening up new markets in food packaging, financial printing and educational materials. “If we were doing things the same old way, three paper machines would be shut down,” says Bill Cohen, Verso spokesman.

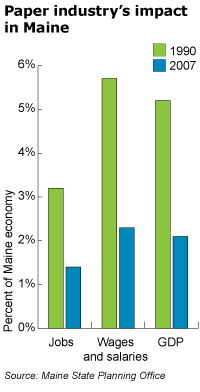

The “same old way” is one obstacle in a struggle to stay ahead of economic trends that have shut down mills and eliminated jobs for the past 20 years. Since 1990, paper industry employment has fallen by 50%, total worker wage and salaries adjusted for inflation have fallen by 45% and paper’s contribution to Maine’s GDP has fallen by 40%. Is there still plenty of life in an industry that is today Maine’s second-largest exporter and pays average wages in excess of $1,100 per week — mostly to Maine’s rural communities, which have suffered job losses for at least a generation and depend on the mills’ tax revenue? A critical key to its success is capital.

Maine’s paper mills contain billions of dollars of accumulated capital equipment — buildings, production machinery and energy generation equipment. Some is over a century old and still working. While no completely new mill has been built in nearly three decades, Maine’s paper companies have spent hundreds of millions keeping existing mills competitive. Keith Van Scotter, president and CEO of Lincoln Paper and Tissue, says, “It is critical in our industry, which has a lot of equipment and very sophisticated processes that are resource intensive, that a continual flow of capital be provided.”

This must continue every year if Maine is to reach the goal of a sustainable paper industry. To stay competitive, corporate investments are needed to maintain infrastructure, improve safety and environmental compliance, increase productivity and find new solutions for customers and increase market share. And the state’s continued exemption and reimbursement of industrial equipment taxes is essential.

Since investment decisions are made by corporate boards examining global options, getting money for Maine mills means demonstrating constantly improving returns. “Capital goes where it’s treated best,” says Van Scotter. Making Maine mills an attractive place for capital investments depends in part on reducing the relative costs of doing business in Maine.

Reducing costs — the “Four F’s”

In paper production, managers agree there are four primary costs known collectively as the Four F’s: fuel, fiber, freight and folks. A consensus on what will help:

1. Fuel: Successful mills will be the ones that consider energy efficiency one of their most important capital investments. Verso Paper just landed a $9 million stimulus grant for industrial energy efficiency. It will match this with $10 million of its own money to undertake 12 projects, seven in its Maine mills. Verso expects to increase efficiency by 33%, says Cohen.

Lincoln Paper and Tissue recently invested $10 million to reduce electric costs by revamping its steam and power cycle. This investment will enable Lincoln to co-generate half of its electricity, twice as much as before. “Getting the price of electricity down is the single most important thing to help the paper industry,” says Van Scotter.

As with taxation, state energy policies affect corporate investment decisions. Industry leaders contend that state support for a liquefied natural gas terminal and pipeline would enable Maine mills to supplement purchased electricity with self-generated power and steam from boilers that could be powered by wood waste or natural gas. Van Scotter adds that industries should be able to benefit from programs such as the Regional Greenhouse Gas Initiative, to reduce operating costs and lower carbon emissions.

2. Fiber: Maine’s competitive advantage for paper is the quality fiber produced from the state’s forests. “Trees in Maine might not grow as fast as in some other places, but they sure make good paper,” says Bill Cohen of Verso.

At the same time, the industry’s customers demand that their paper be produced in a sustainable fashion. Getting Maine’s polyglot of forest landowners to undertake forest certification is one of the industry’s greatest challenges, say mill managers. This contrasts to the experience in other states, where government is a dominant landowner and can “mass certify” lands as sustainable. In Maine, the process is much more cumbersome.

State conservation policies that encourage landowners to practice sustainable forestry will both preserve the great North Woods and help maintain this critical source of rural employment. In 2003, Gov. John Baldacci set forth an initiative to certify 10 million acres as sustainable. “We’ve made a lot of progress,” says Don Mansius, director of Forest Policy and Research at the Maine Forest Service. “We’ve certified 7.5 million acres. A significant increase in acreage is expected over the next year; further, many of the state’s paper mills report that well over 50% of their total fiber supply originates from certified sources.”

3. Freight: Getting product to and from the mills in an efficient and cost-effective manner is another critical component of industry stabilization. There are two ways policy makers can help, say mill managers.

The first is for Congress to raise the weight limits on interstate roads to 100,000 pounds.This would reduce the average cost of delivered wood and improve safety by reducing the number of trucks on smaller, secondary roads. Congress recently approved a one-year pilot program to raise weight limits authored by Sen. Susan Collins and strongly endorsed by Baldacci and the paper industry.

Longer term, paper needs reliable and affordable rail service, says Van Scotter. The move toward “just in time” inventory processes means that customers need their paper deliveries to be predictable and timely. State support for railroad investment in line upgrades and newer rolling stock so trains can go faster and to more places is critical.The governor and Department of Transportation are developing a state rail plan that will prioritize state investments in rail by working closely with businesses. One example of the state’s commitment to improving rail service is the work at Danville Junction in Auburn. When finished, these rail yard improvements will cut transit time for products, such as in-bound chemicals and out-bound paper, through this yard and Maine by 36 hours.

4. Folks: The final key to Maine’s paper industry is its labor force. One-third of Maine’s papermakers will reach retirement age within the coming decade. If paper is to remain a viable industry in Maine and a stable foundation for the state’s rural economy, it must have a ready supply of skilled technicians, engineers and managers. To make that happen, the industry needs to change public perceptions. “Too many young people, and often their guidance counselors, think papermaking is a dirty, dangerous job in a dying industry,” says Verso’s Cohen. In fact, quite the opposite is true, he says. Today’s production workers are skilled problem solvers who are computer-savvy. Some have post-secondary degrees.

Mills also have professional staff — engineers, mill managers, supervisors and salespeople. Cohen notes that, “talking about Maine as a great place to live” can have a positive effect on attracting talented workers to rural mill towns.

A battle for survival

Maine’s paper industry is not dying, but it does face unprecedented challenges. Indeed, John Williams, president of the Maine Pulp and Paper Association says, “An entire generation of Mainers have come of age knowing nothing of the paper industry other than cutbacks, layoffs and mill closings. But the paper industry in Maine is here to stay.”

Will Maine’s paper industry return to the glory days of 25,000 high-paying jobs? Probably not. Based on our research and these interviews, that’s an unreasonable goal. Are Maine’s paper producers a dying industry, inevitably slouching down the path blazed by textiles and shoes? Not necessarily. The most important message we heard that the paper industry wants to convey to Maine citizens and policy makers is that neither extreme is a useful way of thinking about its prospects. Instead, Maine’s best interests will be served, they say, by sustaining what we have — 8,000 jobs and over $500 million in wages.

Jim Nimon, senior economic advisor to the governor, says the Baldacci administration has been a steadfast supporter of Maine’s paper and forest products industries, recognizing they are the “lifeblood of many rural communities.” The state’s takeover of the former Georgia Pacific mill in Old Town until a private investor was found is indicative of that support, he says.

Just as our goal for Maine’s forests should be to sustain the acreage we have and get more value from the wood we harvest, so the goal for the financial and human capital of Maine’s paper industry should be to maintain what we have and get more value from it. Industry leaders and government officials agree it will require innovative collaboration to support and sustain papermaking.

Michael LeVert, Maine state economist, and Chuck Lawton, chief economist with Planning Decisions, a South Portland-based consulting firm, are collaborating on Working Knowledge, a six-part series exploring what Maine’s biggest industries need to prosper. Part III, which takes a look at health care, will appear in January.

Read Part I: Setting the stage

Read Part III: Rx for growth

Comments