Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Portland property shortage brings new life to old spaces

Photo / tim greenway

Justin Lamontagne, a commercial real estate broker at NAI The Dunham Group, helped negotiate space at Thompson's Point for Bissell Brothers Brewing Co., where he's pictured. A space crunch is forcing industrial-use companies to look beyond Portland.

Photo / tim greenway

Justin Lamontagne, a commercial real estate broker at NAI The Dunham Group, helped negotiate space at Thompson's Point for Bissell Brothers Brewing Co., where he's pictured. A space crunch is forcing industrial-use companies to look beyond Portland.

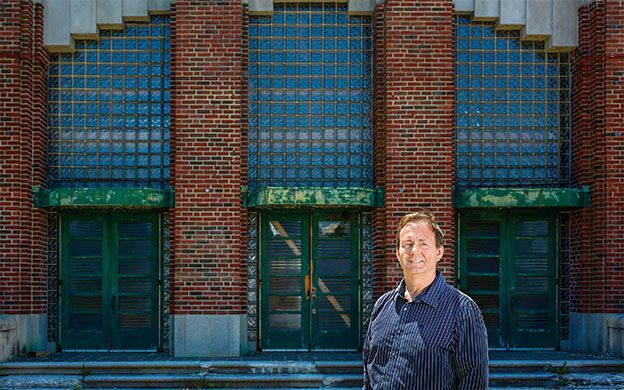

Photo / Tim Greenway

James Howard, president and CEO of Priority Real Estate, is redeveloping a former National Guard armory in South Portland.

Photo / Tim Greenway

James Howard, president and CEO of Priority Real Estate, is redeveloping a former National Guard armory in South Portland.

When Peter and Noah Bissell started Bissell Brothers Brewing Co. in 2013, they were entering a market already saturated with craft beer brands. Starting up at One Industrial Way in Portland, they planned to sell, distribute and promote their product in-house, essentially by word-of-mouth and personal connections.

With millennials a coveted target, and Portland acquiring a growing taste for locally produced products, they were soon growing. But their physical space was crowded and disjointed.

“We were scooping up as many units as we could get,” says Peter Bissell. Each was 1,500 square feet. They had three connected units, so they were able to open up the walls, and a fourth elsewhere in the building. By 2015, the situation proved untenable. “I was looking at what we were doing and how stuff was laid out. There was little room for growth, both floor space and infrastructure. We were operating in different little cells. We needed a big, open space we could design from the beginning.”

With an idea that the solution could be a move to Thompson's Point, Peter Bissell called Justin Lamontagne, a broker at NAI The Dunham Group.

Fast forward to the present and the brewery is now in 10,700 square feet of redeveloped space at 4 Thompson's Point, the so-called Brick North building, with a separate 3,500-square-foot warehouse on Presumpscot Street.

“We're so happy we did it,” says Bissell. “I feel like the space crunch in Portland, where everyone wants both residential housing and commercial space — it's just not out there otherwise. This [Thompson's Point] is like a new neighborhood down here. But there are only so many places you can build in Portland proper.”

Lamontagne cites the “vision and willingness” of developer Chris Thompson to tackle Thompson's Point, a 30-acre former rail yard (that had its name long before the developer, who is not related, came along).

“Now it's a mixed-use building with brewery, retail, a winery and office space,” says Lamontagne. “That's a great example of repositioning an antiquated building into something that's fully leased at market rates — and is a great community amenity.”

Critical space crunch

Portland is in a pickle when it comes to available space — both commercial and residential.

“There's a clear flight to quality across the board in the commercial sector, including industrial, office and retail,” says Lamontagne. “Users have been absorbing the Class A and Class B space at a rapid pace. That, combined with lack of new construction, has left of us with a real space crunch.”

Lamontagne issued a report earlier this year based on an inventory he performed of every industrial building in the Greater Portland region — Portland, South Portland, Westbrook, Scarborough, Gorham, Saco and Biddeford — that showed the industrial real estate market in the Greater Portland area has seen 21 consecutive quarters of declining vacancy rates.

In 2010, the vacancy rate was between 8% and 9%. Today, the rate is about 4%, historically low for this market, he says. As a result, Southern Maine is seeing a critical space crunch among Maine companies needing space to expand or relocate. That's a problem in a time of economic growth.

A number of companies are buying up existing buildings because it can be more affordable to rehabilitate and repurpose old structures than to build new ones. Lamontagne says the cost for new construction of an industrial building, for example, is $100 to $115 per square foot. That compares to the average sale price of existing buildings of $55 to $60 per square foot. Even with rehab costs, that can make it more attractive for businesses to wait and find an existing building.

“It's happening all over Greater Portland,” Lamontagne says. “What users and developers are realizing is it's more affordable to redevelop an old, perhaps inefficient building than it is to build from the ground up. Furthermore, a lot of users, particularly office users, like the finish of a redeveloped product. For example, if it's a mill building, they have the high ceiling, the brickwork, the original moldings. It's an industrial look, and a lot of users are willing to pay a premium for that kind of space.”

New businesses in old buildings

In recent months, there are several examples of companies remaking existing spaces:

- Casco Bay Steel Structures' $3 million purchase of the former Megquier & Jones steel fabrication plant, built in 1965 at 1156 Broadway in South Portland. The purchase is for a like use, but had the added advantage of giving Casco Bay Steel railroad access.

- The sale of the historic but dilapidated 5,700-square-foot commercial brick building at 272 Lancaster St., in West Bayside, to the start-up company Fork Food Lab. Partners Neil Spillane and Eric Holstein took what was basically a shell and invested in a complete build-out to create a collaborative commercial kitchen serving new and existing food businesses.

- Redevelopment of the former Maine National Guard armory, at 682 Broadway in South Portland, is expected to be completed this fall. Priority Real Estate Group, the commercial real estate investment and development firm in Topsham, bought the property from the city to repurpose for a more modern use as an Irving gas station and convenience store, leveraging its prime location at the foot of the Casco Bay Bridge.

- The redevelopment of the Lunt School in Falmouth into office space.

- Conversion of Biddeford's Riverview Mill into office, retail and residential space.

Still, companies seeking to expand or relocate in Greater Portland may have a long wait.

“One of my industrial clients was in the market for almost a year,” says Lamontagne. “We were looking for an existing building and were unable to find one. During that time, we explored building new, and he put land under contract with the intention to build. Shortly thereafter, an off-market listing in South Portland became available and I found out about it. We put it under contract within a day or two. So he ended up finding an existing building that cost him probably half what it would cost to build new. But it took time, and he was fortunate that opportunity presented itself.”

Another example of a creative end-user was the Eastpoint Christian Church, on City Line Drive in Portland, which had been searching for a new site for years. The church settled on a former Bob's Discount Furniture and HomeGoods store in South Portland, renovating it at a fraction of the price of new construction.

“It's a business thinking outside of the box and going where I'm certain they weren't originally intending to,” says Lamontagne.

Companies are looking to Portland's suburbs to find space.

“Westbrook, Scarborough, South Portland, Saco and Biddeford are all very healthy commercially, in large part due to Portland's success,” says Lamontagne. “But we're not seeing huge impacts in the midcoast or Lewiston/Auburn area.”

Still, the Portland area is not seeing an abundance of new construction.

Lamontagne cites one example, an industrial building on Warren Avenue. It was leased before it was finished.

“But new construction is lagging behind,” Lamontagne said. “And that's inhibiting businesses from either moving or growing. What I'm telling my clients now is that we have to be patient in the search, flexible in the requirement and aggressive when the right opportunity presents itself.”

No new office space in nearly a decade

In a newly issued report, CBRE|The Boulos Co. associate Anthony Struzziero has similar observations, noting that, as of June 1, the vacancy rate in Class A office space was 3.41%, compared to 8.8% in 2014.

“With vacancy reaching pre-recession levels and almost no new development in nearly a decade, several expanding companies have had to think creatively to support their growth,” Struzziero writes.

He cites Stone Coast Fund Services and Tilson Technology Management among companies that have adapted to the tight market by leasing space in multiple buildings downtown.

Downtown Portland hasn't added office space since 2007, he writes. At 16 Middle St., off India Street, Bateman Partners plans a 45,000-square-foot mixed-use building that will include office space.

New construction is hampered by long lead times from approvals and permitting to construction and, although many projects are in the conceptual stage, they “will need prolonged confidence in the market if they are to become financially viable,” Struzziero writes. “Without continued growth the city of Portland risks stagnation, which inherently leads to decay.”

All of this has affected the residential market as well.

“One percent, approaching zero,” says Brit Vitalius, principal at the Vitalius Real Estate Group, about the amount of available residential space in Portland. “It's been like that for a few years.”

Yet demand is high, says Vitalius.

“My thesis is there's a fundamental demographics shift going on in Portland,” he says. “Whereas in the past you came into the city and had the white-collar job, then went back to your family in the suburbs, now young people are choosing to stay here and raise families here. There are baby boomers wanting to retire from Greater Portland into the center of the city. We see that trend consistently. And we're definitely on the national radar as a destination. Everyone wants to be in Portland.”

Read more

Rebranding, incentives proposed to drive Scarborough development

Portland Mayor Strimling proposes new landlord restrictions

How To: Craft tax savings for breweries with the federal R&D credit

South Portland armory rehab slated to finish in November

Portland real estate still hot, so where's the best place in Maine to get a home loan?

Portland gets its first taste of the Fork Food Lab

#MBNext16: As craft brewing evolves, Sean Sullivan aims to keep Maine at its forefront

The economy is growing — and so is the need for day care facilities in Greater Portland

It's Friday so let's talk beer: Allagash takes home the gold at brew festival

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments