Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Portland real estate still hot, so where's the best place in Maine to get a home loan?

Portland and South Portland were the fifth- highest markets for home values in August, according to a recent survey by Pro Teck Valuation Services. And real estate tracking website Zillow said July marked the 48th straight month of rising home values, meaning we now are entering the fourth year of consistent appreciation of home values in the United States.

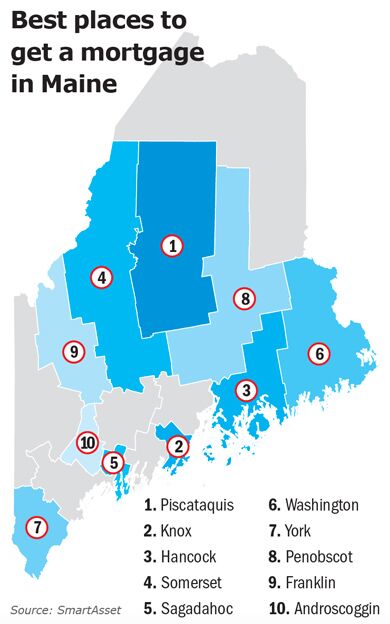

For those finding Portland and South Portland too steep for their wallets, financial technology company SmartAsset recently ranked the best counties for places in Maine to get a mortgage. It looked at overall borrowing costs, ease of securing a mortgage, cheap property taxes and cheap annual mortgage payments.

Ranking first in the Top 10 for the easiest place to get a mortgage at the lowest cost was Piscataquis, followed by Knox, Hancock, Somerset, Sagadahoc, Washington, York, Penobscot, Franklin and Androscoggin.

In terms of the percentage of loans applied for and approved, Piscataquis still topped the list with 66.6% of loans approved, followed by Cumberland, Penobscot, Hancock, Sagadahoc, Androscoggin, York, Knox, Lincoln and Franklin.

Looking at borrowing costs — the mortgage payment plus closing costs over five years — Knox topped the list with the lowest cost of $74,680, followed by Piscataquis, Somerset, Hancock, Sagadahoc, Washington, York, Franklin, Androscoggin and Penobscot. SmartAsset made the calculations based on expected costs over the first five years of a $200,000 mortgage with a 20% down payment, including closing costs.

Property taxes were lowest in Hancock, followed by Lincoln, Franklin, Waldo, York, Oxford, Kennebec, Piscataquis, Washington and Knox.

Knox had the lowest annual mortgage payment at $14,111, followed by Piscataquis, Somerset, Hancock, Sagadahoc, Washington, York, Franklin, Androscoggin and Penobscot.

SmartAsset used data from the Mortgage Bankers Association, U.S. Census Bureau, Bankrate, government websites and its own information to calculate the various rankings.

SmartAsset recommends shopping around, comparing rates and choosing carefully, as rates posted online can vary depending on credit score and how likely the lender feels the borrower is to stop making payment (if they've had late payments on other loans in the past). SmartAsset says the lowest interest rates likely will go to someone with a credit score of 750 to 850, enough assets to make the 20% down payment on the house and net income more than three times the monthly mortgage payment.

Read more

Lack of new construction leads to industrial real estate crunch in southern Maine

Portland property shortage brings new life to old spaces

Tiny lots, big ideas fueled by Portland housing crunch

Maine single-family home sales jump 11% in August

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments