Maine foreclosures continue to decline

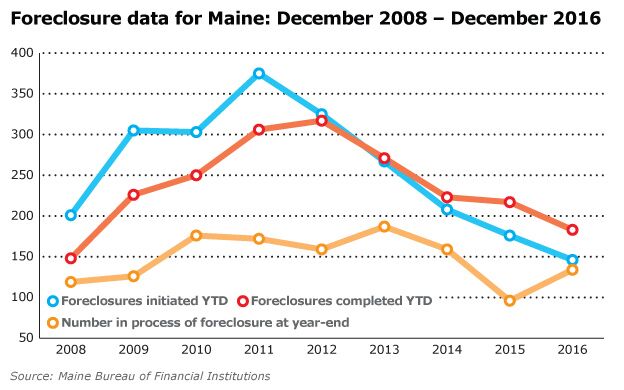

Maine’s Bureau of Financial Institutions reported that initiated foreclosure filings at state-chartered financial institutions continue to drop and have held below the 2008 level for the third consecutive year.

At the close of 2016, Maine’s 31 state-chartered banks and credit unions held 74,000 first-lien mortgages, Bureau of Financial Institutions’ Superintendent Lloyd P. LaFountain III reported in the annual survey the bureau has been conducting since 2006.

Of those 74,000 mortgages, 183 were in-process of foreclosure. This level, representing 0.25% of first-lien mortgages, declined for the fifth consecutive year from the peak level of 0.55% reported at the end of 2011 and currently represents the lowest level of loans in process of foreclosure in the past eight years, when 0.31% was reported at year-end 2008, LaFountain reported.

The data is limited to the 31 financial institutions that have been state-chartered from year-end 2006 through year-end 2016. It does not include data from entities not regulated by the Bureau, such as federally-chartered banks, federally-chartered credit unions and mortgage companies licensed to do business in Maine.

Initiated foreclosures totaled 146 in 2016, representing a continued decline from the peak of 375 reported in 2011.

“Foreclosure activity at Maine’s state-chartered institutions has steadily declined over the past five years and has reached pre-recessionary levels for Maine’s state-chartered financial institutions,” LaFountain stated.

Comments