Tracking changes | The state passes operation of an MM&A line to a veteran rail player

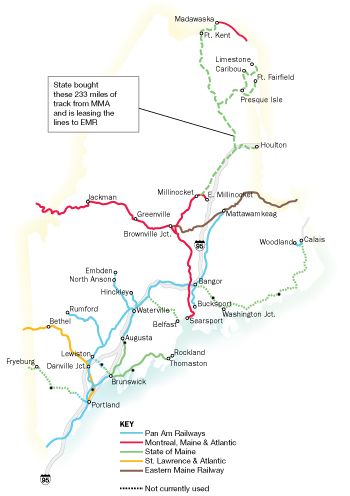

The state swooped into northern Maine last year to save 233 miles of freight railroad from abandonment by Montreal Maine & Atlantic Railway. Had it not done so, 25 commercial customers could have been left in the lurch and 1,000 jobs potentially lost. Now, after buying the tracks for $20 million, the state is handing over rail operations to someone else to preserve both the jobs and a transportation network deemed critical by the businesses that use it.

The Maine Department of Transportation is in the last stage of finalizing the details of its lease to Eastern Maine Railway to rent the tracks from Millinocket to Madawaska at no cost until the line is profitable, according to Nate Moulton, director of MDOT’s rail program. EMR, in turn, is responsible for maintaining the lines. A subsidiary of J.D. Irving Ltd. and the U.S. affiliate of NB Southern Railway in St. John, New Brunswick, EMR, which already operates a rail line between Vanceboro and Brownville Junction, beat out proposals from five other companies for the work. “They had a much more detailed presentation, they are nearby, they are already operating in the state and they are well -funded with good financials. And they had a better understanding of the region,” Moulton says of EMR’s selection.

The challenge now for EMR is to return the lines to profitability. The company should be helped by a $10.5 million TIGER federal grant the state was awarded in February for railroad upgrades. Moulton says the state’s elimination of mortgage payments and interest, as well as property taxes, puts EMR at an advantage. But, he adds, “This is a challenge, they will have to rebuild this business, they’ll have to get more carloads on the line. They have to win new customers or convince old customers to come back. The rising fuel price helps with that, but you have to do it with service.”

Mainebiz recently spoke with EMR’s general manager, Ian Simpson, about his company’s plans to make the railroad profitable. An edited transcript of the conversation follows.

Mainebiz: How many miles of rail does J.D. Irving own or lease in Canada and how many lines does EMR own or lease in Maine and the United States?

Simpson: We have the New Brunswick Southern Railway and then we have the Eastern Maine Railway on the U.S. side, so the two companies combined would operate 280 miles of track, not including the new track. That will add another 233 miles.

Why were you interested in operating the 233 miles of state-owned lines between Millinocket and Madawaska?

Rail is a more efficient and environmentally friendly way to move heavy freight for manufacturers, especially up in the north. The MM&A is also a vital lifeline to that region and is also a strong partner of ours. So we felt it was important that the service be maintained up there. A lot of the operations up there employ a tremendous amount of people in the region.

How is MM&A an important partner to you?

We interchange with them today. The way it works in the rail business, a customer’s load of freight, for example, if the load was going from Maine to California, the rail car itself would travel on many railroads to get to the final destination. Our locomotives would bring it a certain distance; we’d give it to the next railway whose locomotives would take it to the next, and so on. And in Brownville Junction in Maine, EMR interchanges directly with MM&A today, so they are an important partner. So all the railroads in the state of Maine certainly rely on having business from these shippers in northern Maine on the state-owned railways, so it’s important we keep it viable.

What are the opportunities here for EMR?

First and foremost it is to keep the existing business that flows on our line, and the other is the ability to potentially grow, if the service improves. Both those things add stability to our railroad and the employees that currently work with Eastern Maine Railway, and it helps keep many of these skilled employees working in the north, with a chance of growing jobs in the future.

What are the biggest challenges you see?

I would say the biggest challenge that we’ve seen so far is the condition of the infrastructure. And the TIGER grant money that’s been approved certainly will be critical here, and we appreciate the vote of confidence that Maine congressional state reps have given to upgrading the railway. The next thing is earning the support of the shippers in the region who have moved away from using rail over the last couple of years. And a big part of that… is just the unreliability and inconsistency of the service. So that is going to be a challenge for us to earn that respect back. But we’re very confident we will.

What makes you confident you can make this a success when MM&A reportedly lost millions, despite having 25 clients?

It’s certainly difficult for me to comment on MM&A’s financial operation. I can only talk about our view of it. Our strategy will be focused on improving the track speeds and the reliability of the service. We have to invest capital to do that. And then we have to be able to provide competitive options to the shippers. You know, there’s three railroads in addition to ours in that region that potentially could earn the customers’ freight. We believe it will be important to offer all three options to the shippers and customers in the area, because some will have better transit times and better pricing than others.

How would you do that?

Most of the customers’ freight will go to a destination beyond the railroad we’ll be operating. So, for example, if a load were going from Presque Isle to Texas, there could be multiple rail lines involved to get that car load of freight to the customer. As railroads, we interchange freight with each other. If the end of our line connected with one railroad, then our customers would only have one choice. In the case of the Aroostook line, there’s an interchange potential in St. Leonard [in New Brunswick] with CN [Canadian National Railway Co.]; Millinocket with MM&A; and in Brownville Junction, with Eastern Maine Railways, who could hand off to Pan Am [Railways]. So the customer could get rates from all three of those railroads and they would instruct us what rail line they want to use, so we would bring it to that line. We compete, but we’re also very much partners with one another.

What type of upgrades or projects are you planning for all the lines?

The key areas that we think require the most work will be the railway tie condition. A considerable amount of those will need to be replaced. Adding rock ballast, and improving the surfacing of the rail bed. And also there’s some areas that are in critical need of some rail change-outs.

Throughout the 233 miles?

I should point out that all three of those things play a role in the safe track speeds that you can move the product. Today a lot of the freight is moving from 10 to 25 miles per hour, so on the main line between Madawaska and Millinocket … we’re going to put our energy and resources into getting the track speeds up to 30 miles per hour on that stretch. And the branch lines, for example the Houlton branch and the Presque Isle branches, those subdivisions we’ll eventually want to get up to 25 miles per hour.

What kind of investment is that, how many millions and how much time?

The initial funding will come some from our company and there’s been $10.5 million approved through the TIGER grant. It hasn’t been released yet but it looks like there’s a one-year timeframe to spend that $10.5 million in upgrades.

Will that cover, say, roughly half of the project?

You know, we haven’t gotten that far into it yet. The state of Maine has its own engineering group, they will have their recommendations and they’ll also seek some input from my team on where the money will be best spent.

Who are the potential customers for the EMR line? You talked about shippers who’ve migrated away from rail who you want to attract back. Who are they and how many are there?

The state of Maine provided a list of the potential customers up there and we’ve either personally met or spoken to virtually all of them. I would say the core customer base is essentially made up of 20 key shippers up there.

Are they currently using the MM&A service?

I would say that most either are using the MM&A or have used the MM&A. What I can’t comment on at this point until we get operating is how much business opportunity is there that may be moving by truck today, that if the service were to improve or the pricing improve, that sort of thing, could we divert some of that business back to rail.

So these shippers, they move some freight by truck, some by rail?

If a shipper is currently rail-served, they would be making decisions on a daily basis on what’s the lead time, what’s the urgency to get the product to the end customer and can it move by rail because it’s the most economic way to do it, and certainly environmentally it’s the best way to ship product. On the other hand, there could be some orders that are last minute, or have become urgent, and then the truck transport is called.

So I would say that many of those shippers use a combination of both, but from a long-term viability standpoint, especially if your customer market is farther down in the southern or western United States, truck transport is too expensive and prohibitive in some cases. The other point to that is with fuel pricing the way it is, some truck surcharges have exceeded 35%. So truck transport is already expensive relative to rail and then you add the premium fuel surcharge on top of that, it makes it very difficult. Now that happens in the rail business as well, but generally some of the rail surcharges tend to be about half of the truck surcharges.

How many trains will you have running on the lines? How frequent will the service be?

A lot of it will depend on the volume and the needs of the shippers. We have some tentative ideas on the service, we think it will be more frequent than what the shippers have received to this point, and then we will build our service model around what the customers need.

When is your anticipated start date?

The state has asked that we be ready by mid- to late June.

Do you have a sense of what the ongoing yearly maintenance costs might be?

We’ll be in a better position [to answer] after the first full year of operation. A lot of the money initially will be spent on the upgrades by the TIGER money, and that’ll be a good start, and certainly more work will be required after that.

How many people will you be employing in Maine?

We expect the base operations to be 30 people.

Will many of those people come from MM&A?

There’s a lot of very good men and women who currently work for the MM&A and have expressed a lot of interest to come work with us. We’re very confident that we’re going to be able to hire a very good-quality, skilled work force up there. That’s our absolute priority, to hire the existing men and women that work on the line today, because they’ve been very committed to the railroad, they know the railroad, they know the customers up there.

Will you have a base of operations in Maine?

We will see two core areas where most of the employees will be based on the new railway. One in the Oakfield area, and there will also be a base of operations in Squapan.

Is there room in Maine or elsewhere for EMR to expand?

We haven’t thought that far. We’re clearly focused on this new operation in Maine now. One thing we believe is all the railways in the region have capacity to handle more growth. So investment is needed to improve the service and transit times by all the railways in the Maine area. If, collectively, we can improve the service and transit times, we can attract more business to the rail network.

Eastern Maine Railway, a subsidiary of J.D. Irving Ltd.

Maine headquarters: 31 Depot Road, Mattawamkeag

Founded: 1995

General manager: Ian Simpson

Services: Rail transport; track and siding repairs and construction; operation of distribution centers

Revenue, 2010: Did not disclose

Employees: 25 with EMR, with the potential to add another 30

Contact: 506-632-4654;

www.nbsouthern.com

Rebecca Goldfine, Mainebiz staff writer, can be reached at rgoldfine@mainebiz.biz.

Comments