Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- September 8, 2025

- August 25, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Market for rentals is strong: Investors are are flocking to multi-residential properties

Photo / Tim Greenway

Rebecca and Jim Henry bought a multi-family fixer-upper at 11 Carleton St. in Portland — one of several they’ve acquired in Portland and Augusta, driven by a strong rental market.

Photo / Tim Greenway

Rebecca and Jim Henry bought a multi-family fixer-upper at 11 Carleton St. in Portland — one of several they’ve acquired in Portland and Augusta, driven by a strong rental market.

Jim and Rebecca Henry are on a mission to buy older residential buildings and upgrade them without displacing existing tenants.

The Henrys are executives in the software technology industry. Jim is a native Mainer who pursued his career in Boston. Twenty years ago, he met Rebecca, who worked for the same company. Eventually, they founded Remington Street Properties, a real estate development company. Today, they own residential properties, ranging from large buildings with 20-plus units to one-unit condos, in Maine, Massachusetts and New Hampshire.

The couple returned to Maine in recent years, in part because they were attracted to the state’s entrepreneurial vibe and wanted to be part of that growth in the field of residential real estate. Over the past year, they’ve purchased scores of units in numerous buildings in Portland, Augusta and Berwick.

One of their recent transactions was in February, when they purchased 19 buildings containing 154 units in Augusta. The century-old buildings are an eclectic blend, ranging from two- and three-family houses to large buildings.

In Portland, purchases have included a 10-unit on Congress Street and multiple units in the West End. The properties have varying degrees of “fixer-upper” potential, requiring various levels of further investment beyond purchase. As long-term holds, most are “break even” propositions for the moment but are expected eventually to result in higher rents.

Overall, the purchases reflect the couple’s excitement about Maine’s real estate opportunities as the state experiences an entrepreneurial renaissance.

“I’m of the opinion that, in real estate, the best time to plant a tree was 20 years ago. The second best time is today,” says Jim Henry. “I think, just by nature of the fact that people always need somewhere to live, if you choose the right environment and the right municipality that has the right attitude around growth, livability and sustainability, you’ll always have these opportunities. We look for those opportunities.”

Hitting their stride

The Henrys’ activities illustrate Maine’s strong multi-residential rental market. Market drivers include an overall housing shortage, high rental costs in Portland, and availability of housing stock elsewhere, as investors buy structures in various conditions and fix them up either to sell at a profit or for long-term income streams.

“Generally, the market is strong and has become considerably stronger in places like Westbrook and Biddeford, because folks are getting pushed out of Portland,” says Vitalius Real Estate Group Principal Brit Vitalius, an expert in the residential real estate sector. “Portland prices are high. But people want to own real estate, so they’re going out to other cities that are really hitting their stride.”

Vitalius says that, while the multi-family market is strong, sales volume and median sales prices are seeing considerable variability.

For example, sales volume in Westbrook increased 40% from 2015 to 2016, declined 12% from 2016 to 2017, and was up 27% from 2017 to 2018. Sales volume in Portland rose 11% from 2017 to 2018 as investors competed for fixer-uppers.

“Portland doesn’t have many rundown buildings left,” says Vitalius. “So folks are looking to do that outside of Portland.”

Who are the buyers?

There are several types of buyers, says Josh Soley, with Maine Realty Advisors. New investors often look for small multi-families and take one unit for themselves. Experienced investors are building their portfolios or perhaps exchanging smaller properties in order to buy larger ones.

Larger portfolios of 50 or more units often attract out-of-state real estate investment firms.

Why are they looking in Maine?

“Value, quality of life,” says Ed Herczeg, with Bean Group Commercial Real Estate. “They might have family up here. For instance, we just put a building under contract in Bath. The investor has an architectural investment firm in Maryland and sailed a lot of the Maine coastline as a young man, so he has connections and wants to invest in Maine.”

Herczeg sees a lot of multi-family investment in places like Bath, Brunswick and Waterville. Real estate development by Colby College is the primary draw for residential investors in Waterville, he adds.

“That’s creating demand for older properties that have substantial square footage and can be purchased now at a fairly moderate cost,” Herczeg says. “The same is true in Biddeford. You’re seeing that area transitioning from apartments that weren’t great, that now, younger people especially, are looking to move into.”

He adds, “There’s only so much you can do in Portland. The market has peaked. Outside of Portland, you hit Westbrook, Saco, Biddeford, Bath, Brunswick – those are the areas you move to. For people who work in Portland, a 30- or 40-minute drive isn’t bad.”

Who are the sellers?

Typical sellers, says Soley, tend to be older people wanting to retire from property management, who perhaps don’t have any children to take over.

“They give me a call and say, ‘I don’t want do this anymore,” Soley says. “Others are investors who are net-lease buyers but are willing to exchange smaller net-lease properties for larger ones.”

“Net lease” means renters pay other expenses, like property taxes on top of rent.

“Net lease investment is far less management intensive and an easier investment strategy for individual looking to wind down,” Soley adds.

“Typically, these are older people who have held the properties for some time and are looking to capitalize on the market,” says Herczeg. “They might have had tenants for many years and they’ve never increased rents according to what the market can bear. They might have a two-bedroom apartment that they’re only charging tenants $900. A buyer sees he could easily charge $1,200 to $1,400 and will pay a little more for the property based on the upside.”

Upside

The Henrys have been on both sides of the equation, financing new purchases in part by selling other properties.

In Portland’s West End, they purchased three buildings with 23 units for $2.9 million. Soon after, they sold two of the buildings for a combined profit of $384,000. That money then helped to finance the $3 million purchase of the Augusta portfolio. They’ve sold multi-residential holdings in New Hampshire to reinvest in Maine. They’re eyeing other areas of Maine, including Biddeford and Waterville, as entrepreneurial hotspots that invite future investment.

Then there are the costs of renovation. Renovation of one of their Portland properties, on Carleton Street, averages $8,000 per unit and ran as much as $15,000 on one unit. Renovations range from interior updates to costly deferred maintenance issues.

In Augusta, the Henrys expect to invest $250,000 to $350,000 or more to renovate the 19 buildings.

“In the first one to three years of these kinds of properties, we draw little, if any, income off the property,” explains Rebecca Henry. “In the case of Carleton, some of the more dated units were renting well below market.”

Renovations are gradually bringing the units up to market-rate rents, she explains. But for now, with renovations ongoing, they’re just breaking even.

“The intention with Carleton is to build equity in the long term,” she says.

Overall, she says, the projects are affordable to pursue because the properties are not the couple’s sole source of income.

“Not every landlord can afford to invest in a building and then pour further dollars into renovating and rehabbing a property,” she says. “What’s more, not everyone has the stomach for it. We can only do this because we don’t rely on the income at this time and because we partner with strong property management companies with the vision and team to execute. And we know, from experience, that if we invest in the properties early, we can justify market-rate rentals, improve vacancies and delinquencies, benefit from efficiencies and also command a higher sale price when the time comes to divest of a property.”

Risk for renters?

Existing tenants are occasionally displaced as new landlords perform upgrades and raise rents.

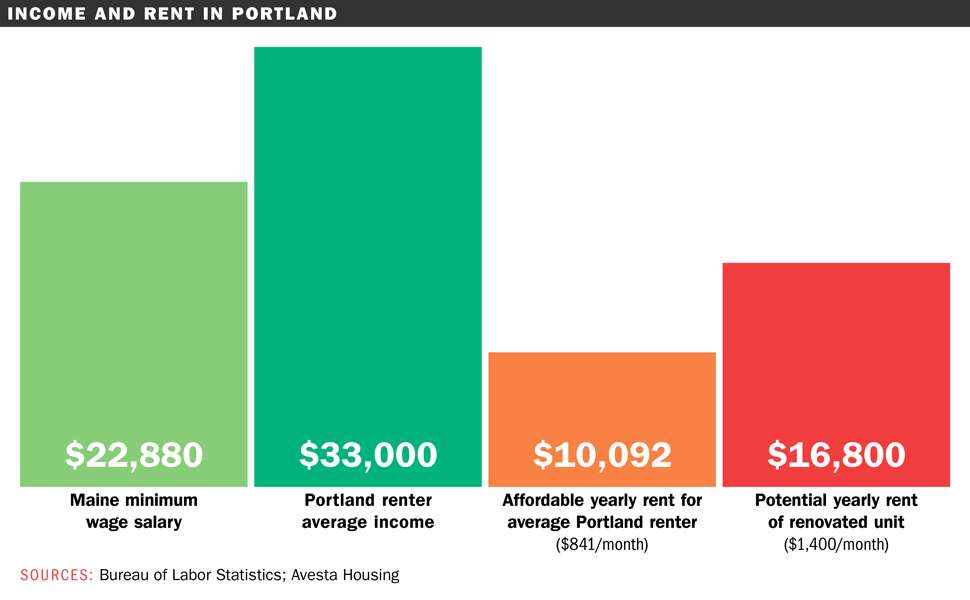

“It’s hugely problematic,” says Avesta Housing President and CEO Dana Totman. “Sometimes we forget who traditionally lives in rental housing. It tends to be low-income people. The average income of renters in rental households in Portland is $33,000. They can afford $841 per month for rent. So every time prices go higher, whether it’s fixing up an existing apartment and pricing it higher or building new housing, which is incredibly expensive due to construction costs, it just never quite matches up very well with what the traditional rental household can afford.”

“Any time there’s a shortage of housing, it puts pressure on low-income residents because values start to go up,” says Vitalius.

“The flip side is, dilapidated housing is not good housing; it’s not safe and it’s not healthy. So Maine’s housing stock, which is mostly 100 years old, is getting a much overdue improvement and has been for the last 10 years.”

A sampling of multi-family transactions

Hollis / 63 units in five locations / $4.23 million: Under contract one month after hitting the market. “We’re seeing a lot more people moving to the outskirts because of the prices in Portland,” says David Jones of F.O. Bailey Real Estate.

Sanford/Springvale / 106 units in 21 buildings / $4 million: Private offer to New York buyer with Maine roots.

Bangor / 18 luxury units, 28 Broad St. / $3.13 million: After two-year $1.6 million renovation, property sells for top dollar to New Hampshire buyer.

Brunswick / 21 units, 6 Potter St. / $1.78 million: One of Brunswick’s largest apartment buildings. Interest seen from investors in California and New York.

Biddeford / 10 units, 61 Bacon St. / $645,000: Sold at auction. With just one hot water heater for all units, renovation is essential.

Bath / 6 units, 41–43 Lincoln St. / $325,000: Bath Housing Development Corp. finds itself in a bidding war.

Advice to young investors

Ed Herczeg recommends that novice investors, looking to get into the multi-residential rental market, buy a smaller multi-unit and, if she’s handy, spruce it up — clean up the yard, paint, perform minor upgrades — and live in one of the units.

“By doing so, you’re allowing the other two or three tenants to pretty much pay your living costs,” he says. “You live rent-free and, in four or five years, your principal has dropped and you can buy another multi-family.”

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments