On the Record: Bill Shanahan helps lead newly merged housing syndicate, but keeps it local

Photo / Tim Greenway

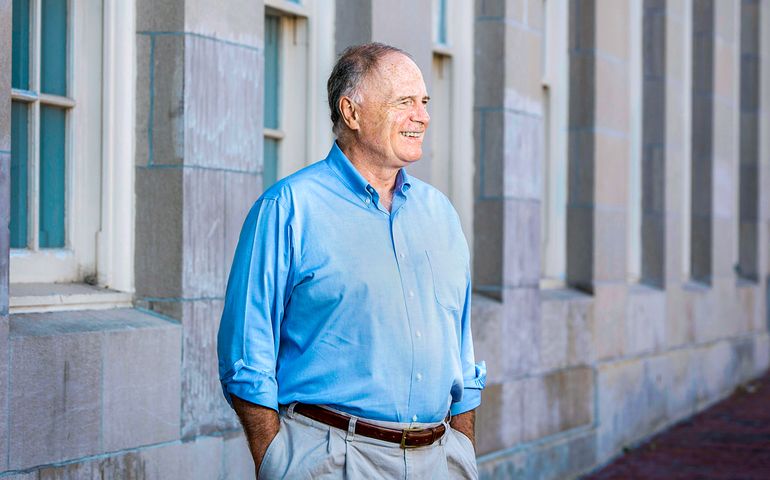

Bill Shanahan is co-president of Evernorth, a housing capital syndicate firm formed when Northern New England Housing Investment Fund merged with Housing Vermont in July. In three decades, they have invested in 13,000 homes for low and moderate-income residents and have raised $1 billion in equity.

Photo / Tim Greenway

Bill Shanahan is co-president of Evernorth, a housing capital syndicate firm formed when Northern New England Housing Investment Fund merged with Housing Vermont in July. In three decades, they have invested in 13,000 homes for low and moderate-income residents and have raised $1 billion in equity.

Bill Shanahan is co-president of Evernorth, a housing capital syndicate formed when Northern New England Housing Investment Fund merged with Housing Vermont in July. Over 30 years, the two entities were behind construction of 13,000 homes for low and moderate-income residents of Maine, New Hampshire and Vermont, and raised more than $1 billion in equity.

Some notable Northern New England Housing Investment Fund projects are the Motherhouse in Portland and 62 Spring St. in Auburn. Shanahan has been with the organization for 20 years, and shares president duties with Nancy Owens of Vermont. Mainebiz caught up with Shanahan shortly after the merger.

Mainebiz: Northern New England Housing Investment Fund has been around for 30 years. What’s its story?

Bill Shanahan: The Low-income Housing Tax Credit Program was created in 1986, but it was slow to take hold in rural states, so the housing finance authorities — MaineHousing, New Hampshire Housing and Vermont Housing Finance Agency — wanted to support the program by creating nonprofits like NNEHIF and Housing Vermont to raise capital and provide expertise in structuring deals using the credits. Syndication firms like NNEHIF are intermediaries — we match investors that can use the credits with affordable housing developments that can use the capital.

MB: What spurred the merger?

BS: NNEHIF and Housing Vermont grew up doing the same kind of work in a parallel fashion across northern New England. We have always worked closely with each other — we share the same kind of challenges — largely rural economies, an aging housing stock, an aging population and a shallow investor market. Honestly, the tipping point was we both wanted to raise more capital, and in order to do that, we combined forces in 2019 before we merged to attract more capital and it worked!

MB: Will developers and communities see changes?

BS: Our goal is to be more impactful, but it was a baseline starting point that we would not do anything to jeopardize our local identity and existing relationships.

MB: What kind of community relationships are important to Evernorth?

BS: It’s hard to think of community development without housing. When we look at housing investments, we’re always cognizant of how that development will fit and who might live in housing we are preserving or creating.

MB: The fund has played a role in a lot of historic redevelopment.

BS: These properties are some of the most challenging, and at the same time the most rewarding. A revitalized historic structure in a struggling downtown can turn around that whole community. We do try to work with developers to create these properties. The federal Historic Preservation Tax Credit program brings more resources to these developments, and in Maine and Vermont there are state historic credits that further encourage the redevelopment and rehabilitation of these properties. And for what it is worth, people really like living in these historic structures.

MB: How important are smaller projects you help fund?

BS: We can create 10 or 11 units that house tenants, who now may get the supportive services they so desperately need. This is where we differentiate ourselves from national syndication firms that would not make these investments. These go back to our local focus — it’s just who we are. It’s our DNA.

MB: What else can be done?

BS: With all the housing we have been able to preserve or create, it hasn’t been enough. The Low-income Housing Tax Credit Program program serves people at certain income levels and the program has its limitations. The challenge is to find other ways to satisfy the demand for housing, particularly for people with unique housing needs. We will continue our commitment to making the LIHTC program work, but we want to find ways to help those people that struggle finding housing. There is nothing more basic to our health and welfare than having a home. That’s true for all of us personally and as a community.

0 Comments