Retiring to Vacationland: Maine’s growing attraction for retirees ‘from away’

Photo / Tim Greenway

Lea Hopkinson, left, and Peg Adams, residents of Cumberland Crossing with their cockapoo, Buddha, relocated to Maine from Santa Rosa, Calif., to escape wildfires.

Photo / Tim Greenway

Lea Hopkinson, left, and Peg Adams, residents of Cumberland Crossing with their cockapoo, Buddha, relocated to Maine from Santa Rosa, Calif., to escape wildfires.

They met at a Sadie Hawkins Day dance in Salem, Mass., and now call Maine home. Peg Adams, 76, a retired teacher, guidance counselor and college administrator and Lea Hopkinson, 78, a retired physical therapist and acupuncturist, moved here with cockapoo Buddha from Santa Rosa, Calif., in September 2021, to escape wildfires and droughts.

“We moved out to California to be near one of my kids and grandson, but we ran away from too many forest fires coming down the mountains and decided that wasn’t a good way to become sedentary seniors,” Hopkinson says.

They live in Cumberland Crossing, a 55-and-older development by OceanView at Falmouth, in a house with a sunroom and patio, with a “wonderful group of neighbors,” according to Adams.

“Our children are far away but lots of people here are new to Maine,” she says, while Hopkinson recalls seeing “more gay flags out than we had ever seen” when they arrived.

For a growing number of older Americans, Maine isn’t just Vacationland — it’s a desirable place to retire. While some come because of family or New England ties, others cite reasons from Maine’s cool climate that’s less prone to extreme weather and plentiful continuing education opportunities.

“There’s this assumption that people always go south,” says Shireen Shahawy, OceanView’s director of sales and marketing. “What we find is that some of our residents might go away for a few weeks in the winter, but they’re not afraid of being here.”

She mentions one couple from Texas in the process of moving to Maine “because they’re tired of the climate, terrified of the electrical grid and not exactly excited about the politics” in the state they’re leaving.

‘You won’t save on taxes’

While being rich in monetary terms is not a prerequisite for retiring in the Pine Tree State, those minded to move should plan their finances accordingly — and be prepared to have up to 7.15% of personal income taxed, the highest rate in New England. Florida, a popular retirement spot, is one of nine states without a personal income tax.

“You won’t save on taxes by moving to Maine,” says Jill Hibyan, a Portland-based private client advisor with F.L.Putnam Investment Management Co. To anyone mulling a move, she says, “It’s never too early to start planning for another stage of life.”

In Topsham, 81-year-old retired field engineer Bob White can attest to that, five years after finding a new home in the Highlands retirement community with his wife, Sara, from Sunnyvale, Calif. Sara, 79, is a retired executive secretary whose experience includes a year abroad in Paris, helping “Gone with the Wind” actress Olivia de Havilland answer fan mail.

Bob jokes about living on a “wrinkle ranch,” and has this advice to anyone about changing their residency for retirement: “Start a good investing program no later than about 1975.” By luck, he says he took an online course in personal financial development that gave him a good start but he’s now stymied by rising expenses this winter.

“Between gas and electricity and general prices, we’re having to do some reconfiguring on how we’re going to get more money,” he admits. “I’ve got enough investments to be very helpful, but I’m probably going to have to figure out a way to get $2,000 more a month.”

Sara finds that while there are some things they miss about California, it’s best to steer clear of making comparisons “because we just drive ourselves crazy.”

How Maine stacks up

In the latest WalletHub survey of the best states to retire, Maine ranks No. 29 out of 50, with strong scores for quality of life and health care eclipsed by poor marks for affordability.

Another analysis, by GOBankingRates.com, looks at how long a $1 million nest egg will last in each state. In Maine, the timeframe is 18 years, two months and 31 days. That compares to only 10 years plus change in Hawaii, the most expensive state for retirees, and less than 14 years in New York, the second costliest. Within New England, Rhode Island is the only state where the savings would last longer than Maine — by a little more than five months.

The AARP Livability Index, which scores states, cities and even zip codes, puts Maine in the top half of desirable places to live, with above average scores for housing, transportation and the environment.

“Before you pick up the index, what I ask everybody to do is think about the long term and how your life might change,” says Rodney Harrell, AARP’s vice president for home, family and community, who created the index in 2015. “The biggest pitfall is to avoid looking for the perfect place.”

Describing every housing choice as a compromise, Harrell cites AARP research showing that most adults want to stay put in their homes and communities as they age but admits that the pandemic’s long-term impact on moving patterns remains to be seen.

Boomers on the move

In 2022, more than 234,000 Americans moved to retire, up 4% from 2021, says a report by California moving company Hire A Helper. It found that 12% of retirees moved for cheaper housing, the highest since 2014, and listed the Sunshine State as the top go-to place.

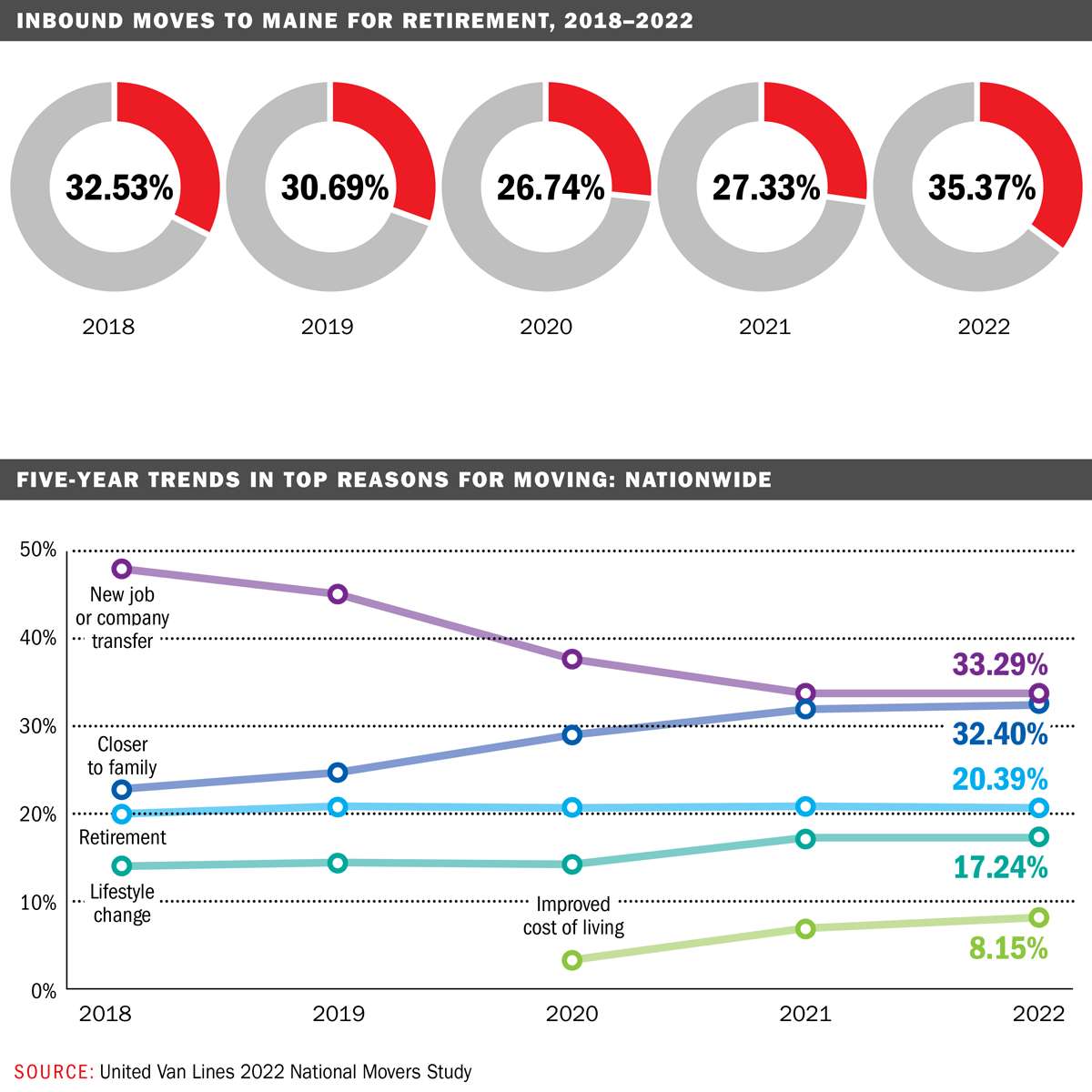

While Maine was not among the top 10, a report by United Van Lines released in January shows a far higher percentage of people coming to Maine for retirement (35.4%) in 2022 than those who left (22.4%). The 35.4% inbound rate is up from 27.3% in 2021 and the highest in five years, according to Eily Cummings, a spokeswoman for UniGroup, United Van Lines’ Fenton, Mo.-based parent company.

“The levels we are seeing for retirement in Maine are back to pre-pandemic numbers,” she says. “This is likely due to the lower cost of living — 3% below national average and significantly lower than some of the more traditional retirement states — environment, and slower pace.” Looking ahead, “we would expect the number to continue at pre-pandemic percentages, which are around 30%.”

The same report found that a higher percentage of people moved into Maine than out of Maine for retirement, and that the 65-and-older group accounted for the largest proportion of inbound moves to the Pine Tree State.

Higher mobility rates for older adults may be explained in part by Baby Boomers’ higher spending power, education and access to health care than their forebears. (Boomers are often defined as those born between 1946 and 1964, or ages 59 to 77 this year.)

“My generation, the Baby Boom generation, is the healthiest and wealthiest generation ever to walk on the face of the Earth,” William Beach, commissioner of the U.S. Department of Labor Statistics, told journalists at a National Press Foundation fellowship in Washington, D.C., last September. “And medical care is more accessible than it ever has been before.”

At the same time, Beach noted that the assets of the current generation — who received $25 trillion in wealth transferred from their parents and are estimated to transfer $60 trillion to their children — are “extraordinary unequal.” Put another way, “Now we have so many more people who are wealthy, but the distribution is enormous.”

As more people choose Maine for retirement, some are also turning to local advisors to help manage their affairs. Mackenzie Arsenault, a principal with Cornerstone Financial Planning in Portland, says she’s working with several clients who have retired and moved to Maine, as does Lebel & Harriman’s Rebecca Burchill, the Falmouth firm’s managing director of financial planning.

“While a majority of our clients are Maine natives, recently we have seen an increase in the need for financial planning for those moving to Maine from out of state,” Burchill says.

At home in Maine

More affordable than many traditional retirement spots and most of its regional peers, Maine offers perks for older individuals coming here from all over the country and all walks of life.

Family reasons brought Maria and Phil Ptacin to Portland in 2018 from Battle Creek, Mich., where Maria ran restaurants and Phil was a family physician. Both are in their 70s and retired, though Phil fills in two to three days a month at Martin’s Point Health Care in Biddeford.

After deciding to move to Maine on a flight back from Detroit, they settled into a downtown Portland condo four months later — conveniently across Casco Bay from their grandchildren, ages 4, 7 and 9, and walking distance to restaurants and symphony concerts.

“We were living in a large home on a lake in Michigan, and we thought, we’ll live on a lake or the ocean in Maine,” says Phil. “Then we started to find out what the costs were to do that.”

Here in Maine to stay, Maria — who was born in Poland and educated as a physicist — says she likes to say that “we can survive on one chicken a week.”

“I’m very happy we moved here,” she says, “and we are so blessed.”

In Scarborough, Anne Bartol Butterfield and her husband, Sandy Butterfield, feel the same way, after relocating from Boulder, Colo., in 2020. They came for a combination of reasons, including a desire to protect the family beach place built by Anne’s great grandparents from worsening storms.

Since coming back, Sandy has organized construction of a sand dune and sea wall that Anne says was highly effective in the last storm while Anne has reconnected with childhood friends. A board member of WildEarth Guardians, a nonprofit defending wildlife and wild space across the western United States, she is looking to expand her environmental work in Maine and considering her future commitments.

“When it comes to nonprofits,” she says, “I like lots of them.”

Family history also brought Susan Cary and her husband, Larry Borysyk, to Maine, decades after her parents built a house on Peaks Island where they retired and that’s still in the family. Previously living in western Massachusetts, Borysyk, 77, is a retired exercise physiologist who had worked in cardiac rehabilitation, while Cary, 72, is a partly retired addiction psychiatrist.

They live in Cape Elizabeth, where he is a backyard beekeeper with three hives that are currently dormant but honey-filled, and they go on regular walks to Fort Williams Park with labradoodles Gracie and Growler.

Comparing prices between here and their previous residence, “Income taxes don’t seem to be a big difference,” Cary says, “but everything else is more expensive — groceries, gas, all that stuff.”

On the plus side, she admits to “getting spoiled” in a short time by the wide choice of good-quality local restaurants.

Back at Cumberland Crossing, Adams and Hopkinson are delaying travel as long as they have cockapoo Buddha, who is blind and has an enlarged heart and accompanies them everywhere in his carriage, even to church in Yarmouth and shopping at L.L.Bean in Freeport. The couple has lived in many places over the years, including the country of Mexico after retiring early.

Despite their previous nomadic wanderings, Hopkinson says, “we feel like we’re here to stay.”

0 Comments