WEX scraps acquisitions as virus impact hits travel sector; undershoots on earnings

WEX Inc. (NYSE: WEX), a Portland-based provider of corporate payment solutions to the fleet, travel and healthcare sectors, on Thursday posted first-quarter earnings that fell below expectations.

It also pulled out of two acquisitions with a combined $1.7 billion price tag, a first for the company, which also announced steps to cut costs and control capital expenditures.

Earnings per diluted share in the quarter ended March 31 were $1.81, up 5% from a year ago but falling short of market expectations. Analysts polled by Zacks Investment Research had projected earnings of $2.05 a share.

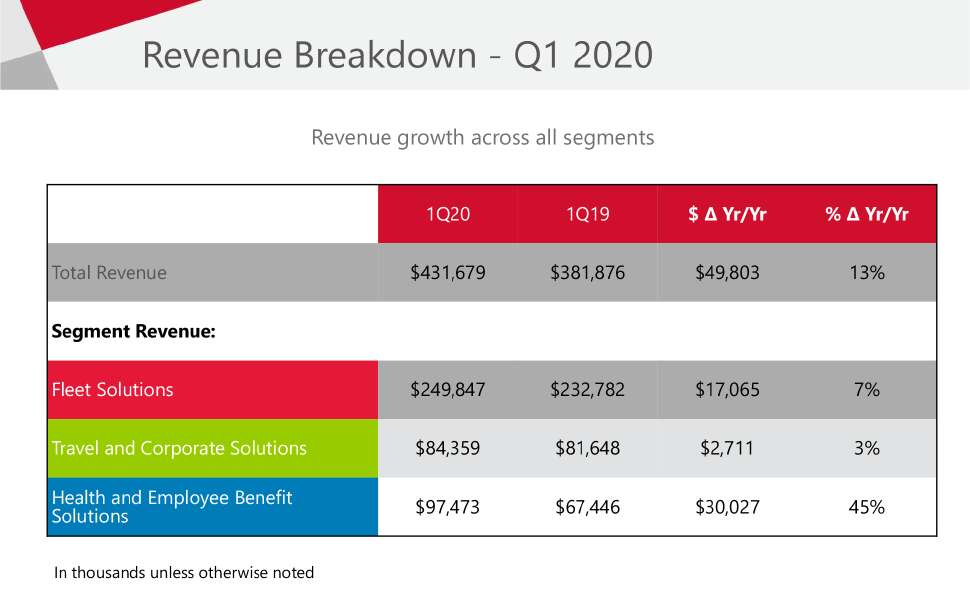

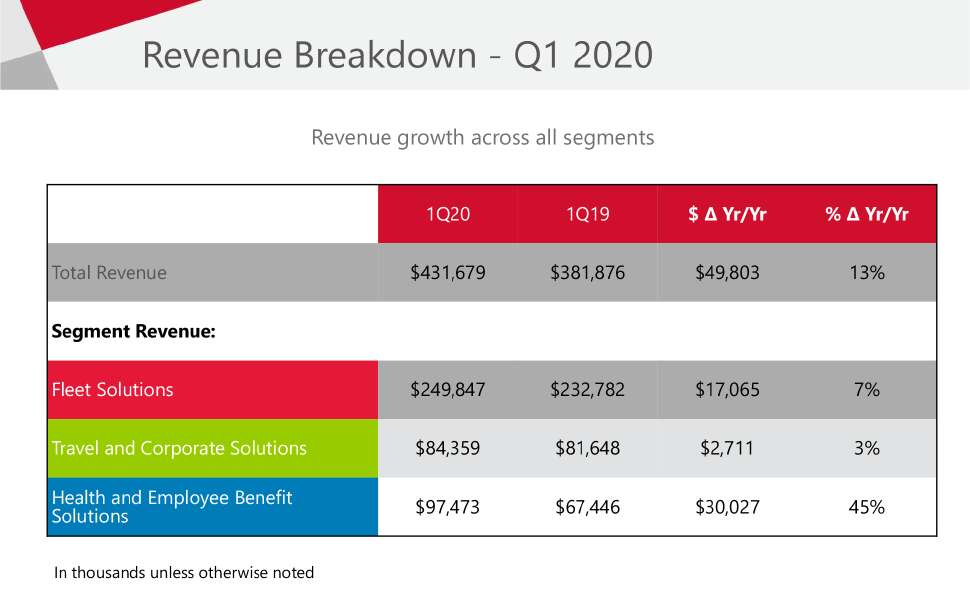

Fourth-quarter revenues were 13% higher over last year at $431.7 million, exceeding the Zacks consensus forecast of $425.64 million. The reported revenue was also at the lower end of WEX's expected range.

Melissa Smith, WEX's chair and CEO, told Mainebiz in a phone interview that she sees the growth continuing in the company's health and employee benefits division, noting it now accounts for 25% of revenues.

"It's a diversification play that we had a number of years ago that has created a lot of stability for the organization," she said.

Citing the effects of the novel coronavirus, WEX announced precautionary steps including pulling the plug on the acquisitions of eNett, a Singapore-based provider of business-to-business payment solutions to the travel industry, and Melbourne, Australia-based B2B payment provider Optal.

Both deals were unveiled in January at a cost of $1.7 billion in cash and stock.

In late morning trading, shares of WEX rose 6.1% to $138.07, giving the company a market capitalization of $6 billion. The stock is down about 35% from early February, compared with an 11% drop for the Standard & Poor's 500.

Today's news comes less than a month after WEX announced plans to trim its U.S. workforce by 2% and put another 3% on temporary furlough.

Smith told Mainebiz that the company anticipates bringing back all 117 U.S. furloughed employees by early August, and that it is in the process of taking voluntary actions in other markets.

Exact steps depend on what's happening in each country in regard to COVID-19, she told Mainebiz by phone. WEX employs about 5,000 people worldwide.

"Each country has had different reactions to COVID-19," she said. "And so we have been going through our offices around the world, and to the extent that we're taking any actions, we're doing it very thoughtful of whatever the regulations are."

Asked about Maine's economy, she said: "If you look at where Maine sits geographically, we're right on the edge of a pretty big COVID bubble, so these are hard choices that Gov. [Janet] Mills is making right now, trying to protect the safety of the people that live and work in Maine, conscious of the fact that our environment here right now actually looks pretty good from a COVID standpoint, but we're an hour away from a pretty big spike in activity."

Refocusing spending priorities

The company also said it had taken a series of actions to protect its financial flexibility, including pay cuts for the board and executive officers and refocusing capital allocation priorities.

In today's earnings release, Smith said that WEX is "managing the company for the long term and keeping our strategic pillars in mind so that we are well-positioned for when the economy recovers."

Of the steps announced Thursday, she said, "This combination allows us to navigate times like this without sacrificing our commitment to long-term sustainable growth. We have established a strong platform that is more resilient and diversified than ever before. While there is uncertainty in the near term, I am confident WEX will emerge a stronger business when conditions improve."

She told analysts in a conference that the company will continue to invest in all parts of the business, but at a slower pace due to the pandemic, and said it had not taken the decision lightly to walk away from the two acquisitions that WEX is not required to close, a first for the company.

Smith added that the cost-cutting measures announced Thursday and previously will "keep us focused on weathering the storm without sacrificing our long-term growth potential."

She also said the resilience and diversity of the company's portfolio coupled with market-leading positions in each segment plus a strong balance sheet "positions us well to navigate through these turbulent times."

Behind the numbers

The company attributed the 13% year-on-year revenue increase to the performance of its corporate payments and U.S. health businesses, which it said was partially offset by lower travel and fleet volumes in the second half of the quarter as the pandemic began to impact those markets.

"In response to these challenging market conditions, which are continuing in the second quarter, we rescaled portions of the business to better align with the current operating environment," said CFO Roberto Simon. "We are effectively responding to COVID-19 developments and remain confident in our business and the future of WEX."

WEX's fleet business, the largest of its three business segments which collects fees from fuel purchases, reported first-quarter revenues of $249.5 million, up 7% from last year.

Its corporate payments segment, which generates revenue from travel-related purchases like hotels and airfare, posted first-quarter revenues of $84.4 million, up only 3% from the year before.

WEX's smallest but fastest-growing business segment is its health and employee benefits platform, which posted first-quarter revenues of $97.5 million, a 45% jump over last year.

Smith told Mainebiz she expects that growth momentum to continue, noting that it has created a lot of stability for the company.

1 Comments