Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- September 8, 2025

- August 25, 2025

- August 11, 2025

- July 28, 2025

- July 14, 2025

- June 30, 2025

- June 16, 2025

- June 2, 2025

- May 19, 2025

- May 5, 2025

- April 21, 2025

- April 7, 2025

- March 24, 2025

- March 10, 2025

- Feb. 24, 2025

- Feb. 10, 2025

- Jan. 27, 2025

- Jan. 13, 2025

- 2025 Book of Lists

Williamson reflects on Homer exhibit sponsorship

"Weatherbeaten: Winslow Homer and Maine," which closed on Dec. 30, broke December attendance records and helped the Portland Museum of Art boost its membership by 20% to nearly 9,000.

Taking Maine's pulse

Carol Coultas- In Short

- Focus on Augusta/WatervilleFocus on Augusta/Waterville

Boghossian tees up Lockwood Mills development

Douglas RooksWhen Paul Boghossian launched the partnership that restored the historic Hathaway Mill in Waterville five years ago, he had no idea he'd just now start renovations to the other two buildings in the mammoth Lockwood Mills complex.

- How To'sHow To's

How to know if you need help with QuickBooks

Alison HinsonDo you use QuickBooks as your accounting software? If so, you're in good company. QuickBooks is the world's most popular small business accounting program and is used by millions of people.

Maine ports make headlines in 2012

Matt DodgeMaine's maritime ports made headlines as 2012 came to a close, with talk of re-establishing ferry service to Canada, a narrowly averted strike and a new budgetary highwater mark for one of Maine's busiest ports. Here's the ebb and flow:

5 economists forecast the year ahead

Every year, Mainebiz asks five prominent Maine economists to give us their predictions for the upcoming year.

- Focus on Augusta/WatervilleFocus on Augusta/Waterville

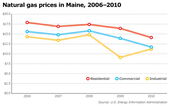

2 firms battle over Kennebec Valley natural gas market

Matt DodgeDespite its modest market demographics, the Kennebec Valley has become the site of a showdown between two natural gas providers vying to supply service to the area.

Today's Poll

In 2026, Maine voters will have their say in four key elections.

U.S. Sen. Susan Collins, R-Maine, is up for reelection for one of Maine's two Senate seats. (U.S. Sen. Angus King, I-Maine, will face reelection in 2030.) The November vote has added weight because Collins chairs the Senate Appropriations Committee, a significant source of Maine's federal funding.

In the House of Representatives, U.S. Rep. Jared Golden, D-2nd District, is not seeking reelection. The district includes northern and much of eastern Maine. And U.S. Rep. Chellie Pingree, D-1st District, is running for reelection.

Gov. Janet Mills, a Democrat, will term out as governor.

Individual Democrats and Republicans come and go, but the money elected officials control can be a major factor in Maine's economic prosperity.

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register