Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

-

- Lists

-

Viewpoints

-

Our Events

-

Award Honorees

- 2025 Business Leaders of the Year

- 2025 Outstanding Women in Business

- 2024 40 Under 40 Honorees

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

-

-

Calendar

-

Biz Marketplace

- News

-

Editions

View Digital Editions

Biweekly Issues

- September 22, 2025

- September 8, 2025

- August 25, 2025

- August 11, 2025

- July 28, 2025

- July 14, 2025

- + More

Special Editions

- Lists

- Viewpoints

- Our Events

- Calendar

- Biz Marketplace

Small Business

-

Maine hair salons are trying to cope with coronavirus, and new competition

William Hall Updated: June 2, 2020While salons across the state began to reopen during May, a chain of 4,500 franchises opened its first two in Maine. Hair care businesses everywhere have been rocked by the pandemic, but some here express cautious optimism.

William Hall Updated: June 2, 2020Mainers push for SBDC update, to boost COVID-19 small business survival

Maureen Milliken May 29, 2020U.S. Rep. Jared Golden's bill to reauthorize Small Business Development Centers, adding more money and functions, is stalled in the Senate. He and program officials say the legislation is more important as small businesses struggle to stay afloat.

Maureen Milliken May 29, 2020Small-biz relief program on track for 'mid-course correction,' King says

Renee Cordes Updated: May 29, 2020The Paycheck Protection Flexibility Act, co-sponsored by U.S. Sen. Angus King, R-Maine, passed in the U.S. House of Representatives on Thursday and heads next to the Senate. He talked with Mainebiz on Thursday.

Renee Cordes Updated: May 29, 2020MCF awards $200K in Startup/Scale Up grants, from Millinocket to Portland

Staff May 22, 2020Recipients in the latest funding round include Our Katahdin, to develop affordable incubator space in downtown Millinocket, and the New England Arab American Organization in Portland.

Staff May 22, 2020As economy reopens, Maine state chamber launches COVID-19 public awareness campaign

Renee Cordes Updated: May 21, 2020"This is ME Counting on You," is a new public awareness campaign by the Maine State Chamber of Commerce. The campaign urges safe practices to stop the spread of COVID-19 so that businesses can reopen and Mainers can return to work.

Renee Cordes Updated: May 21, 2020Amid pandemic, Maine farmers markets are busier than ever

Laurie Schreiber May 20, 2020While the spread of COVID-19 affects Maine's food industry, farmers markets are busier than they’ve ever been. The information is anecdotal, but most markets are reporting that, for this time of year, they’re seeing an increase in shopper traffic.

Laurie Schreiber May 20, 2020Dozens of Maine business owners urge Mills to continue quarantine

William Hall May 19, 2020After tourism advocates last week urged the governor to discontinue the requirement on travelers to the state, over 80 small business owners argue that lifting the quarantine would be disastrous to public health and to the economy.

William Hall May 19, 2020Portland council OKs outdoor restaurant, retail plan

Renee Cordes May 19, 2020The plan, approved in a virtual meeting Monday evening, would turn six downtown streets into pedestrian-only venues for outdoor dining and retail from June 1 to Nov. 1.

Renee Cordes May 19, 2020Maine fishing family turns fishermen’s pants into totes and more

Laurie Schreiber Updated: May 18, 2020The pandemic hasn't stopped a fisherman's family from launching their new manufacturing business by the seat of their pants, literally. The first batch of inventory received so much interest that Taylor and Nikki Strout decided to push forward.

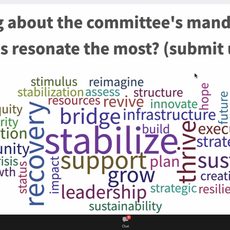

Laurie Schreiber Updated: May 18, 2020Economic Recovery Committee will be bridge to rebuilding economy, members told

Maureen Milliken May 15, 2020Using the 10-year economic development plan unveiled in December, the 40-member committee that met for the first time Friday is charged with looking at solutions to help the state recover from the economic impact of the pandemic.

Maureen Milliken May 15, 2020Thinking on their feet: Restaurant owners adapt to changing times

Renee Cordes Updated: May 18, 2020Even the fast-moving restaurant industry has been tested by the pandemic, and small eateries are having to make hard choices. "It's either evolve or die," says one Maine restaurateur.

Renee Cordes Updated: May 18, 2020Derailed for now, five small businesses make changes to stay on track

Maureen Milliken Updated: May 18, 2020These snapshots show how small businesses are making the best of a big challenge. Plans are on hold, and frustration can be frequent. But the businesses are ready to rebound.

Maureen Milliken Updated: May 18, 2020Fork Food Lab, Atlantic Sea Farms cook winning recipes in move from food retail to ‘etail'

Renee Cordes Updated: May 18, 2020Since the pandemic hit, these small businesses in Maine's food industry have altered the way they go to market, and are enjoying the just desserts.

Renee Cordes Updated: May 18, 2020Startup restarts: Mission-driven pivot sparks growth at two Maine niche textile makers

Renee Cordes Updated: May 18, 2020From apparel to PPE, from wallets and bags to face masks, these niche manufacturers realized switching product lines filled a critical need — and also made business sense.

Renee Cordes Updated: May 18, 2020Small businesses fight the pandemic: Manufacturers, breweries and more change up production

Laurie Schreiber Updated: May 18, 2020Manufacturing plants, breweries and university labs may seem like unlikely business partners. But in the age of coronavirus, Maine small businesses and other organizations are teaming up to produce critically needed supplies.

Laurie Schreiber Updated: May 18, 2020From the Editor: As pandemic gets entrenched, businesses find ways to adapt

Peter Van Allen Updated: May 18, 2020The timing of this small business issue comes at a time when small businesses are in disarray, struggling to find their way during the COVID-19 crisis.

Peter Van Allen Updated: May 18, 2020

Today's Poll

Sponsored by Kennebunk Savings Bank

Maine's cruise ship season is in full swing, running from late September through early November. Thousands of passengers are expected to visit Portland, Bar Harbor, Eastport or Rockland.

This week alone, Portland is set to welcome around 16,000 cruise ship passengers.

But as the season ramps up, it's bringing mixed reviews. Some locals brace for the crowds and many business owners say cruise ship visitors don't spend much while in the port. Other business owners argue that, even if cruise ships don't benefit their own coffers, they still benefit the overall economy.

When we asked this question in 2023, Mainebiz respondents, 21% said the visits bring customers and revenue, while only 18% said the visits don't help their business.

More than half of the respondents, 53%, said cruise ships benefit the overall economy.

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

This website uses cookies to ensure you get the best experience on our website. Our privacy policy

To ensure the best experience on our website, articles cannot be read without allowing cookies. Please allow cookies to continue reading. Our privacy policy