American Steel brings new technology to an old industry, saving time and money

A Maine company that recently started processing steel with a next-generation, $1.4 million laser has actually been handling metal since before the state was a state.

American Steel and Aluminum LLC in South Portland uses the 56,000-pound, German-made machine — one of about 20 installed worldwide last year — to cut, drill, engrave and shape steel into complex designs and sizes, all produced to custom specifications.

By using the laser device, the company can easily make dovetails and other precision-cut connections without old-school welds, saving time and money. A single employee needs only a couple of minutes to turn out processed metal that previously could take an hour and involve separate steps by five workers.

For its customers, the precise work also has benefits.

“[American Steel] is one of the first in Maine to provide value-added services to the steel that manufacturers are consuming,” says Tyler Fitzpatrick, commodity manager at Fisher Engineering, a Rockland manufacturer of snow plows.

American Steel delivers steel parts in partially finished, easily assembled kits, each of which can equip 20 plows.

“They support us very well by providing precise laser-cut, kitted parts so we can continue to make high-quality plows,” Fitzpatrick says.

A changing industry

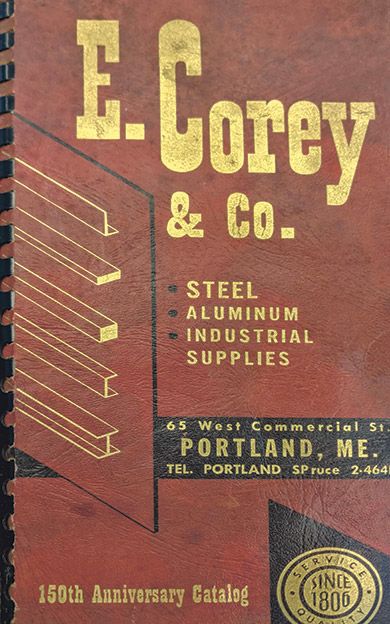

The high-tech operations at American Steel bear little resemblance to its original business, established in 1806 by Francis Edmonds as Swedes Iron, which was on Portland's Long Wharf. Back then, merchant ships delivered much of the country's bar iron from ports in Sweden and Norway.

Soon Swedes Iron was also carrying steel and in 1869 incorporated as E. Corey & Co., after the name of Edmonds' partner. At one time Portland's oldest existing business, the company remained on the waterfront until it merged with American Steel and moved in the 1960s to the current location on Wallace Avenue in South Portland.

In addition to South Portland, American Steel operates facilities in Auburn, Mass.; Fremont, N.H.; and Syracuse, N.Y.

Steel, aluminum and copper-nickel alloy, from U.S. and Canadian mills, arrive via rail and truck as sheets, coils, tubes, bars, beams and other shapes. Inside its cavernous 80,000-square-foot Maine facility, American Steel stores nearly 4,000 forms of metal, from 50-foot-long, 16-inch-wide beams to quarter-inch-wide “keystock” steel used in gears and couplings.

“Steel is not just steel,” says Sam Blatchford, American Steel's president. “There are thousands of varieties, and a lot of science behind each one.”

American Steel saws and mills the raw metal to customer specs before distributing the processed materials to manufacturers throughout Maine and the Northeast. The metalsmithing is a growing part of the business, and an increasingly important service for customers.

The value-added work represents about 10% of American's business, according to Blatchford. But he hopes that portion will eventually grow to 50%.

“What we're really going after is, 'How can we assist customers to get better throughput and be more profitable, by doing more of the stuff they're experts at?'” he says.

Hidden impact

While customers such as Fisher, Bath Iron Works and North Berwick-based Hussey Seating Co. are well-known in Maine, you won't find the American Steel and Aluminum logo on plows, ships or your seat at Gillette Stadium. It may even come as a surprise that Maine is doing steel work at all.

The steel industry has moved far beyond its roots in Pittsburgh and the industrial Midwest.

American Steel employs over 100 and is a subsidiary of privately owned Nova Steel Group, a Quebec-based processor and distributor with plants in Canada, the United States and Mexico.

And while Maine doesn't manufacture raw steel, steel fabrication and processing account for more than 600 jobs statewide, $36 million in wages and $135 million in direct economic output, according to 2018 data from the American Iron and Steel Institute. Suppliers to the state's steel industry generate another $151 million in output.

Those statistics represent a small fraction of the $206 billion industry nationwide, and are less than half the corresponding results recorded in New Hampshire. Nevertheless, businesses like American Steel play a key role in Maine's manufacturing sector — a role that belies the numbers.

Because American Steel can cut steel to length, handle initial fabrication and ship almost anywhere, it is a good match for local industry, according to Bill Whittier, senior project manager at the Maine Manufacturing Extension Partnership.

“In Maine, small manufacturers are prevalent. And they're all over a very vast state,” Whittier says. “It's a long way from the steel mill to the end of the road, but [American Steel] is reaching all the corners of Maine.”

The company's fleet of 10 tractor-trailers make 200 deliveries a week, and the Maine location is a benefit, Fitzpatrick says. “One of the biggest challenges you face when dealing with steel is the logistical cost to move it,” he says, “so it's helpful having American Steel and Aluminum so close to help us control our cost.”

Industry challenges

Geography presented a problem after the Trump administration imposed tariffs on steel and aluminum last year. While the import taxes benefited steel manufacturers, many steel processors and their customers were forced to pay higher prices.

“The initial impact of the tariff was very disruptive to our normal supply chain, as we have always relied on the closest mills to New England which happen to be in Quebec and Ontario,” says Blatchford.

Despite its Canadian connection, American Steel increasingly turned to domestic mills. Today, one of its primary suppliers is Charlotte, N.C.-based Nucor Corp., the largest U.S. steelmaker.

“This is one of the reasons why you need to have a good supply base, why you need to have many suppliers,” Blatchford says. Meanwhile, he notes, prices have peaked and have returned to “more normal levels.”

Other challenges remain. Blatchford says the company has a shortage of employees. That was one of the major reasons for investing in the laser device.

“I think it's a common issue within all of Maine manufacturing — no one can find talent,” says Blatchford. “It is really difficult finding people. And we make sure to hang onto the good ones. But things were getting to the point where we couldn't take on any more work.”

By enabling one employee to do the job of five, he hopes, the new laser device will help American better use its stretched-thin workforce.

Laser processing will also provide higher-quality processing for customers, says Whittier, who has advised American and led Maine MEP's technical assistance to the company.

“Maine manufacturers will be able to reduce the amount of rework necessary,” he says. “This is just a step up for everybody.”

One of American Steel's customers, Gary Merrill, president and CEO of Hussey Seating Co, agrees: “Having a local supplier who both knows our business and invests in the future of manufacturing in our state is a key piece in expanding the global footprint of Maine-manufactured products.”

Now it's up to Blatchford and his team to prove that additional value to manufacturers.

“The machine can pay for itself, but we have to grow the business,” he says. “The manufacturing community in Maine is fairly limited, so we have to go deeper into customers.”

Comments