Businesses balk at Mills’ proposal to tax PPP loans

Plans by states, including Maine, to tax PPP loans are creating a backlash from businesses.

Under the budget proposal from Gov. Janet Mills, loans proceeds under the federal Paycheck Protection Program would be taxed as ordinary income.

States would use such taxes to compensate for revenue lost in other areas in the past year.

If that part of the budget is approved, Maine could see revenue of $100 million.

The Maine State Chamber of Commerce is among the organizations that have weighed in against that idea, testifying before the state Legislature.

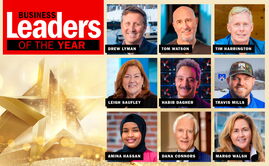

Dana Connors, president and CEO of the chamber, part of the original appeal of the PPP was the aspect of it being a tax-free loan at both the federal and state level.

“We did advocate for total conformity,” Connors told Mainebiz. “It’s a benefit that was provided at the federal level and one that businesses here in Maine definitely depended on. The double benefit had tremendous meaning in the pandemic and all the struggles Maine’s small business and hospitality industries, among others, including manufacturing faced during this time.”

Business owners Connors has talked to are "disappointed," he said, and were expecting the same treatment on both the federal and the state level.

Some 28,000 Maine businesses received a total of $2 billion in PPP loans.

The Joint Standing Committee on Appropriations and Financial Affairs is holding public hearings this week on LD 42, “An Act Making Certain Supplemental Appropriations and Allocations and Changing Certain Provisions of the Law Necessary to the Proper Operations of State Government (Emergency).”

The Bangor Region Chamber of Commerce urged members to “take action today and contact your legislators and urge them to VOTE to fully align with the federal government on tax conformity.”

The Bangor chamber said a state tax on PPP loans would “further burden Maine businesses that received federal funding as a result of COVID-19.”

Greg Dugal, director of government affairs for the trade group HospitalityMaine, has said publicly half of its industry would not have survived without the federal PPP loans.

"[We're] getting a tremendous amount of feedback from our members as one more unexpected cost could be the last one incurred by some hospitality businesses. Remember the Maine Economic Recovery Grants are taxable too, so it could be sizable tax bill if we don’t conform to federal PPP income tax forgiveness to some degree," Dugal told Mainebiz.

The owner of a Yarmouth restaurant, the Muddy Rudder, told WGME Channel 13 that a $199,000 PPP loan last spring was crucial to the business's survival, allowing it to remain open and meet payroll. The restaurant’s revenue has been about half a normal year. If the state taxes the PPP loan, owner Matthew Witham told the TV station, the Muddy Rudder would face a tax bill of $14,500.

Mainebiz web partners

This money has been spent already. They will not be giving it up.

Augusta cares about Augusta and social programs.

1 Comments