Maine assets key to CT utility's growth

In 2012, Connecticut Water Service Inc. became the largest investor-owned water utility in Maine.

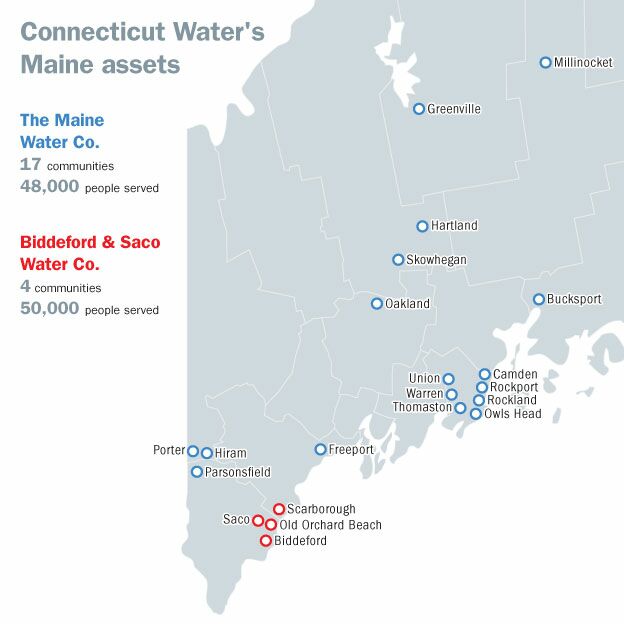

Its entry into Maine water markets started with the $53.5 million purchase of Aqua Maine (now Maine Water Co.) in January, an acquisition that includes 11 water systems serving 48,000 people in 17 communities. It closed the year with the $19.8 million purchase in December of the Biddeford & Saco Water Co., which supplies water to almost 50,000 people in southern Maine.

The Maine acquisitions increased Connecticut Water's overall customer base by 35%, making it one of the 10 largest publicly traded water utilities in the United States and the largest in New England. It now supplies water to almost 100,000 people in Maine, and nearly 400,000 people overall when its Connecticut customers are counted.

And it begs the question: Why is a Connecticut water company buying its way into Maine?

Michael Roomberg, vice president of equity research at the New York City-based investment firm Ladenburg Thalmann & Co. Inc. and an expert on the water industry, offers two reasons: It expands Connecticut Water's customer base and therefore its revenues. More importantly, it does so in a different regulatory and geographic environment.

The benefit, Roomberg says, is a hedge. If the company is seeing less water usage in one state because of a wet summer (for example, people aren't watering their lawns as much), the other state's weather might be driving water usage up. Likewise, he says, one state's regulatory commission might be slower or stingier in approving rate increases than the other's.

For Connecticut Water, he says, diluting those risks by expanding into another state is the equivalent of not putting all its eggs in one basket. In Roomberg's view, it's a smart move that bodes well for its investors and its new customers in Maine.

"Connecticut Water is an extraordinarily well-run, investor-owned regulated water utility," he says. "The company has been supremely skillful in balancing the interests of investors, customers, regulators and local officials."

New owner, same mission

In a Nov. 9 press release announcing the Maine Public Utilities Commission's approval of the $19.8 million purchase, Biddeford & Saco President Jerry Mansfield underlined why joining with Connecticut Water and its other Maine subsidiary made sense: "The increased access to capital by becoming a part of Maine Water and CWS allows for greater infrastructure investment to maintain and improve the system, which is needed for future economic development as well as public health and safety."

The benefits for Aqua Maine were slightly different, in part because its parent company, Aqua America, serves 3 million residents in 10 states and reported net income of $143 million in 2011. It decided to sell its Maine assets to focus on increasing business in growing population centers. A much larger company than Connecticut Water, Aqua America, and therefore its Maine subsidiary, didn't have a problem with access to capital.

But capital was a driving force.

Maine Water Co. President Judy Wallingford, who oversees the operations of the former Aqua Maine and Biddeford & Saco, says the circumstances leading to their sales were different, but their purchases by Connecticut Water highlight a convergence of two challenges in the very capital-intensive water industry:

- Smaller water utilities — even when they're investor owned, as both Maine companies were before being acquired by Connecticut Water — increasingly are challenged by the high cost of replacing their aging water mains or upgrading treatment facilities in an era of dwindling state and federal funding. This was particularly true for Biddeford & Saco, which tried to raise $2.1 million in 2010 through the sale of up to 35,000 shares of common stock, but raised less than half that amount.

- Larger investor-owned utilities — while they typically have readier access to private capital — are challenged by the need to keep investors happy in an industry that's regulated by state public utilities commissions. They can't simply raise rates to increase profits; the rate hikes have to be justified and approved by regulators.

Gaining new customers through acquisitions, then, helps increase a larger utility's revenue base, and that's what leverages capital investments the smaller utility might not have been able to make on its own. By employing economies of scale on a wide array of costs — from the chemicals used in the water treatment process to buying property and general liability insurance — Wallingford says Connecticut Water and its Maine subsidiaries should be able to lower the average cost of providing safe drinking water to customers. That has already happened with Biddeford & Saco customers, who saw a planned 2012 rate hike filing delayed until at least the second half of this year.

"Connecticut Water brings to the table its knowledge base, and that expertise can be shared with us here in Maine," she says, adding that sharing best practices is a two-way street, citing the electronic billing system already at Maine Water as something both Connecticut Water and Biddeford & Saco will be able to emulate.

A growing company

Investor analyst Roomberg is bullish on Connecticut Water Service Inc., describing its stock as "a strong performer for investors." It's listed on the NASDAQ Global Select Market.

He says the company's 56-year record of paying quarterly dividends —which currently yield an annual 3.4% rate of return — is particularly prized by investors wanting a safe and predictable stock in their portfolio. Those dividends, in turn, are fueled by steady growth in the company's earnings.

Connecticut Water's total operating revenues grew from $46.9 million in 2006 to $69.4 million in 2011. By far the largest revenue growth was in the residential sector, which went from $29 million to $43.65 million in those five years. Net income went from $6.7 million in 2006 to $11.26 million in 2011.

In last year's third-quarter report, the company anticipated ending 2012 with $12.72 million in net income. The addition of Maine Water as a subsidiary, coupled with the sale of land in Plymouth, Conn., was cited as a prime reason for the $1.4 million increase over 2011.

Roomberg says Connecticut Water's strong market performance in recent years coincides with the arrival of Eric Thornburg in 2006 as the company's chairman, president and CEO following a long career with American Water, the largest publicly traded water and wastewater utility company in the United States. He says the challenge Thornburg faces as Connecticut Water's CEO is universal among water companies, large or small: How to pay for essential infrastructure upgrades involving underground water mains 50, 80 or even 100 years old.

Thornburg's answer: Customer satisfaction.

"We're determined to build the trust relationship between our company and our customers," he says. "We know the rest will work out if we really focus on providing excellent service to our customers."

In terms of replacing aging underground water mains, Thornburg says trust comes through educating ratepayers about long-term infrastructure needs and costs. The next step involves using some of the company's capital to pay for a replacement program that tackles the infrastructure needs head-on, instead of leaving them for future ratepayers and taxpayers.

To that end, Connecticut Water's board has OK'd $4.8 million in capital spending for Maine Water Co., a decision made before the Biddeford & Saco deal closed. Wallingford expects an engineering survey of the Biddeford & Saco system will require $1 million to $1.5 million in capital investment in 2013. Across the state, Maine's aging water systems need about $1 billion in upgrades over the next 20 years, according to the American Society of Civil Engineers.

Thornburg acknowledges that part of the appeal in acquiring the Maine companies is a new state law that allows water utilities to assess a temporary surcharge to help pay for water infrastructure (see sidebar, page 13). Connecticut has a similar program, which Connecticut Water tapped to help finance the replacement of 15 miles of pipe last year. For 2013, the company's board of directors budgeted a $31.3 million capital spending plan that includes $15 million to replace unreliable, undersized or leaky pipes in Connecticut. Since 2007, the company has replaced more than 50 miles of aging water mains.

In December, a public stock offering of 1.7 million shares of common stock, priced at $29.25, raised $43.1 million, of which $17 million will be used to pay for part of the $53.5 million purchase of Aqua Maine.

Thornburg says the stock offering was the first in more than 20 years for Connecticut Water, and it offered a solid affirmation of the company's performance in recent years.

"We had requests for 3.2 million shares," he says. "Most of our shareholders are everyday people who are looking for a low-risk investment and a reliable income stream."

Looking ahead, Thornburg sees the two Maine purchases as providing a "solid platform" for continued expansion.

"Additional size helps drive revenues," Thornburg says, noting that he's told investors and analysts the hub of the first circle of growth centers on Connecticut and Maine. The second concentric circle covers New England, and possibly would extend into New York. The final circle covers the Atlantic Seaboard.

Balancing public-private interests

Thomas Welch, chairman of Maine's PUC, is reluctant to characterize Connecticut Water's purchase of two Maine water utilities in a single year as a trend. He considers it "more of a coincidence than anything else" that Maine Water's prior owner, Aqua America, decided to sell its Maine assets in a retrenching strategy at roughly the same time Biddeford & Saco failed to raise the full $2 million it needed for capital expenses and began seeking a buyer.

In reviewing Connecticut Water's plans before signing off on the acquisitions, Welch says, the PUC had to make sure "there's no harm to the ratepayer." Questions get asked about the company's financial well-being, its track record and ability to make necessary investments in the infrastructure that will keep the drinking water safe for its customers, he says. In the case of an investor-owned water company, the PUC also recognizes it's entitled to make a profit.

"How a company achieves a profit, we don't tend to micromanage that," Welch says. "If the company in front of us is providing the service, it should be at a fair and affordable price; anything outside of those public interests is not our concern."

Thornburg describes Maine's PUC as "tough but fair," with a "pretty short window on its rate cases" — adding that in both acquisition proceedings "The reputation of Judy Wallingford and her team carried a tremendous amount of weight."

Wallingford had been president of Aqua Maine and its predecessor companies since 1993.

"We've gone through this a few different times," she says. "For me and my folks who've worked there for awhile, when the company changed hands, we said, 'We know how to do this. We're still here serving our Maine customers, and that's what matters."

Her to-do list as president of Maine Water includes setting up a new community advisory committee in the Biddeford/Saco area to increase customer outreach. Wallingford says she shares Thornburg's belief that good solid customer service is the key to success in the water industry. The blended company has a 92% customer satisfaction rate based on an independent annual survey by the Center for Research. She believes Connecticut Water's ownership will bring much-needed capital resources to both Maine subsidiaries, but especially Biddeford & Saco.

"We are essential for economic development," she says. "We know this is the right long-term solution for the communities we serve."

Comments