Maine's bottled water industry taps into an $11.8 billion trend

The recent chemical leak in West Virginia that left 300,000 residents without useable tap water for close to a week underscores the growing market for bottled water. But the demand for bottled water extends far beyond emergencies: sales already are on track to top those of carbonated soft drinks by 2020, driven by health-conscious, on-the-go consumers.

That thirst for water has cascaded throughout the country over the past two decades. Maine alone has 18 bottled water plants, according to figures from the state's Division of Environmental Health. Most recently, the Passamaquoddy tribe revealed plans to bottle “Passamaquoddy Blue” in Indian Township, a move that could create 70 good-paying industrial jobs in a region beset by rampant unemployment. Bottlers of all sizes are expected to benefit from water's increasing popularity, from giant Poland Spring Bottling Co. in Poland to more boutique bottlers like Summit Spring in Harrison.

A survey by New York-based consultancy Beverage Marketing Corp. and the International Bottled Water Association in Alexandria, Va., noted bottled water sales were up 6.7% in 2012 over the previous year and predicted they will keep rising. Bottled water consumption still is about half that of carbonated soft drinks in the United States, where consumers buy $11.8 billion worth of bottled water a year.

The change from two decades ago is striking. Jason Seavey recalls loading only two cases of bottled water among the carbonated beverages filling the delivery truck he drove for Pepsi 20 years ago. Nowadays, Seavey is the non-alcohol sales manager at National Distributors Inc., the South Portland-based wholesaler for Anheuser-Busch, where trucks now carry 100 to 150 cases of water, he says.

While the IBWA had no sales breakdowns for Maine, Seavey says National Distributors, which is one of the largest beverage distributors for southern Maine, sells about 250,000 cases of all sizes of bottled water annually, with 24 bottles in a case, including carbonated and still waters. That's a lot, he says. National Distributors sells seven still waters, including Poland Spring, Summit Spring, Icelandic Glacial (imported via Eimskip's cargo shipping line in Portland), and other brands belonging to Nestlé Waters, the parent company of Poland Spring. It also sells four sparkling waters and six enhanced waters, such as those with vitamins added.

Beverage Marketing attributed bottled water's popularity mainly to health concerns like obesity and diabetes. Others in the industry point to the poor quality of some tap water, which can contain pharmaceuticals, arsenic, uranium, fluoride or other substances, as well as the switch from soda to water in schools. Consumers also are seeking a non-alcohol alternative and convenient drinks for their fast-paced lifestyles, industry experts say. And they're willing to pay an average of $1.50 or more for a bottle of water they consider safe and healthy.

A water sommelier?

Selling bottled water isn't a business for the faint of heart. U.S. consumers can buy at least 100 different types of bottled waters, according to industry estimates, making it especially difficult for small bottlers or newcomers to the field to gain traction, let alone earn a living.

“The profit on one case of water is pennies,” says Thomas Brennan, senior natural resource manager at Nestlé Waters North America Inc., which sells the Poland Spring brand. Perrier bought Poland Spring in 1980 when the Maine-based operation had fewer than two dozen employees and was almost bankrupt, and then Nestlé purchased Perrier in 1992. Poland Spring has grown its employee ranks to 800 today. Nestlé sells Poland Spring, Perrier, S. Pellegrino, Pure Life and Arrowhead among its dozens of worldwide water brands.

“We have significant capital investment, our factories are efficient and our output is high,” says Brennan. Nestlé has invested more than $500 million in Poland Spring since 1998, according to company information. With its stable of water brands, Nestlé's net sales of water in 2012 were $3.9 billion, and it was the largest bottled water company and third largest U.S. non-alcoholic beverage company by volume. The company would not provide numbers for Poland Spring, which is sold only in the U.S. Northeast, where it has a dominant share in the New York, Boston and Hartford area markets.

Adds Brennan, “Smaller mom-and-pop shops need to go into niche markets like health food stores to make a go of it.”

Seavey of National Distributors agrees. “Small companies need to play in the premium category, which is showing faster growth but with a smaller customer base than commodity waters,” he says. “Older consumers who understand it [premium water] are buying it as well as younger consumers who think it is cool.”

That's just the strategy Summit Spring is taking. The company sells its premium spring water to Whole Foods and other natural grocers, primarily in Maine and New Hampshire, and it sells its high-end Raw Water directly to consumers over the Internet. Raw Water is not treated at all, whereas the company's premium spring water is treated with a submicron filter to remove small particles like sand and with ultraviolet light to extend shelf life.

“Raw Water is like unpasteurized milk, like a fine wine,” says Ray Simoglou, operations manager at Summit. “It needs to be properly stored in a cool, dark place.” The company sells about 10 cases of the Raw Water each week, about 20% to 25% of its total sales volume. Most of the Raw Water is bought by younger people ages 18-35 who are looking for a higher-end product, he says.

Because of the way Summit bottles its water, taking the overflow that gravity forces downhill from its spring to its bottling plant rather than pumping water out of the ground, it is not a high-volume operation.

“We'll never be a huge company, even at full capacity, because we don't pump the water out of the ground,” Simoglou says.

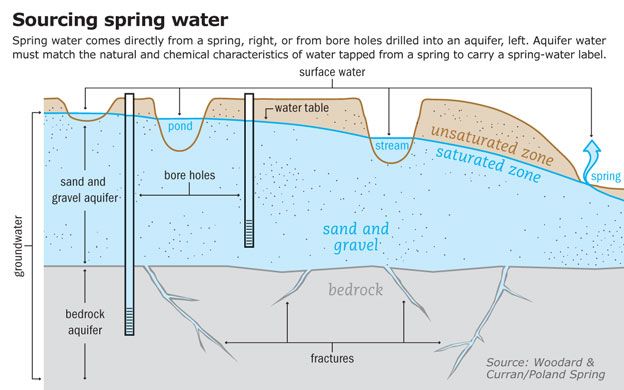

He is referring to the practice at some other spring water sellers, particularly large companies like Poland Spring, of pumping water out of boreholes drilled into the aquifer near the spring. The difference in water collection methods spurred complaints to the U.S. Food and Drug Administration about the use of the term “spring water.” The FDA in 2000 clarified its definition of what could be called spring water. Among other things, bottlers have to test to assure that the natural and chemical makeup of water from boreholes is the same as the nearby spring.

What differentiates spring water from other water is it moves constantly as pressure in the ground forces it to the surface, where it bubbles, but never freezes over in winter. Passively tapping the spring water versus using a pump can make a big difference in how much water is extracted. Simoglou says Summit scoops up 35-55 gallons per minute; bottlers using pumps can extract several times that amount. Poland Spring's Brennan says his company looked to purchase Summit at one point, but the spring, which could potentially produce 35 million gallons per year, was too small.

(Story continues after interactive graphic.)

Greener pastures

N. Bryan Pullen, president and owner of Summit, says he's trying to expand beyond Maine and New Hampshire into Massachusetts to grow his business, and he's moving from five gallon jug sales to focus on 0.5 liter or 1.5 liter recyclable PET bottles.

“We're trying to bring an ultra-premium product to people who care,” says Pullen. “I can't compete with Nestlé and Poland Spring. They bottle for a fraction of the cost.”

The company has signed on three distributors in Maine, including National Distributors, to help push sales locally. But Pullen says sales now are confined to Maine and New Hampshire, which makes growing the company challenging.

“We're competing in one of the poorest states in the nation. So we need to get into Massachusetts, which has some of the richest people,” Pullen says, but gave no specifics about strategy. Revenues are currently about $1 million a year, but with the spring's capacity the company has the potential to top $100 million, he says.

The local market also challenges Poland Spring. “Maine isn't our market for water,” says Mark Laplante, natural resource supervisor for springs at Poland Spring, who avoids drinking his own well water at home and instead buys bottled water for himself and his dogs. “New York and Boston are the largest markets for us so far.”

A recent Nielsen survey of grocery-store sales found that Poland Spring was metro New York's favorite drink, rising 4.5% to 98 million gallons for the year ended Nov. 2. Jane Lazgin, company spokeswoman at Nestlé Waters' headquarters in Stamford, Conn., says Poland Spring topped liquid beverage sales, including sodas, in metro Boston and Hartford as well. She attributes Poland Spring's well-established brand and images of Maine as a place that consumers see as natural to helping boost sales.

Laplante says the biggest competitors for Poland Spring are private labels like BJ's Wholesale Club and Shaw's Supermarkets because of the lower prices of those products. Nestlé's best-selling Pure Life also is at a lower price point, but he says it's not spring water. Purified water goes through a multi-step purification process that involves reverse osmosis and/or distillation.

The Passamaquoddy tribe doesn't plan to compete directly with Poland Spring, even though it reportedly has a 1,000-acre aquifer with 22 untapped springs on its land. In earlier published reports, a hydrologist estimated the tribe could tap 1 million gallons a day, and noted the rainwater and melting snow could provide more than 700 million gallons of water from the multiple wells without having to tap into the aquifer.

Michael Dugay, a developer consulting with the tribe, says he cannot comment about the status of the project now, because a due-diligence review is under way. Published reports noted the tribe needs to get $22 million in funding from the Bureau of Indian Affairs before it can build a bottling plant. The goal is not to compete with Poland Spring, but to go after store-labeled water and sales to the U.S. government.

Summit's Pullen and others are concerned about competition heating up. Pullen is sticking to educating consumers about the benefits of high-end water. “Cheap competitors are selling well water instead of spring water,” he says. “It's a price sensitive business, and trying to educate the public is expensive.”

Read more

Comments