Maine's business tax burden isn't that bad, national study says

Courtesy / Tax Foundation

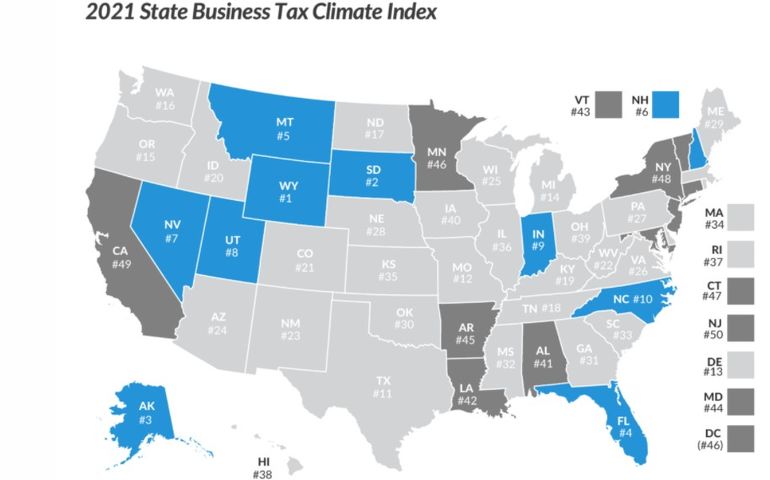

A map shows states with the best tax climates, according to the Tax Foundation, in blue. States with the worst tax climates appear in dark gray. Maine, shaded in light gray, ranked in the middle of the pack.

Courtesy / Tax Foundation

A map shows states with the best tax climates, according to the Tax Foundation, in blue. States with the worst tax climates appear in dark gray. Maine, shaded in light gray, ranked in the middle of the pack.

Mainers making plans to handle their business tax liability in 2021 may have reason to be grateful, at least a little. The state ranks better than most in the Northeast for having a favorable tax environment.

The nonpartisan Tax Foundation recently released its annual State Business Tax Climate Index, which places Maine No. 29 among the states in a measure of how well their tax codes are structured. Last year, Maine ranked No. 33, and in previous years has ranked at about that level.

In the overall tax climate ranking, Wyoming ranked No. 1, while New Jersey had the least favorable tax climate for business, ranking No. 50.

The foundation, one of the country’s leading tax research organizations, compiles the index from over 100 variables in five different tax categories: corporate, individual income, sales, property, and unemployment insurance.

Among northeastern states, only New Hampshire, No. 7, and Pennsylvania, No. 27, ranked higher than Maine this year.

In the comparisons of different tax categories, Maine ranked highest in favorability for its sales tax, No. 8 in the U.S.

Another analysis by the Tax Foundation, released Wednesday, provided a closer look at sales taxes in each state. Maine’s statewide sales tax, 5.5%, was No. 29 in a ranking of the highest rates. But with no local sales taxes, Maine again placed No. 8 in the overall sales tax ranking.

0 Comments