MEREDA Index: Real estate activity reaches record in first quarter

Photo / Tim Greenway

Tyler Technolgies new $28 million office building in Yarmouth, which opened in February, is one of several major office building projects driving record activity in the commercial construction sector in Maine.

Photo / Tim Greenway

Tyler Technolgies new $28 million office building in Yarmouth, which opened in February, is one of several major office building projects driving record activity in the commercial construction sector in Maine.

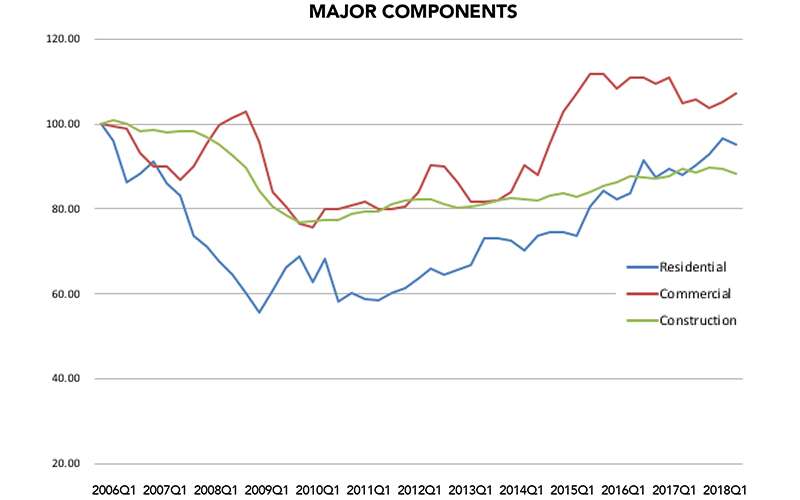

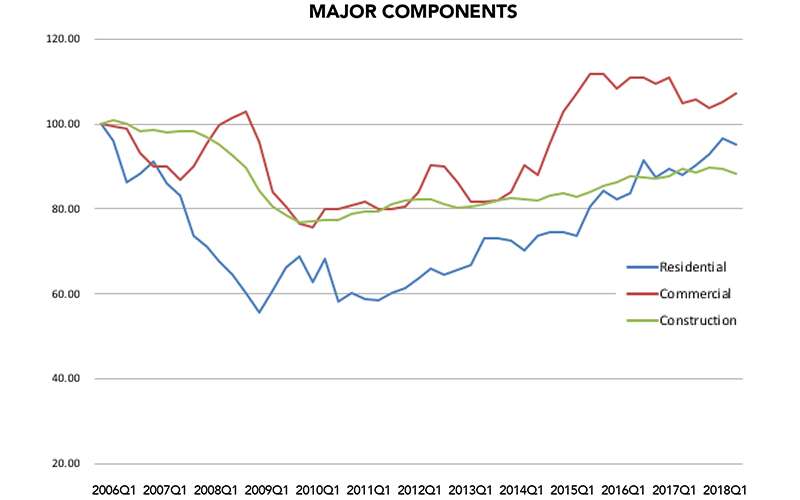

The MEREDA Index, a quarterly measure of real estate activity in Maine, reached a new record through the first quarter of 2018, driven primarily by rising prices in the residential and commercial markets

The index, a composite measurement of residential and commercial transactions plus new construction, is 100.4. That represents a 2.4% increase since the third quarter of 2017 and 4% over the 12 months since the first quarter of 2017.

The latest index was announced at the Maine Real Estate & Development Association’s spring meeting on May 16. The index is a composite of nine seasonally adjusted measures reflecting new development and transactions involving existing properties and covering the commercial and residential markets statewide.

“This is great for the industry, the citizen, the town and cities,” Paul Peck, an attorney at Drummond & Drummond who serves as president of the Maine Real Estate and Development Association's board, said at MEREDA's announcement. “It’s an exciting time to be in the real estate industry.”

In written comments, Peck said Maine's real estate market is led by the commercial sector, with historic highs besting pre-recession performance. There’s likely to be continued growth for many months to come, he said, perhaps slowed only slightly by rising interest rates, land prices and construction costs.

Drivers for growth are likely to include Maine’s older housing stock and aging populations, with opportunities for new construction and remodeling.

On the commercial side, Peck said, hospitality, medical and industrial real estate activity continue to lead the way, with some office construction starting in cities. However, continued growth is hampered by the lack of trained tradespeople in Maine, he said.

“I’m still bullish on the market,” he said in a video presentation at the conference. “We’ve had slow and steady growth over the last five years, not huge, rocketship growth. Interest rates are up but still historically low, so I expect further growth. There’s no reason to believe the real estate sector will not continue to be strong in the new few years.”

Commercial market hits record high

The commercial market was up by 3.1% in the past two quarters and 2.2% over the past year. That’s a record high, Katie Millett, a commercial broker with NAI The Dunham Group, said in a video presentation.

“Everyone knows downtown Portland is on fire,” Millett said. “We have so many exciting projects,” like WEX’s global headquarters now under construction on Portland’s eastern waterfront. “The peninsula is the hot spot. You see little sectors popping up. Bayside is continuing to emerge as an up-and-coming neighborhood. Forest Avenue is making a lot of changes with coffee shops and retail.”

Millett added: “That activity is expected to grow into the outskirts. It has to, because there’s not a lot of room left on the peninsula, and people can’t afford the prices anymore on the peninsula.”

On the commercial side, she said, “We’ll continue to see new construction, particularly in industrial. Inventory is so low, we need to see industrial construction.”

1031 exchanges fuel 'feeding frenzy'

The type of deals the industry is seeing, she said, is mostly a result of 1031 exchanges.

“But those 1031 buyers are having a hard time finding replacement properties because the inventory of quality, investment-grade properties is so low,” she sadded. “So when something does come on the market, you see a feeding frenzy, and likely get into multiple-offer situations.”

In written remarks, Millett said other challenges include the price per square foot of commercial sales, which risen dramatically over the past two quarters and the past year – 31.7% and 21.1% respectively. The increase is driven primarily by lack of inventory, she said.

“As a result, when a property hits the market, there is a feeding frenzy that drives prices upward,” she said.

The industrial market is also tight from both the sale and leasing perspectives, also resulting in multiple offers, she said.

Cooling of residential market?

With regard to the residential market, the seasonally adjusted median house price rose 6.9% over the past two quarters and 9.5% over the past year. Permits for new single and multifamily construction are estimated by Moody’s Analytics to show strong growth of over 16% on a seasonally adjusted basis over the last two quarters, suggesting the rising prices are calling forth additional supply.

Low inventory is driving higher prices, David Marsden, a broker with the Bean Group in Portland, said in a video presentation.

“It’s a simple economic issue,” he said. “That being said, in Greater Portland now, the median price is hovering at $300,000. This is a historic high.”

Portland’s condominium market remains strong, driven largely by empty-nesters and young professionals, he said. The trends are also positively affected by the ability of many people to work wherever they live, thanks to telecommuting.

However, Marsden said, not enough supply is coming online. New construction is negatively impacted by the rising price of building materials and a shortage of labor, he said.

As a result, he said, “I’m predicting a cooling of the market, but on a watch-and-see basis. Inventory is low. This isn’t sustainable long-term.”

Construction sector: Market's hot

Then there’s the construction sector, which is seeing mixed signals.

There’s been a rise in residential permits, which suggests additional supply in the residential market will be coming in the months ahead, according to MEREDA. But that additional supply is not showing up, as construction employment has declined over both the past two quarters and the past year. Those declines are the first that have appeared in several years.

“The construction market is quite hot,” Jeff Zachau, president of Zachau Construction in Freeport, said in a video presentation. Class A office projects and multi-family projects are growing in size. In Portland, “a few years ago, we were building a lot of 25- to 30-unit projects; now 50- to 70-unit projects,” he said. Office buildings are also on the larger side, like Tyler Technology’s new 100,000-square-foot building overseen by Zachau Construction that opened this February and the WEX building now under construction, he said.

At Zachau Construction, he said, “We have a number of projects in the pipeline going two or three years out. But at the same time, we remain cautious to see what the overall economy does. I think everyone’s nervous the interest rate will creep up.”

To mitigate market fluctuations, he said, early engagement by contractors is important. “Some of our most successful projects, we were engaged early” on factors like site selection and budget planning. In the end, having an active team from the beginning helps bring a successful project to reality.”

Tight labor market a challenge

In his written remarks, Zauchau said construction performance is affected by declining employment numbers. “With an extremely tight labor market, contractors are being forced to be creative,” he wrote. “Larger and varying types of projects are being built with alternative methods of construction; for example, prefabrication and/or modular. Additionally, the tight labor market has forced our firm and others to find skilled workers from outside the state.”

The industry is also seeing challenges in increases in material pricing, he said. In the first quarter of 2018, the industry saw double-digit increases in materials such as wood and steel.

Still, he said, “At Zachau, we continue to be cautiously optimistic. One of the biggest factors limiting growth is the labor shortage and undoubtedly we are all looking for ways to attract and retain new and younger talent. While the question still remains how long this labor shortage will last, it is clear that construction firms in this market will continue to do more with less.”

Comments