Real estate will be strong in 2021, but lower end of recovery needs help, forecasters say

Image / NAR Forecast Summit

A panel of economists at Thursday's National Association of Realtors forecast summit said the lower half of the recovery needs to take hold to make the real estate market sustainable.

Image / NAR Forecast Summit

A panel of economists at Thursday's National Association of Realtors forecast summit said the lower half of the recovery needs to take hold to make the real estate market sustainable.

The real estate market will weather the COVID-19 pandemic and come out strong on the other end, economists at the National Assocation of Realtors 2020 Forecast Summit said Thursday.

But there was also concern by many who spoke that federal help is needed for those at the bottom of the recovery, and by association the housing market, to fully recover and be sustainable.

The summit Thursday was held virtually and attended by more than 10,000 from across the country.

Economists in several different presentations said the "K-shaped recovery," in which different parts of the economy recover at different rates, must be straightened out for real estate to stay strong across the boards.

There's a differentiation between who's been hit the hardest financially from the pandemic, said Dana Peterson, chief economist at the Conference Board. Women and minorities, who make up much of the hospitality and service industries, have lost wages and jobs at a higher rate than other Americans. The fact that they can't pay for housing has a ripple effect.

"We're not going to see the bottom half of the 'K' come up," until economic recovery reaches those people, she said.

Peterson was on a panel with David Berson, senior vice president and chief economist for Nationwide Mutual, and Nela Richardson, senior vice president and chief economist for ADP. It was moderated by Natalie Campisi.

Richardson said the K-shaped recovery is particularly difficult because the difference between "winners and losers" is so extreme. "We're all going through the pandemic, but people are experiencing it very differently," she said.

Potential first-time buyers, for instance, can't find homes they can afford. While there's movement for those who can work remotely to areas where housing is less expensive, many lower-income workers are often tied to a location, working jobs that can't be done from home, so they aren't part of that migration.

Berson said that, overall, 2021 "is going to be a strong year for housing."

Unlike the recession of a decade ago, when homeowners found themselves under water and housing values dropped as foreclosures flooded the market, this time around, the issue is lack of inventory. The panel said that once the pandemic turns the corner, homeowners may be more comfortable putting their houses on the market.

Berson said that while the implementation of a COVID-19 vaccine means things will turn around in the future, there will still be a "soft patch" in the coming months that needs to be bridged by fiscal stimulus to keep it from being prolonged, something Peterson and Richardson agreed with.

They also agreed that stimulus will help keep renters with a roof over their heads and keep multi-family owners afloat until a recovery takes hold.

Commercial will be hardest-hit

Lawrence Yun, National Association of Realtors' chief economist and senior vice president of research, said the highest growth areas for the housing market will be in the Midwest, where prices will remain "very, very affordable."

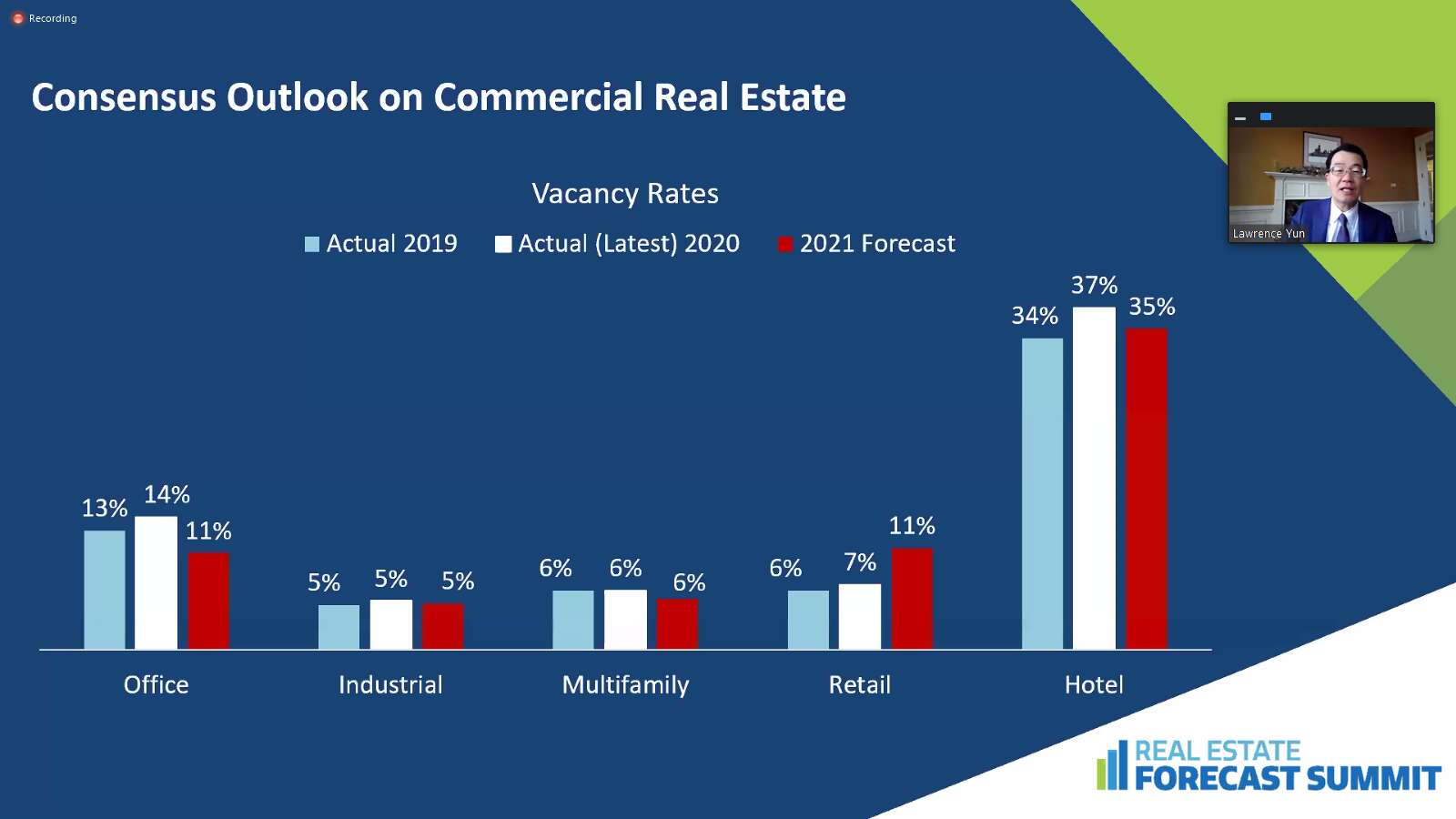

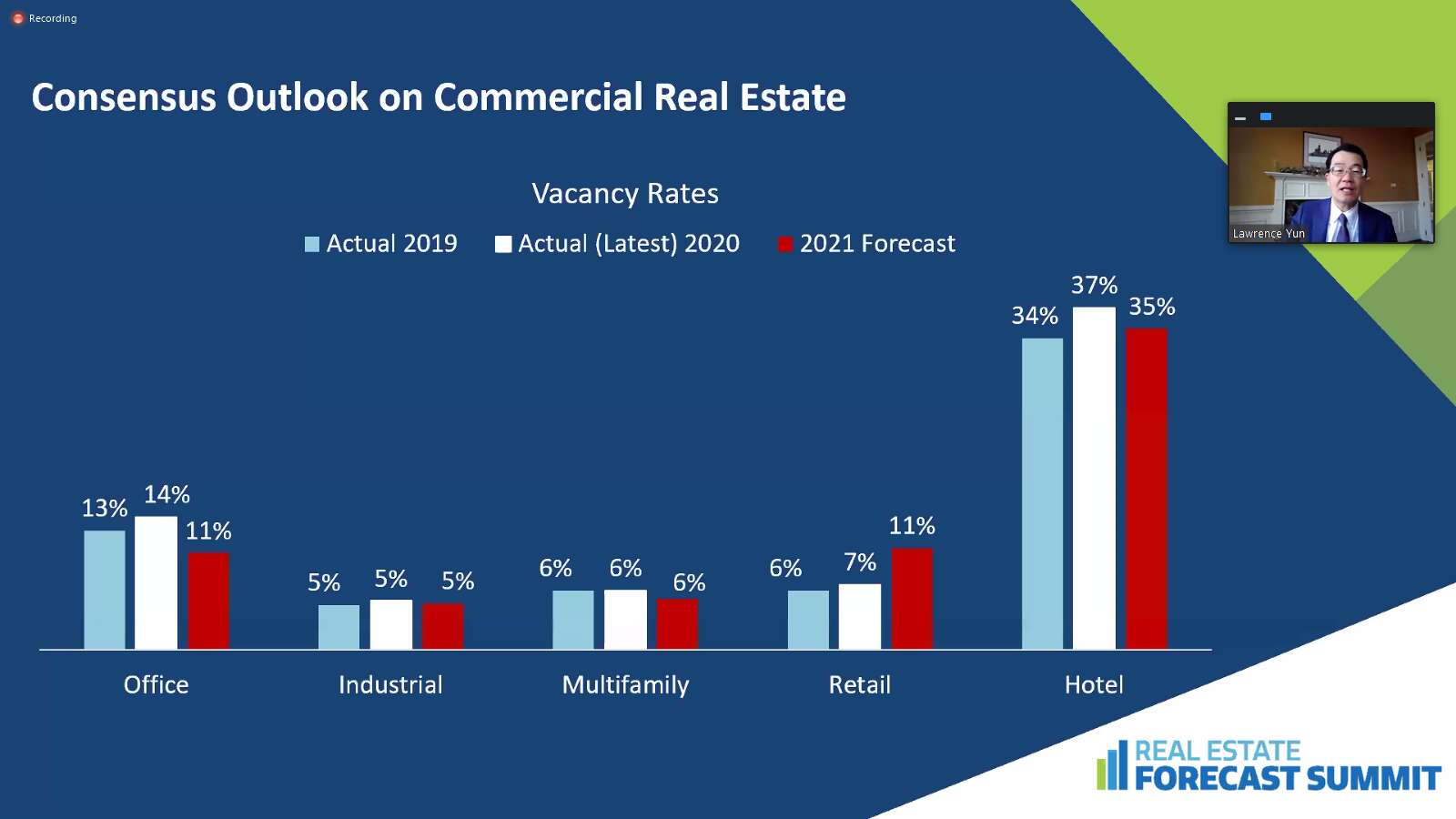

In commercial real estate, vacancy rates will be similar to 2019, with the exception of retail, which he expects to be the hardest hit from the pandemic once the numbers from 2020 are tallied.

He also expects businesses to go back into offices, with working from home being an occasional option, but not a full-time trend.

Jim Parrott, of Parrott Ryan Advisors, and a fellow at the Urban Institute, in a separate presentation, said he expects to see more of a federal focus on housing from the Biden administration.

Biden cares about housing, he said. "For him it's part of the American Dream, it's a visceral centerpiece and what he's about as a leader."

Parrott said, in that light, it's likely that homeowners will see protections that will help them through until a recovery takes hold.

He also echoed what other speakers had said, that most homeowners "aren't upside down," as they were in the last recession. "I don't feel we're heading for a cliff," he said.

However, Parrott added, there's going to be a "serious amount of stress" in commercial real estate, particularly for small businesses.

He said that incentives will have to be balanced with recovery driven by the private market.

0 Comments