The $32M deal: Turning a failed student dorm into 200 workforce apartments

Photo / Tim Greenway

Port Property Management CEO Tom Watson with Bayside Village’s Lindsay Cannon, property manager, far left, Shauna Dineen, assistant property manager, left, and LeighAnne Bennett, housing coordinator, at 132 Marginal Way. The apartment they are in was a quad apartment and is being converted into one- and two-bedroom apartments.

Photo / Tim Greenway

Port Property Management CEO Tom Watson with Bayside Village’s Lindsay Cannon, property manager, far left, Shauna Dineen, assistant property manager, left, and LeighAnne Bennett, housing coordinator, at 132 Marginal Way. The apartment they are in was a quad apartment and is being converted into one- and two-bedroom apartments.

Bayside Village Apartments at 132 Marginal Way in Portland is a former student dormitory that’s a sizeable eye-catcher from I-295, with a façade in a palette of greens and tan.

Inside, lengthy corridors on four floors are divided into 100 “quads.” Each quad has four bedrooms situated around a common living space and kitchen.

But after the dorm opened in 2008, its mission to offer housing aimed at students never really took off. The property has gone through several owners who have had varying degrees of success in operating it solely for students or, more recently, also offering it for single-room-occupancy rentals.

Now Portland developer Tom Watson and his partners have acquired the property for $20.85 million and expect to invest another $11 million to redevelop it for workforce rental housing.

Watson owns Port Property Management/Tom Watson & Co. in Portland and is a partner in Bush Watson, a real estate investment firm.

“We said, ‘Look, the city of Portland needs workforce housing,’” he says. “’Let’s take these 100 quads and turn them into workforce housing apartments,’ which is what we do and what the city needs. We saw a great opportunity here.”

Portland’s economic development director, Greg Mitchell, says the project comes at a time when demand for housing remains high for “the missing middle,” the city’s middle-income needs.

“It all helps,” says Mitchell. “We’re looking to activate single-family homes, apartments, rentals as well as for-sale units across the board. Different housing products are needed to attract millennials, single people, couples, families — and to strengthen the attractiveness of Portland on the marketplace. It’s a comprehensive approach.”

Dorm fail

Bayside Village, which is 238,301 square feet, is less than a mile from both the University of Southern Maine and Maine College of Art. But it’s also in a neighborhood that has seen tremendous growth in the past decade, with much of the surrounding West Bayside area taking off. It is walking distance from a Trader Joe’s, a Whole Foods and a Hannaford. It is amid a retail and professional strip that includes medical offices, pharmacies and specialty retailers.

Developed by Rockport-based Realty Resources, Bayside Village opened in 2008 as Portland’s first private housing development for college students.

But in 2010, developers defaulted on the nearly $21 million mortgage. The occupancy rate was 45%. The property was taken over by its lender, KeyBank.

In December 2010, KeyBank sold the property to the Federated Cos., which is based in Miami and manages 7,500 units of residential housing with an aggregate value of $1.5 billion.

Federated stabilized the property and overhauled marketing and pricing strategies. A year after acquiring the property, Federated had Bayside Village fully occupied. And by 2012, it sold the property to Chicago-based Blue Vista Capital Management.

Watson and his partners, under the name West Bayside Partners LLC, bought the property this past September, working with Joe Porta of Porta & Co.

Joe Delano at Bar Harbor Bank & Trust arranged 80% of the financing for the acquisition and renovation. The partnership is financing the remaining 20%.

“It was a very straightforward deal,” Watson says of the bank loan. “Joe Delano knows a lot about what Port Property Management does. Over the past 25 years, we’ve bought stressed properties, renovated the units, made them nice-quality apartments, and rented them. We now own 1,500 units in Portland and South Portland. So this project is right in our wheelhouse.”

During the due diligence process involved in the acquisition, Watson explored the property’s history. Basing his observations on what he was able to learn and on his 25 years in the business, he says a couple of factors may have prevented the student-housing mission from really taking hold.

First, there appeared to be a fair amount of partying and “overexuberance,” as he says, that attracted police visits early in the dorm’s history, which may have discouraged student rentals.

Another factor may have been the dorm’s lack of affiliation with any particular college.

“I think it might not have hit on that school pride piece,” he says. “If you think about it, you go to college X and stay at their dorm: The thing you have in common is that you’re all at college X. You have this intrinsic camaraderie. I don’t think that ever took hold here.”

At some point, the rooms were offered for single room occupancy to the broader rental market. That model also failed, he says, due to the quad configuration, which isolated renters who didn’t know each other in their individual bedrooms.

“What we found,” he says, “is that people in these rooms did not know their quad mates and did not particularly feel safe there.”

Transition to market rate

Bayside Village’s change to market-rate apartments will mean some tenants may be priced out.

Rent and utilities currently range from $650 to $700 per room. After renovation, rent and utilities for a one-bedroom apartment is planned to be $1,300 to $1,450; and for a two-bedroom apartment $1,500 to $1,750.

“We have to be very thoughtful about how we work with tenants when they’re transitioning to new homes,” says Watson. “This is not just about the construction. Every tenant’s life circumstance is different. There’s no one-size-fits-all.”

An on-site property manager is assisting with transitions and the partnership set aside $125,000 to help people through their move. Watson expects the transition process to last for a year or more.

“It’s about having those conversations,” he says. “It’s trying to get hold of people by email, phone calls, knocking on their doors, having people come down to the office, understanding their situation and explaining to them what we’re doing with the property and what the timeframe is. Port Property has apartments around the city of Portland, so we can ask, ‘Can we move you into a Port Property apartment?’ ‘Do you want to stay here when we’ve done over an apartment?’ It’s a lot of work.”

Renovations on the first cluster of 12 apartments began in January and more will ensue as spaces become available. That includes dividing each quad into one-bedroom and two-bedroom apartments. Existing common space goes with the two-bedroom unit; new living and kitchen spaces will be built for the one-bedrooms. Bathroom and kitchen renovations include new fixtures, flooring, cabinets, countertops, large appliances lighting and paint. Each unit will have a washer and dryer.

The property is rare in Portland, Watson says. For one thing, it’s relatively young, built only 12 years ago, compared with an average of 70 or 80 years for much of the city’s housing stock. It’s also cheaper to renovate, at an estimated $165,000 on average per unit, compared with new-construction cost of $230,000 per unit, “which was a key factor my broker was constantly driving as our risk hedge,” he says.

Once the project is complete, he adds, it will be a worthwhile long-term hold worth an estimated $38 million, $6 million above the combined cost of acquisition and renovation.

‘Missing middle’

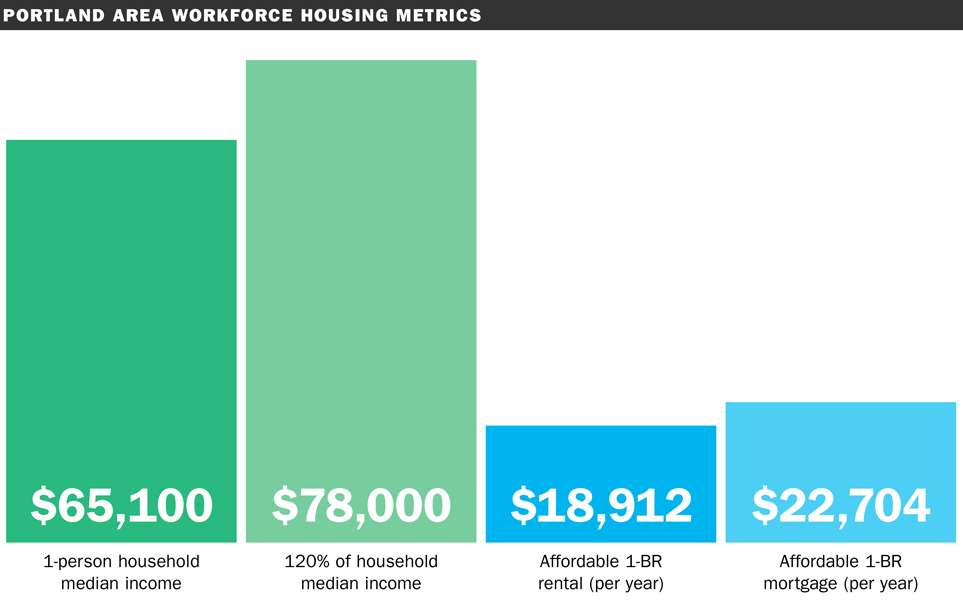

Overall, says Mitchell, the project helps to address that need for housing in the “missing middle.”

Portland has a mix of new or pending affordable housing as well as new luxury housing, particularly on the East End. So private ventures like Bayside Village “help address the middle income needs for housing in the city,” Mitchell says.

To encourage similar private investment, Portland has initiatives underway that include making city-owned land available at low or no cost to support housing projects and looking at creative ways to open up parcels that have gone undeveloped because of lack of roads or utilities. Other initiatives tackle things like density, height and parking requirements in various zones to accommodate development of more affordable units. So-called inclusionary zoning requires certain new projects to include workforce housing.

“We’re using a menu of options to try to activate more housing,” Mitchell says. “We’re entering a new era where we’re trying to stimulate investment in a number of ways.”

0 Comments