Trade winds: Maine companies look to Asian growth markets

Business between Maine and the Far East, particularly China, is heating up. Among the examples: one Portland-based company expects its Chinese subsidiary to turn a profit in the next couple years; another plans to soon test-market its product in China first [before the United States or elsewhere]; and the Maine International Trade Center plans to open up a Shanghai office in the first quarter of 2015, possibly as early as January, to encourage Chinese foreign direct investment in Maine.

“We've identified good quality and depth in [Maine's] clusters and assets that could get international recognition — advanced materials and composites, products for aerospace including precision manufacturing, food processing and life sciences,” says Janine Bisaillon-Cary, president of MITC. “The Shanghai office will have some trade capabilities, but it will be focused on foreign direct investment.”

She hopes the new office will also be able to help Maine companies to some degree on the trade side, especially with finding suitable Chinese partners. “The hardest thing is vetting importers or potential distributors,” she says.

Bisaillon-Cary says that when she has taken potential Chinese investors around Maine, they have been very impressed with the work ethic and abundance of natural resources that are sustainably managed. The Chinese government has changed its policy, she says, to build sustainability into efforts to do business in the United States and Europe.

Some U.S. businesses may naively assume that a country under Communist rule might not be wise in the ways of capitalism-based business, but she says China is one of the oldest trading countries in the world, and its negotiating skills have been around for centuries. And it has a strong trading tradition with Maine.

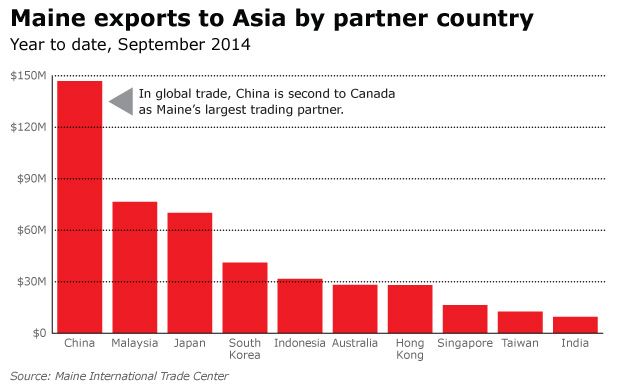

China is Maine's No. 2 trading partner in total dollar value with almost $147 million for all goods (through September 2014), behind Canada's more than $1 trillion. The top items traded are wood pulp, paper and paperboard; fish and crustaceans; industrial machinery; and wadding, such as felt and twine. The two countries have been the first and second top trading partners for Maine since 1996, when MITC was started and began compiling the trade statistics.

China also is Maine's top Asian trading partner, followed in order by Malaysia, Japan, South Korea and Indonesia. One example of a big Maine success in China is Maine lobster, whose trade has grown more than 400% in the last few years, according to MITC.

“There's been a major shift in firms going to China,” says James Breece, associate professor of economics at the University of Maine's School of Economics in Orono. He also teaches a Chinese economy course. “Initially [firms went there] for cheap labor. But now companies go to China to manufacture and to sell in the Chinese market, where the growing middle class is the top consumer.”

China is the world's largest country by population and second-largest by land area. Its gross domestic product was $9.24 trillion in 2013, more than half that of the United States' GDP of $16.8 trillion. China's population, at 1.36 billion, is more than four times that of the United States, at 316.1 million. Its largest city and business center, Shanghai, has 24 million people in a 2,448-square-mile area. That's about 9,700 people per square mile in that city alone compared to 43 people per square mile in all of Maine, which has a total population of 1.3 million and a 2013 GDP of $51.2 billion compared to close to $300 billion in Shanghai.

That makes China a promising market for Maine companies, along with Japan, South Korea, Taiwan, Singapore, Indonesia and Vietnam, according to MITC.

Talk does not cook rice (Chinese Proverb)

China is a land of opportunity, but it still is the “wild, wild east,” says Brian McNamara, president and CEO of Falmouth-based Southworth International Group, which makes vertical work-position products that help move large items. He says his company was one of the earliest Maine companies to do business in China, and learned from the school of hard knocks.

He expects the company's Chinese subsidiary, Southworth Shanghai Lift Table Co. Ltd. in Fengxian, to turn a profit in the next couple years. The U.S. parent company has invested more than $1 million in the subsidiary, which employs 100 local people. Set up in 2005, the subsidiary still contributes less than 5% of the company's overall revenue, now $50 million a year. The subsidiary is breaking even.

“We haven't been able to build momentum,” he says. “But we're hiring people with multinational experience.”

With the local expertise in place and a thriving market, McNamara says he hopes to use China as a base to expand into the rest of Asia.

But things weren't always so positive. McNamara will be the first to urge caution when approaching the Chinese market.

“We are the only Maine company that has survived for 25 years in China,” he says. “I can't tell you how to survive, but I can tell you what not to do in China.”

Southworth initially formed a joint-venture in China in 1989. At the time, it was about one-third the size of its revenue today. “It was very ambitious, some might argue crazy, in terms of our size then,” he says. But the joint venture helped the company learn about China, which while having an incredibly vast geography and population, in 1989 had almost no economic or distribution infrastructure.

“We were learning who had money, that the tax situation is dynamic and currency is an issue,” he says. Then there was the question of who would buy the company's products, which were aimed at helping people work more safely and productively.

“When you pay people less than $1 per hour, manufacturers didn't buy our stuff for productivity. Safety rules weren't highly prioritized,” he says. “But buildings were going up in China, and construction was growing, so there was a need for material handling equipment.”

That's when he learned about Chinese corruption, which he says Southworth avoided, and as a result had to walk away from business. And then there was the counterfeiting.

“We've seen our own product come to the United States, right down to the colors. An ex-employee of the Chinese joint venture left with the drawings,” he says. “Today those remain threats. We've just become better at steering around them.”

Not much happened in terms of sales for Southworth by the joint venture, though McNamara figures it did something right, as it was named the “joint venture of the year” in its first year of operation.

Things took a turn for the worse in 2002, when the joint venture partner was acquired by a Chinese private enterprise that wanted to fully run it. The joint venture quickly fell apart.

“In 2004 we tried to close it officially, but it simply fizzled,” he says. “We didn't lose money. We put a lot of time into it, so it was mostly sweat equity.”

The story of the ill-functioning joint venture doesn't end there. Southworth had trademarked its name in China 1988. But that didn't stop one partner from the company that bought the joint venture from auctioning off the trademark — which he then bought himself. Southworth was told there was little they could do about it.

“I was in an Apple store in China that didn't have Apple products,” he says. “If someone makes all Rolex parts in China, and then a Chinese guy [counterfeiter] puts them together, is it still a Rolex?”

McNamara says a Chinese businessman gave him three pieces of advice: trust no one, trust no one, trust no one.

He translates that as being very careful before proceeding, as the benefits can outweigh the risks.

“In the 1990s, we learned about all the things that were different about China, but never lost sight of the potential of a large country that was growing, and companies here [in the West] making big commitments to China,” he says. “So we turned our focus to multinational customers that brought a lot of their own processes from home.”

McNamara admits his stories could scare people. And they should, he adds. “People should go over with great caution, commit money and find a trusted partner. All of these hurdles I talked about in the 1990s still exist. But there are paths around them,” he says, even for small Maine companies.

Failing to plan is planning to fail (Chinese proverb)

John Markin, president and CEO of EnviroLogix in Portland, which makes diagnostic kits to detect genetically modified organisms in seeds, tells similar tales of business differences in China while with a former employer, Kodak.

Kodak was spending $1 billion in China and looking to negotiate a joint venture in 1997 with a state-owned film manufacturer. In fact, there were seven state-owned film businesses that the Chinese government wanted to privatize, with Kodak's help. Markin says Kodak formed joint ventures with three of them and shut down the other four. But to get to that point, Kodak needed the local mayor to resolve things.

The negotiating parties in China may not always be who you expect them to be. And the negotiations don't start until you get ready to sign a contract, says Markin.

“The Chinese are very good negotiators. You believe you've agreed on something and at the 11th hour things change and you move onto another topic,” he says.

But, like McNamara, the differences in business practices aren't keeping Markin from a potentially lucrative market for a new product that EnviroLogix is testing in China before anywhere else.

The company has just consolidated its two distributors into one, which he met within the past couple weeks.

Large companies genetically modify their seeds to increase yields or repel insects. But such genetically modified organisms, or GMOs, aren't wanted by consumers in countries including Europe and Japan, which are big markets for Chinese produce.

“If they have GMOs, a country can turn away a barge,” Markin explains. “We sell kits to detect above a certain level. We sell them to grain companies and different countries.” The food labeling laws in China in some cases are stricter than those in the United States.

The new test will detect GMOs in soybean milk, mostly for domestic Chinese consumption.

“We will test-market the test in China and learn from the Chinese market as to whether the test is the right sensitivity,” he says. “Our distributor thinks there's a big market for it, so [we met] with the distributor and its customers, which are Chinese food processors.”

More than half of EnviroLogix's more than $20 million in total revenue is outside the United States. Asia is a small percentage of revenue, but it is doubling, and China comprises about 5% of revenue, Markin says. China is the company's biggest-growing market.

“We require payment in advance. We don't stock distributors with products we own. They buy them in U.S. currency, so the risk is minimal,” he says.

“People need to accept that they need to spend time to invest in finding the right distributor,” he says. “If you look to set up an entity in a country, you need experienced help to guide you through that.”

Read more

Another thing about Maine: It doesn't shut down after Labor Day

Comments