WEX ends 'year like no other' with 9% drop in Q4 revenue

Photo / Jim Neuger

WEX's newest building, shown here, is located at 100 Fore St. in Portland.

Photo / Jim Neuger

WEX's newest building, shown here, is located at 100 Fore St. in Portland.

WEX Inc. (NYSE: WEX), a Portland-based financial technology service provider, on Wednesday reported a 9% drop in fourth-quarter revenue, impacted by lower average fuel prices and foreign exchange rates.

Fourth-quarter revenue amounted to $399 million, compared to $440 million a year earlier. It was also slightly below the $384.6 million consensus forecast reported by the the Institutional Brokers' Estimate System on Reuters.

WEX also posted a $5.30 loss per diluted share for the quarter, compared to earnings of $1.24 per diluted share for the same period last year

The company, which operates in more than 10 countries and 20 currencies, said the $41.1 million year-on-year revenue decline includes a $16.8 million negative impact from lower average fuel prices and currency exchange rates.

Bullish on long-term growth, WEX Chair and CEO Melissa Smith told Mainebiz in a phone interview that the company had been on a path of diversifying the business for many years, mainly by reducing the proportion of revenues affected by fuel prices from more than 70% to only 20% today.

"The company is much more resilient than it ever has been," she said.

In late morning trading, WEX shares were trading down 4.21%, at $220.24 a share, after falling as low as $215.49 in earlier trading. That puts its market value at around $9.8 billion.

'Year like no other'

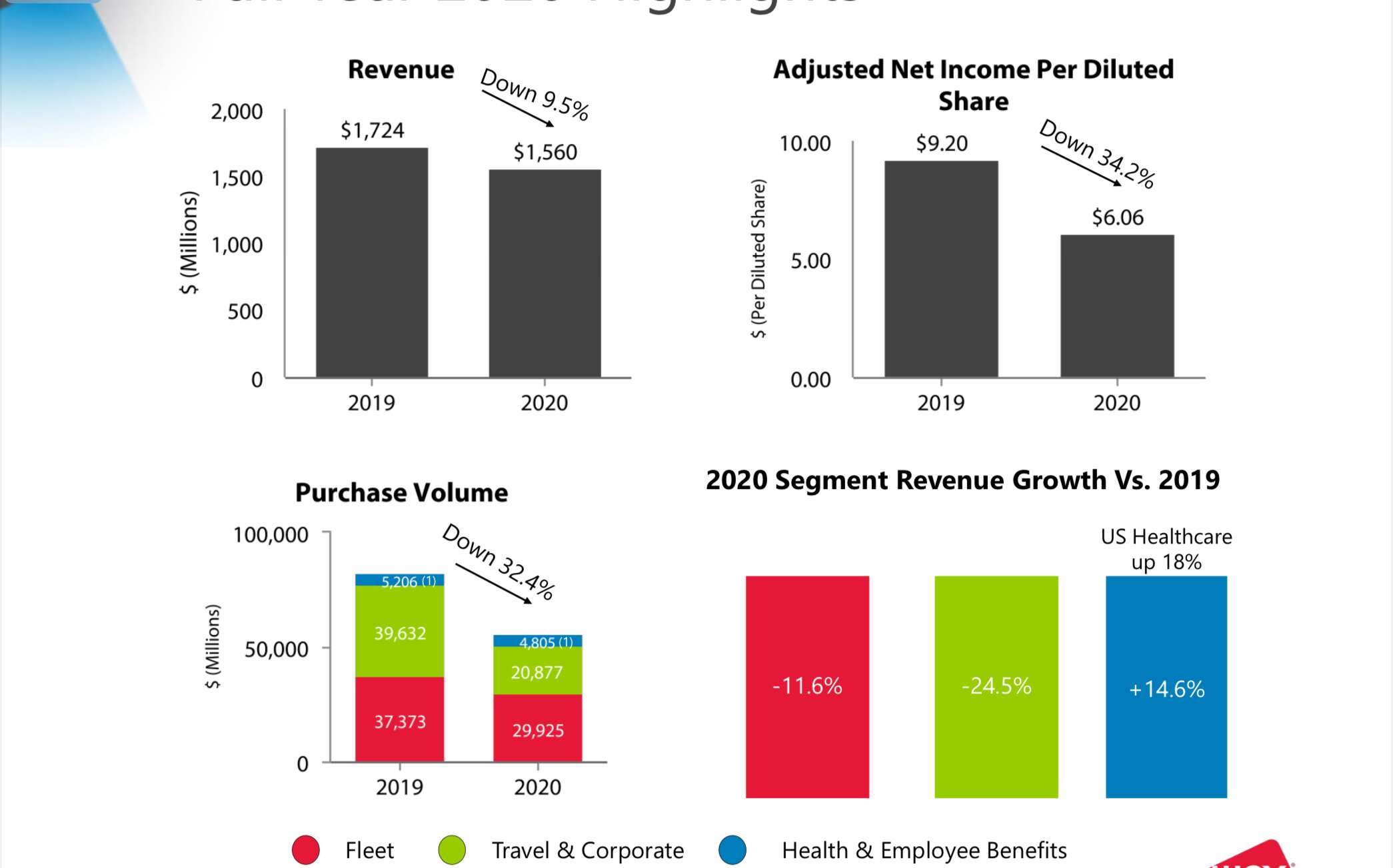

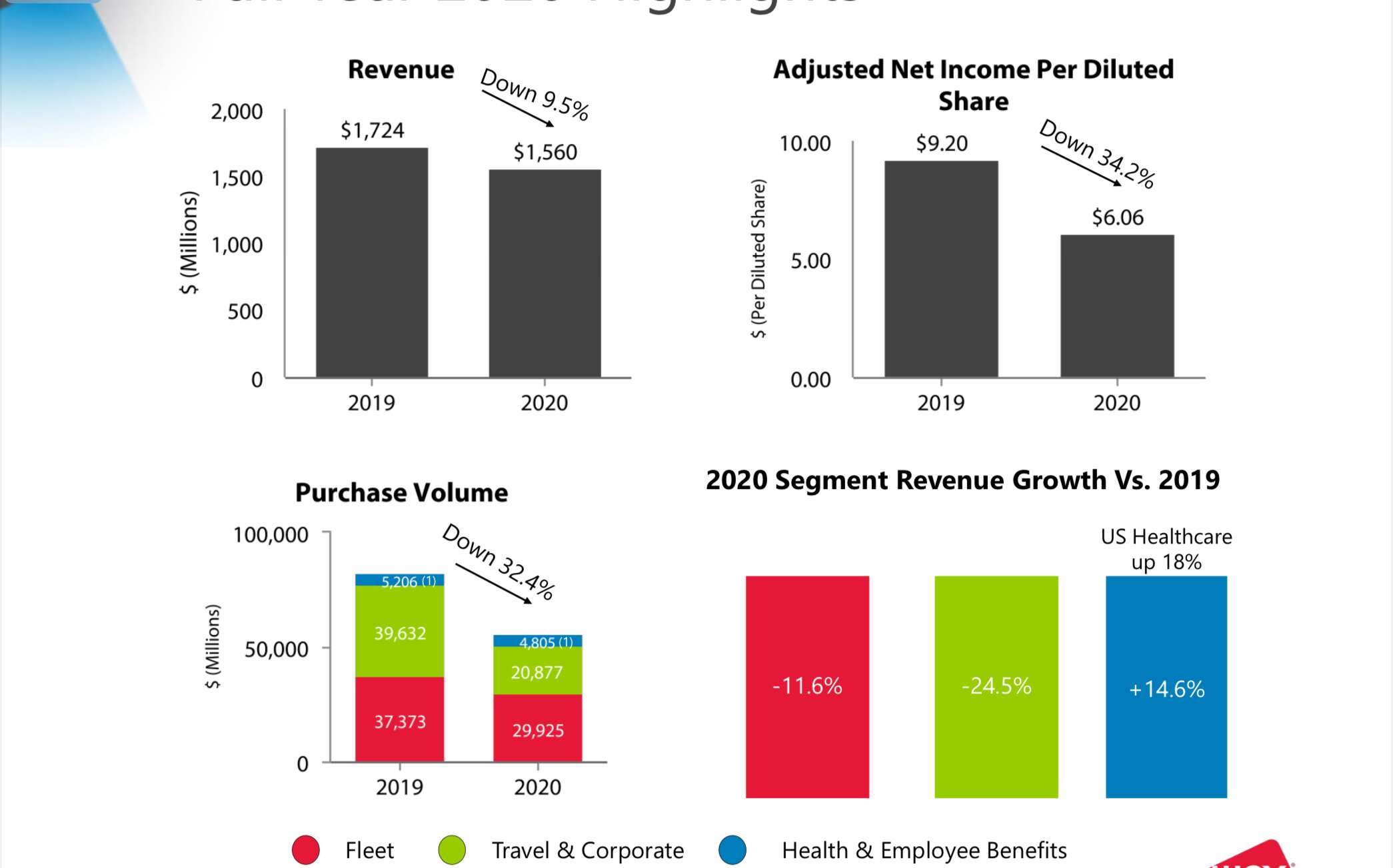

Full-year revenue for 2020 decreased 9.5% to $1.56 billion.

Of the company's three business segments, U.S. health and employee benefits was the only one that registered an increase in revenues over 2019.

"This year proved to be a year like no other as the world faced a number of challenges, Smith said in Wednesday's release. "Nevertheless, WEX remained resilient as we continued to advance our strategic objectives."

She later told Mainebiz that WEX has invested heavily in the health benefits part of its business, but also noted that it was working with customers in many different industries in its fleet and travel divisions.

Going forward, she said that the two acquisitions completed at the end of 2020 positions WEX for "some really great long-term growth" despite short-term volatility in the travel market.

"It's something that will be really good for our customers and shareholders," she said.

She was referring to the acquisitions of eNett, a provider of business-to-business payments solutions for the travel industry, and B2B payments company Optal for around $577.5 million, a fraction of the original price tag.

Still unable to give a financial outlook because of the pandemic, the company reported more than $65 million in savings from various actions undertaken in 2020 and said it believes its balance sheet and liquidity position remain strong.

In speaking to Mainebiz, Smith gave a shoutout to the resilience of WEX employees during the pandemic and the fact that they've been able to feel connected while working from home.

She also said there was no update on WEX's plans for a new building in Scarborough that remains in a holding pattern because of COVID.

Meanwhile in a new downtown Portland building at 100 Fore St. where the company is sub-leasing space to Northeastern University's Roux Institute, WEX plans to occupy one floor.

WEX employees have the ability to work from home through the end of June, Smith said.

Excerpt from investor presentation

0 Comments