Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

-

- Lists

-

Viewpoints

-

Our Events

-

Award Honorees

- 2025 Business Leaders of the Year

- 2025 Outstanding Women in Business

- 2024 40 Under 40 Honorees

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

-

-

Calendar

-

Biz Marketplace

- News

-

Editions

View Digital Editions

Biweekly Issues

- September 22, 2025

- September 8, 2025

- August 25, 2025

- August 11, 2025

- July 28, 2025

- July 14, 2025

- + More

Special Editions

- Lists

- Viewpoints

- Our Events

- Calendar

- Biz Marketplace

Small Business

-

Recovery committee urges immediate action to save Maine's economy

Maureen Milliken July 2, 2020Immediate and direct economic relief to businesses, financial support for education reopening and enhanced broadband expansion are the three top ideas from the committee charged to find ways to save the state's economy.

Maureen Milliken July 2, 2020Golden introduces 'new PPP' bill with longer-term support for small businesses

Maureen Milliken July 2, 2020The RESTORE Act, similar to one being introduced in the Senate, provides longer-term loans that are more flexible than the Payroll Protection Act, and fixes some of the problems small businesses had with the original program.

Maureen Milliken July 2, 2020For Cumberland-based Reconnect, Rayshard Brooks left a special legacy

William Hall Updated: July 1, 2020The technology business has been around for 11 years, and began this one by changing things up. But Reconnect Inc. didn't anticipate it would get caught up in a tragedy that's changing the United States.

William Hall Updated: July 1, 2020The outsiders: Startups in Maine’s $3B outdoor recreation industry are long-term bullish

Renee Cordes Updated: June 29, 2020Despite the pandemic, the industry is big and getting bigger, partly driven by entrepreneurs with an appreciation of Maine's great outdoors and who aren't afraid to go off the beaten path.

Renee Cordes Updated: June 29, 2020FAME ups loan limits for businesses hurt by shutdown

Staff Updated: June 23, 2020To keep pace with the evolving financial needs of its customers during the pandemic, the Finance Authority of Maine is offering special terms in several of its business assistance programs.

Staff Updated: June 23, 2020In Bar Harbor, a candy-making institution struggles through the pandemic

Laurie Schreiber Updated: June 17, 2020Every summer, Ben & Bill's Chocolate Emporium is packed with customers eager to buy a Willy Wonka-level array of homemade candies and ice cream. This year is dismal. Co-founder Bill Coggins has launched a GoFundMe campaign to keep going.

Laurie Schreiber Updated: June 17, 2020On MDI, summer residents rally to help local businesses with $800K boost

Laurie Schreiber Updated: June 16, 2020When the pandemic began to threaten the local economy of Mount Desert Island, a group of summer residents joined with neighbors and the community to provide grants to businesses in need.

Laurie Schreiber Updated: June 16, 2020Nonprofit notebook: Portland arts spot is crowdfunding; CEI gets $100K gift

Renee Cordes Updated: June 16, 2020Performing arts venue One Longfellow Square has launched a crowdfunding campaign to stay afloat until mid-2021, while Coastal Enterprises Inc. receives a donation to help in its COVID-19 relief efforts.

Renee Cordes Updated: June 16, 2020Gorham textile designer wins 'Greenlight Maine' $100K prize

Renee Cordes Updated: June 15, 2020In the final round of the Maine business-pitch television series, Erin Flett competed against Chad and Nicole Humphrey of Humphrey's BBQ and Heather Desjardins of technology startup iTell Alert.

Renee Cordes Updated: June 15, 2020Craft brew fans drink up Kennebec Valley Chamber's at-home brewfest

Maureen Milliken June 12, 2020When it became clear in April that the Kennebec River Brewfest, the chamber's biggest fundraiser, would not happen in August as planned, the chamber came up with Brewfest in a Box. It sold out in three hours Wednesday.

Maureen Milliken June 12, 2020Nominate a Mainebiz Woman to Watch by June 30

Staff Updated: June 12, 2020This year perhaps more than ever, Mainebiz needs your help in finding inspirational leaders from the private and nonprofit sectors to honor.

Staff Updated: June 12, 2020Citing Black Lives Matter, Black Dinah Chocolatiers will change its name

Peter Van Allen June 11, 2020Black Dinah Chocolatiers, named for a mountain on Isle au Haut, told customers on Facebook that it will drop its name after a more than a decade in business, citing the Black Lives Matter movement and concern about customers' reaction to the name.

Peter Van Allen June 11, 2020Skowhegan grant program writes checks to 23 businesses

Staff June 11, 2020The grant program was set up in February to pay for technical assistance to small businesses, and expanded in May to help them survive the pandemic. Funding from the Bill and Joan Alfond Foundation recently increased the number of beneficiaries.

Staff June 11, 2020Experts discuss PPP loan forgiveness at free Mainebiz webinar on Thursday

June 10, 2020In this second Mainebiz discussion of the Paycheck Protection Program, a panel of four experts will show how businesses can qualify for loan forgiveness, and will review the latest rules and share case studies.

June 10, 2020Maine's rural reopening speeds up as COVID-19 cases in some counties trend down

Staff June 5, 2020As COVID-19 cases stay flat and decrease in 13 rural counties, tap rooms, bars, and more are allowed to reopen June 12. But the reopenings require adherence to state health and safety checklists, some of which have been updated.

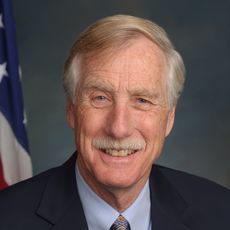

Staff June 5, 2020King bill to tweak small-biz bailout program heads to Trump's desk

Renee Cordes June 4, 2020The bipartisan Paycheck Protection Program Flexibility Act, co-sponsored by U.S. Sen. Angus King, makes adjustments to better support small businesses coping with the pandemic's economic fallout.

Renee Cordes June 4, 2020

Today's Poll

Sponsored by Kennebunk Savings Bank

Maine's cruise ship season is in full swing, running from late September through early November. Thousands of passengers are expected to visit Portland, Bar Harbor, Eastport or Rockland.

This week alone, Portland is set to welcome around 16,000 cruise ship passengers.

But as the season ramps up, it's bringing mixed reviews. Some locals brace for the crowds and many business owners say cruise ship visitors don't spend much while in the port. Other business owners argue that, even if cruise ships don't benefit their own coffers, they still benefit the overall economy.

When we asked this question in 2023, Mainebiz respondents, 21% said the visits bring customers and revenue, while only 18% said the visits don't help their business.

More than half of the respondents, 53%, said cruise ships benefit the overall economy.

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

This website uses cookies to ensure you get the best experience on our website. Our privacy policy

To ensure the best experience on our website, articles cannot be read without allowing cookies. Please allow cookies to continue reading. Our privacy policy