Augusta real estate portfolio bought for $5.75M in 2020 turns over for $13M

Courtesy / Capital Properties LLC

The seller of a multi-family portfolio completed about $2 million in upgrades since buying it in 2020.

Courtesy / Capital Properties LLC

The seller of a multi-family portfolio completed about $2 million in upgrades since buying it in 2020.

A multi-family portfolio in Augusta that sold for $5.75 million in 2020 recently went for $13 million in an off-market deal, signaling what the buyers said was an up-and-coming collection of properties with additional value-add opportunities in a strengthening market.

Door Fund Inc. bought the portfolio, consisting of 219 units across 48 buildings plus four vacant lots, from Capital Properties LLC. Brandon Mitchell of Malone Commercial Brokers represented the seller and Tyler Hall of Keller Williams Realty represented the buyer. The transaction closed June 9.

The seller

Capital Properties LLC is an investor partnership led by Aaron Walker.

The partnership acquired the bulk of the portfolio — 204 units across 44 buildings — in 2020 from a Maine investor who had assembled the properties over a 30-year span and embarked on improvement projects.

Brandon Mitchell represented Walker and his partners in that deal as well.

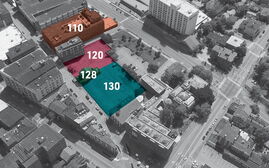

The properties are located within a half-mile of each other. Many are on Northern Avenue, Washington Street, Mt. Vernon Avenue, Bridge Street, Green Street and Chapel Street. The average age of the buildings is 100 years old.

The buildings range from one to 11 units. Over half of the properties are either three, four, or five units.

Walker and his partner increased the collection from 204 units across 44 buildings to 219 units across 48 buildings through the acquisition of four buildings in late 2021.

Walker grew up in Standish, went into the military, and, in 2004, moved to Massachusetts, where he was a commissioning engineer for a utility company.

He then transitioned into full-time real estate investment.

“My approach has always been value-add — inject the outside capital, improve the resident base and improve the community overall by bettering the building,” he said.

When he acquired the portfolio, he split his time between Massachusetts and Augusta.

“I would sleep on a couch in the back of the office,” he said with a laugh.

Since 2020, the partnership invested about $2 million of cash flow into capital improvements, including upgrades for about half the units and for infrastructure. The units were generally occupied throughout the time.

“As we lost people through attrition, we’d renovate the units and the new people would come in at market rates,” he said.

The time was right to sell, he said.

“I look at my exit as three to five years on any portfolio to recoup the equity,” he said. “That’s been my strategy.”

Walker credited Mitchell as well as his legal counsel, Eleanor L. Dominguez of Ainsworth, Thelin & Raftice, for their work in getting the deal done. Dustin Carson at TD Bank, he added, was instrumental in securing financing.

The buyers

Tyler Hall, one of the partners in the buyer group, got wind that Walker might be interested in selling 77 of the units. The discussion was casual at that point and there was never an official listing.

“So I contacted him, and through a conversation I found out he actually had 219 units in the area,” said Hall.

Hall told Walker he’d be interested in the whole package.

Said Walker, “I decided, ‘Okay, I’ll sell the whole package and it would be a much easier transaction than trying to parse out just the 77. It came together organically.”

Hall put the deal under contract personally, then structured the other pieces of the deal together with Door Fund Inc., a Massachusetts firm led by a friend of Hall’s, Michael Marchetti.

Together, they put together a syndicate of about 14 investors, plus Hall and Marchetti, to back the deal. Hall and Marchetti are the largest shareholders and will handle day-to-day operations.

Hall, who is in his early 30s, grew up in Gardiner, near Augusta. He bought his first real estate investment property in 2017, enjoyed the experience, then became a real estate agent, closing $11.5 million in his first year at Keller Williams Realty and earning the firm’s Rookie of the Year accolade.

He continued to build his portfolio in southern Maine. With the Augusta acquisition, he now has over 300 residential units and 28,000 square feet of commercial space.

At the same time, he’s been exploring the field of motivational speaking, with presentations at venues such as graduations and high school classes. His success in real estate, he said, has been a way to demonstrate a can-do spirit when climbing up from life’s low spots.

Marchetti, also in his early 30s, was born and raised in Massachusetts, but also spends a great deal of time in Rockland, where his family is from. Before the Augusta deal, he had compiled over 700 units across Massachusetts and New Hampshire.

“We’re the two largest shareholders in this because we believe strongly in the market and in this particular portfolio,” Marchetti said.

The plan is to invest approximately $2 million in renovating the interiors of approximately 120 units for middle-income renters. The units are about 95% occupied and the work will be done as they turn over.

“That would be sufficient to turn the portfolio into something really fantastic and it will be a great return for our investors,” said Marchetti. “The deal itself was very strong.”

0 Comments