Capital gains: How women are transforming the investment landscape

Photo / Tim Greenway

Julia Trotman, a former Olympic sailing champion, is a partner with Valo Ventures, a venture capital firm she co-founded in 2018.

Photo / Tim Greenway

Julia Trotman, a former Olympic sailing champion, is a partner with Valo Ventures, a venture capital firm she co-founded in 2018.

Competing in a male-dominated arena is familiar territory to Julia Trotman, an athlete-turned-venture capital investor based in Portland.

“One of the things I loved doing growing up was competing on boys’ teams,” says Trotman, a former competitive sailor who won a bronze medal in the 1992 Olympic Games in Barcelona.

“I played ice hockey with the boys instead of doing figure skating. I competed in sailing against boys because I could win,” she says. “I always wanted to be in the arena and not necessarily thought of as a girl.”

Today in an industry where women hold only 15% of partner or decision-making roles, Trotman is a partner with Valo Ventures, a climate solutions-focused firm that invests in early-stage technology companies.

“Women are great investors because they’re great supporters,” says Trotman, who also mentors entrepreneurs in the ClimateTech Incubator program at Northeastern University’s Roux Institute in Portland. Though the Harvard undergraduate and MBA alumna never envisioned a career in finance when she started out, she now can’t imagine doing anything else: “I love venture investing because it is art plus science.”

As more women control capital, they’re not only building their own portfolios but also breaking barriers in early-stage investing to support innovation and the next generation of women-led startups. That’s happening on a small yet meaningful scale in Maine, with many women taking leadership roles in financial advisory firms, working in venture capital and joining the Maine Angels group of accredited investors in growing numbers.

$100 trillion wealth transfer

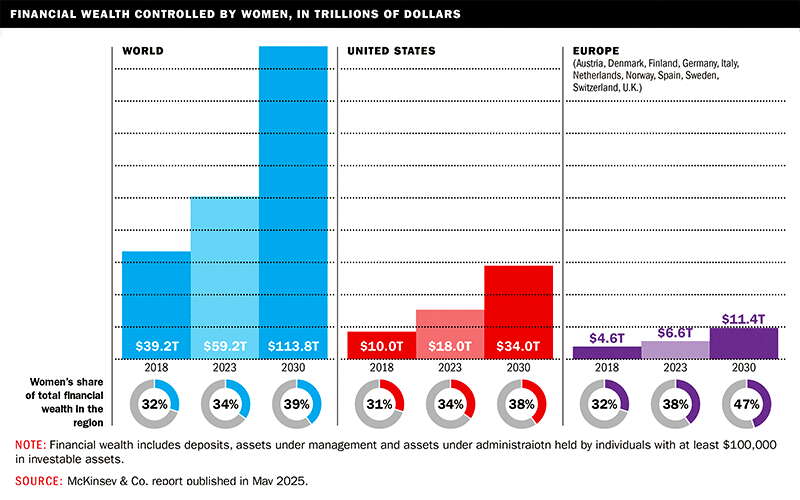

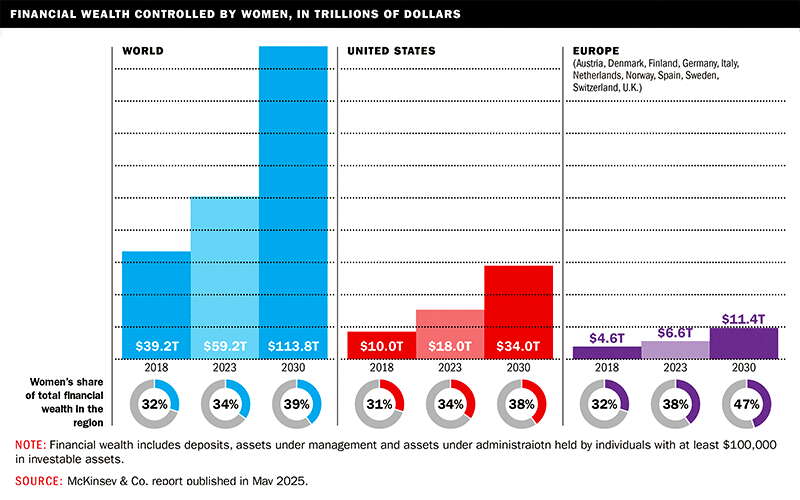

The rise of female investors around the globe is documented in a May report by McKinsey & Co. It shows that women currently control about a third of retail financial assets in the United States and Europe. By 2030, that share is projected to exceed 40% as the growth of female-controlled assets worldwide continues to outpace the market. Between 2018 and 2023, global financial wealth climbed by 43%, while the amount of wealth controlled by women rose by 51%.

The dollar amounts are staggering. As of 2023, women controlled an estimated $60 trillion in global assets under management. By 2030, that figure is projected to approach $114 trillion, representing 10% growth per year.

Reasons cited for the shift include a decline in marriage rates coupled with high divorce rates, continued growth in women’s earnings and longer average life spans. Women, for example, are not only more likely to marry later in life but also more likely to stay single and more likely to divorce if they do marry, McKinsey researchers note.

Inheritance via the so-called great wealth transfer from baby boomers and older generations is also a factor, as laid out in a December 2024 report by Cerulli Associates, a Boston-based financial services firm. It expects $124 trillion in wealth to be transferred through 2048, with $105 trillion of that amount flowing to heirs and the rest to charity. Projections of horizontal, or intra-generational, transfers show that $54 trillion will be passed on to spouses before eventually transferring to heirs and to charities, and that $40 trillion of the spousal transfers will go to widowed women in the baby boomer and older generations.

All that wealth in new hands will usher in a new generation of investors, with far more women in the mix than before.

Maine Angels flying high

Based in Portland, Maine Angels is a nonprofit network that finances innovative startups. Its members — 102 in total, 30% of whom are women — invest in and mentor early-stage companies, both as individuals and via pooled capital in sidecar funds. Collectively since 2003, they’ve spread more than $41 million across 100 companies.

The new Dirigo Angel Fund III, a $2.8 million venture fund that closed in November, is the group’s largest to date. Half of the 20 investors in the fund are women.

Backers include North Yarmouth resident Marie McCarthy, who joined Maine Angels a few months after retiring as chief operations officer at L.L.Bean.

“I had heard of Maine Angels maybe a decade or so ago, but I don’t know that I would have been at the investment level,” says McCarthy, who serves on several corporate boards. Today, “I have a little bit of elbow room to learn more about” angel investing.

Finding the experience “immediately mind-expanding,” she says it “feels more like college than retirement.”

Along similar lines, Mary Ellen Eagan became interested in investing after retiring from a corporate job in transportation environmental policy and strategy in 2022, when she moved to Maine from Massachusetts. Now a self-employed consultant in Rockland, she is the new chair of Maine Angels and part of a group of women members who meet monthly, joined by guests from other organizations.

“We’re not recruiting, but we’re providing a platform for people to understand how the investment process works and who all the players are,” Eagan says. “It gives women a better understanding and more confidence in proceeding down that path.” She also credits former Chair Sandra Stone for laying the groundwork for more female participation. During her four years as chair, Stone challenged every male Angel to bring in a prospective female Angel and is pleased to see the group growing.

“Many of our new members are not immediately investing — they’re watching and learning, and I encourage particularly the women to ask questions,” she says.

Stone notes that while women are more likely than men to finance startups focused on women’s health and other products that improve women’s lives, having a diverse investor base of both men and women leads to better outcomes as shown in several studies.

‘More women at the table’

Maine Angels’ newest fund has made five investment commitments so far and includes goals to back businesses across the clean technology, life sciences, aquaculture and agriculture and forestry sectors — all targeted as strategic by Maine.

With more women in the group, Maine Angels aims to put more capital in the hands of women founders, who still receive a tiny fraction of the funding their male peers do. One report, published in May by the U.K.-based Founders Forum Group, shows that out of $289 billion in venture capital deployed worldwide in 2024, only 2.3% was allocated to female-only founding teams.

“Women founders receive 2% of venture funding nationwide and this low percentage has not improved for 20 years,” notes Bobbie Lamont, the group’s membership chair.

To help rectify the situation in Maine, Dirigo III is steering a third of its investments toward women and historically underrepresented founders to align with previous funds, where that percentage ranged from 31% to 48%.

“Data indicates that women-founded startups outperform financially, and yet a targeted approach remains necessary to address disparities,” notes Lamont. Bringing more women into the Angels “should help move the needle.”

The former science educator developed an interest in investing from her mother, who would translate the financial pages into Yiddish for Lamont’s Polish-born uncle who had a menial job at a brokerage firm in New York City and didn’t speak English.

“He probably wrote down what he saw his bosses doing, and all through my childhood my mother was always poring through the New York Times,” recalls Lamont. Today, she likens angel investing to “buying local” in Maine and sees her role as a bridge between two worlds.

“Now I’m privy to some high wealth circles, but I am always super-connected to low wealth circles,” she says. “It’s all very interrelated for me.”

‘Critical’ support for HighByte

Home-grown startups in Maine Angels’ portfolio include HighByte, a Portland-based developer of industrial operations software. The company, founded in 2018, has raised $17.2 million in equity to date.

Torey Penrod-Cambra, part of the three-person founder and leadership team, says that support from Maine Angels was critical to HighByte’s early fundraising and growth.

“It was refreshing to see so many women investors at the table from such diverse background,” she says.

Today, 21% of HighByte’s equity is owned by female investors or women-led venture firms, which Penrod-Cambra says happened organically rather than a result of a deliberate strategy.

Raising funds has had its challenges, like fielding questions from would-be backers that Penrod-Cambra says would never be put to male founders.

“I have been asked directly by potential investors about how I will balance child care with the demands of starting a company,” she says. “Frankly, this is not a question we ask male founders.” She says that while those types of personal questions tend to reflect unconscious bias rather than ill will, the situation seems to be improving as more women become investors. To keep the pipeline going, she would like to see more women starting businesses.

“After a successful exit, many founders go on to either start another company or they move into venture funds or angel investing,” she says. “If we’re not filling the top of the funnel with more women startup founders, we will continue to lack women investors. This is an obstacle, and it takes time to fix.”

Investing for ‘impact’

As women around the world gain wealth and financial independence, they are increasingly leading the shift toward investing for impact as well as financial returns.

That’s long been a focus for Karin Gregory, co-founder and managing partner of Blue Highway Capital in Biddeford. The private equity boutique, launched in 2016, invests in rural businesses including Springworks Farm, a Lisbon-based organic grower of lettuce using sustainable aquaponics technology.

“We invest in companies that somebody might think of as venture-y that are still at an early stage but have revenues and repeatable customers,” says Gregory, who recently returned from a gathering in New York City with 150 other impact-oriented funds.

“It comes back to the need to make a difference with their money, whether it’s climate or something that makes us a healthier, happier world,” she says. “Of course you want to make money, but women might forego the return for the reward of the investment that they make.”

0 Comments