Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Good deal: For small businesses, SBA 504 loans lower the price of entry to real estate

Photo / Tim Greenway

Ian Dorsey, president and CEO of Mast Landing Brewing Co., left, and Paul Collins, vice president of Granite State Development Corp., at Mast Landing Brewing Company in Westbrook. Collins says the SBA 504 loan program provides great advantages to borrowers, like Dorsey, who recently bought more tanks, a pilot brewhouse, and more canning machinery in response to high demand.

Photo / Tim Greenway

Ian Dorsey, president and CEO of Mast Landing Brewing Co., left, and Paul Collins, vice president of Granite State Development Corp., at Mast Landing Brewing Company in Westbrook. Collins says the SBA 504 loan program provides great advantages to borrowers, like Dorsey, who recently bought more tanks, a pilot brewhouse, and more canning machinery in response to high demand.

It took about a year for the owner of AutoMile Motors to find property to buy on U.S. Route 1 in Saco.

Justin “Jay” Gould and a partner were looking to have the security of ownership, rather than a lease, and also wanted to expand the auto dealership. The “AutoMile” brand meant the search was limited to just that — a mile-long stretch on Route 1 known for its automotive dealerships and services.

“AutoMile Motors has to exist on the auto-mile,” says Gould.

Initially the partners looked at properties in the $300,000 range, an affordable price based on what they assumed would require a 20% to 25% down payment for a bank loan, with future upgrades paid for out-of-pocket when possible.

He approached NBT Bank in Portland about financing. There, Wayne Morphew, a senior business banking officer, recommended Gould apply to the U.S. Small Business Administration 504 program, which provides loans advantageous to borrowers for certain commercial purposes in combination with a regular bank loan.

Morphew connected Gould with Paul Collins at Granite State Development Corp. in Portland. Granite State is a certified development company, a nonprofit that administers the 504 program on behalf of the SBA.

Gould learned the 504 provides long-term, below-market, fixed-rate loans with a down payment as low as 10% — far lower than the 20% to 25% required by a conventional loan.

That broadened his search. When a much larger 20,000-square-foot building on 1.69 acres popped up, the loan program made it possible for Gould to take on the $1.1 million price tag and also invest immediately another $200,000 in renovations to become a turnkey operation.

“It allowed us to get into a million-dollar property with just 10% down,” Gould says. “We’re not big-money guys. So for guys like us, we only had to come up with $110,000 to start building our dream. This lowered the price of entry into the commercial real estate game.”

Building dreams

Helping small businesses build their dreams is the goal of the SBA 504 program, thanks to long-term, fixed-rate financing for eligible projects.

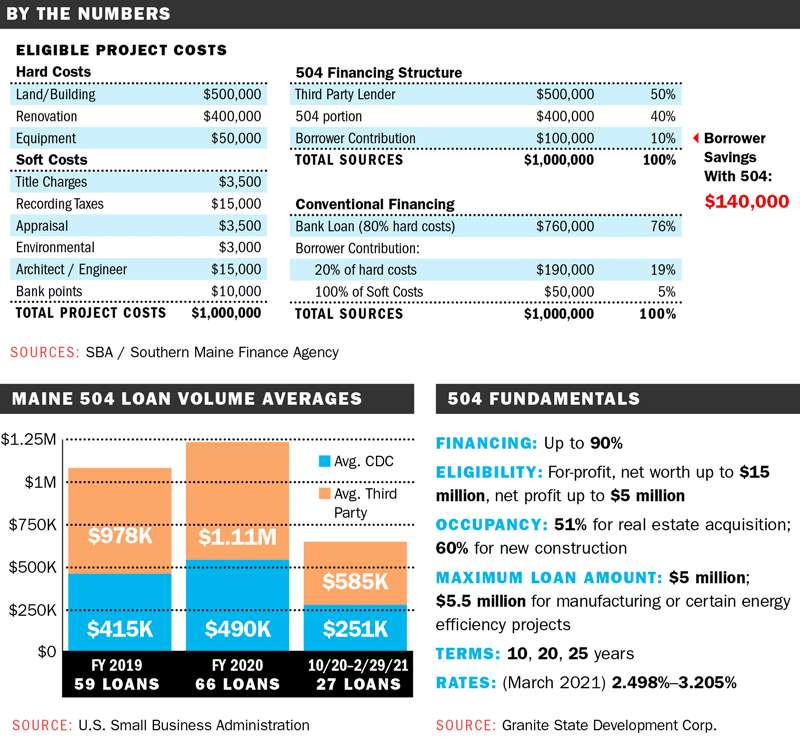

In the typical 504 project, a third-party lender — a bank or credit union — funds 50% of the cost with a loan secured by a first lien. An SBA-licensed certified development company, or CDC, funds 40% through a loan secured by a second lien. In most cases, borrowers provide the remaining 10%, although start-up and special-purpose projects require up to 20% equity.

A 504 loan can be used for a range of assets, including purchase or construction of:

- Existing buildings or land

- New facilities

- Long-term machinery and equipment

Or the improvement or modernization of:

- Land, streets, utilities, parking lots, landscaping

- Existing facilities

In Maine, the loans are mostly used to buy, build or expand commercial real estate, says Diane Sturgeon, deputy district director of SBA’s Maine District Office. The program requires a much lower down payment than conventional bank financing, allowing borrowers to retain more working capital for their business and providing predictable payments through the life of the loan, she explains.

“Normally if you’re doing a commercial real estate deal, the lender is looking for 20% to 25% cash down,” she says. “For a million-dollar deal, that’s a lot for a small business owner.”

‘I found property’

Most deals start with the banks, explains Granite State’s Collins.

“The banks have a relationship with their borrowers,” he continues. “The borrower says, for example, ‘I found property I want to buy,’ or, ‘I need this piece of equipment,’ or, ‘The landlord is selling me the building we’re in.’”

Once it’s determined the 504 is the right fit for the borrower’s project, the CDC and the bank pursue separate underwriting processes.

“I describe the process as the bank doing the credit analysis while we make sure the deal fits with SBA 504 loan program parameters,” says Collins.

Benefits for borrowers include the lower down payment, which allows them to retain working capital.

“That’s the lifeblood of any business,” says Collins. “That allows them to grow and continue to develop their business.”

Another plus: The SBA provides fixed interest on the loan for 20 to 25 years on real estate and 10 years on equipment, which compares favorably to bank loans, which generally have shorter terms and the potential for increased interest rates when the term resets.

Granite State averages 50 to 70 loans in Maine and 250 to 300 in New England per year through the program. In February, Granite State partnered on 10 projects approved by the SBA, including a marina in Lebanon, a Mexican restaurant in Kittery and a tire recycling company in Fairfield. Total project costs ranged from $235,000 to nearly $9 million. The projects involved seven different banks.

“We’ve done deals across the state — Presque Isle, Machias, Kittery, Bethel,” says Collins. “It’s driven by the banker. A lot of borrowers have great relationships with their banks, and when banks recognize an opportunity, they bring us in.”

Brewery equipment

Loans in recent months include borrowers from the hospitality, convenience store and manufacturing sectors.

“I’m working on a couple of manufacturing businesses now,” Collins says. “The majority of deals I work on are real estate. A few deals each year are just equipment. A lot of those are breweries, because it’s usually a large dollar amount for an equipment-only request.”

One of those was Mast Landing Brewing Co. in Westbrook. Owner Ian Dorsey needed additional fermenters and a five-barrel “brewhouse” to make pilot batches — part of a planned expansion. When the pandemic zeroed out draft sales, he also needed more canning machinery for his growing retail market. All together, he’d need $750,000.

Coming from a finance career, Dorsey was aware of the SBA’s programs since starting the business in 2015. But he didn’t realize the 504 covered equipment as well as real estate. His regular lender, Bangor Savings Bank, suggested the 504 for its lower interest rate and brought in Collins.

“This was a very flexible program and it was also smooth and quick,” says Dorsey.

Between the underwriting and application, the process took about six weeks. The parties did the closing together.

Dorsey views the program through both his finance and small-business lenses.

“I think it’s absolutely critical,” he says. “It would be devastating to Maine’s economy and to businesses if those vehicles went away.”

Falling into place

At the Frog & Turtle Gastro Pub in Westbrook, business was booming before the pandemic. The owners wanted to build a second story to add capacity. Without the 504, they wouldn’t have been able to, says Guy Cote, one of the pub’s partners.

Cote came across the program in an article, talked with his bank, Evergreen Credit Union, and with the Southern Maine Finance Agency, a CDC in Biddeford. “Everything fell into place for what we wanted to do,” Cote recalls.

Interest rates on a conventional loan alone “would have put the project out of reach,” he says.

Cote found it took about six months to get the loan. “There were a lot of hoops to go through,” he says. But, he adds, he had plenty of help navigating the process.

“It can be a time-consuming process,” agrees Southern Maine Finance Agency’s president, Will Armitage. “Because of the federal component, there are a few more steps required than with a conventional loan. But at the end, when you get approved, you get the benefits of a lower interest rate and a lower down payment.”

Armitage explains how a loan pans out with and without the 504. Say a borrower needs $950,000 for hard costs (real estate, renovations, equipment) plus $50,000 in soft costs (fees and taxes), for a total of $1 million overall.

With 504 financing:

- The third-party lender provides 50% or $500,000.

- The 504 portion is 40% or $400,000.

- The borrower contributes 10% or $100,000.

With conventional financing:

- The third-party lender provides 80% of the hard costs, or $760,000.

- The borrower contributes 20% of the hard costs plus 100% of the soft costs, or a total of $240,000, which is $140,000 more than the 504 deal.

Peace of mind

NBT Bank’s Morphew, who worked on the AutoMile deal, says the 504 program is beneficial for banks, helping them mitigate risk while still allowing them to retain a first-lien position. At the same time, borrowers “don’t have to worry about injecting their whole life savings into a project,” he says. “They don’t have to worry about their nest egg being exhausted.”

Debt relief

As part of the CARES Act, the SBA provides debt relief for 504, 7(a) and microloan borrowers, covering payments, principal, interest and fees for six months if the borrower received a loan before Sept. 27, 2020.

Additionally, SBA will make payments for a three-month period on new loans approved this year between Feb. 1 and Sept. 30.

Source: U.S. Small Business Administration

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments