Idaho law informs health bill

With the passage of the state’s new health insurance reform law, Maine suddenly has much more in common with Idaho than just potatoes. LD 1333, a controversial bill passed earlier this month after heated partisan rancor, overhauls the health insurance market for about 40,000 people who buy their coverage independently or through employers with 50 or fewer workers.

The bill allows insurance providers from other New England states — except Vermont, which was excluded because of its pursuit of a single-payer system — to sell insurance in Maine beginning in 2014, and gives insurers more latitude in setting rates. But the chief similarity with the Idaho system the measure was modeled after is the creation of a high-risk reinsurance pool for the sickest residents. Idaho, a state with a similarly sized but younger population than Maine’s, instituted its pool in January 2001. Today, the pool provides coverage for about 1,650 residents, funded largely

by a portion of the state’s premium tax, as well as by premiums and federal grants.

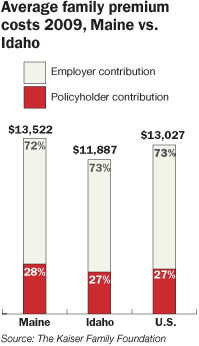

Idaho legislators sought to keep rates for the pool’s plans between 125% and 150% of the cost of a comparable plan in the regular market, and over the last decade rates have held at the lower end of that range, says Shad Priest, deputy director of the Idaho Department of Insurance. Determining whether Idahoans pay lower rates overall as a result of the pool’s creation, however, is a tough call, since premium and health care costs continue to rise nationwide, Priest says. “It’s really, really hard to tell what impact, if any, it’s had because everything keeps going up,” he explains. The average family premium for employer-based coverage in Idaho was $11,887 in 2009, compared to $13,522 in Maine, according to the Kaiser Family Foundation. The national average was $13,027.

Alex LaBeau, president of the Idaho Association of Commerce and Industry, says he can’t recall hearing any complaints from members in the last five years about the high-risk pool. “It was reasonably successful,” he says. “It’s a fairly substantial pool for Idaho.” Suzanne Budge, director of Idaho’s chapter of the National Federation of Independent Business, also gives a positive, if not resounding, assessment. “The system seems to have worked reasonably well as a high-risk pool,” she says.

But with federal Affordable Care Act reforms looming, the pool could become obsolete if its enrollees abandon it in favor of the act’s much-heralded health care exchanges.

Future impacts

In Maine, the insurance option for high-risk residents will take the form of the Guaranteed Access Plan, funded by an assessment — some call it a “tax,” others a “user fee” — on premiums for nearly all Maine policyholders. The assessment would generally be limited to $4 per month, but could go as high as $6 per policyholder per month if demand spikes unexpectedly, says Sen. Rod Whittemore, a Skowhegan Republican and chairman of the Committee on Insurance and Financial Services. Lawmakers estimate the pool will need roughly $24 million, though the number of future enrollees remains to be seen, he says. “We wanted to find a way, other than Dirigo and government subsidies, to protect these people with high risk,” Whittemore says. Insurers will cover policyholders’ first $7,500 in expenses per year, while the reinsurance association, a quasi-governmental entity administered by a third party, will kick in 90% of the next $25,000 in costs and 100% above that level.

In Idaho, the law allows insurers to be charged a special assessment to meet unanticipated demand in the high-risk pool, but it’s never been triggered. There, all carriers that offer individual health insurance must also offer the $18 million pool’s five guaranteed-issue plans, which are sold at the same rates and cover similar benefits but vary on cost sharing. The most popular coverage, a health savings account compatible plan, rings in at $306 monthly for a 40-year-old male non-smoker and $218 for a comparable woman (with no coverage for maternity expenses), and has a $3,000 yearly deductible and $1 million lifetime cap. Maine’s law sets no cap, in accordance with state and federal mandates, Whittemore says.

Premiums in the Idaho pool, which covers about 1.6% of the eligible, insurance-buying population, vary based on age, gender, family size and tobacco use. In Maine, LD 1333 allows insurers to charge policyholders based on age, occupation, geographic location and tobacco use, which opponents say will give typically younger urban residents lower rates at the expense of their older, rural counterparts. The law doesn’t outline what plans will be available through the Guaranteed Access Plan.

Many thought the pool’s creation would lure more insurers to Idaho’s market, but greater competition hasn’t materialized, says Priest. The state still has the same major players — BlueCross of Idaho and Regence BlueShield of Idaho, which offer competing plans that represent 80% of the market, plus a third major insurer, Pacific Source. “We haven’t seen any big increases [in competition],” Priest says. “We’ve already got two big players that are competing pretty strongly. It’s tough for another player to come in.” In Maine, three companies sell insurance in the individual market: Anthem, Harvard Pilgrim and Mega Life, with Anthem serving about half the enrollees.

What effect the Affordable Care Act will have on Idaho’s pool remains unknown. In April, Idaho Gov. C.L. “Butch” Otter issued an executive order prohibiting the state from implementing the federal health reform law, after the state legislature considered a bill to nullify it, a measure later dropped at the urging of Idaho’s attorney general.

In Maine, the Guaranteed Access Plan will at the very least serve as a stopgap measure to cover the estimated 133,000 residents lacking insurance until the ACA takes effect, Whittemore says. If the system works well, the pool could potentially coexist with the federal reforms, as could Idaho’s. Meanwhile, the Maine People’s Alliance, the Maine Democratic Party and others are exploring a people’s veto of LD 1333 to prevent it from becoming law 90 days after the Legislature adjourns.

Provisions of the health reform bill

In addition to creating the Guaranteed Access Plan, a pool to insure high-risk residents, LD 1333 also:

Allows companies from other New England states, except Vermont, to sell insurance in Maine starting in 2014

Permits insurance companies to charge rates based on age, occupation, geographic location and tobacco use. A participant in the Guaranteed Access Plan will pay the same premium as a healthy person fitting similar criteria.

Repeals Rule 850, which requires insurers’ provider networks to have primary care doctors within a 30-minute drive of policyholders’ homes and hospitals within an hour’s drive. Insurers may provide incentives to encourage policyholders to visit certain locations, but can’t deny coverage at local health care facilities.

Allows businesses to band together to buy insurance for their employees

Comments