King bill to tweak small-biz bailout program heads to Trump's desk

A federal bill that gives business owners more flexibility in how they can spend funds from Paycheck Protection Program loans is headed to President Donald Trump's desk after receiving approval Wednesday in the Senate.

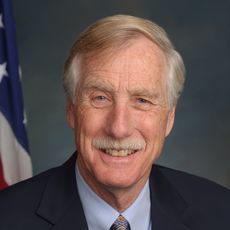

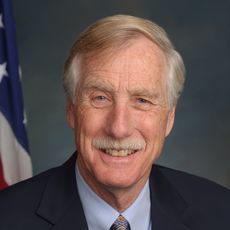

The bipartisan bill, cosponsored by U.S. Sen. Angus King, I-Maine, was passed a week after overwhelming approval by the U.S. House of Representatives, 417-1.

On the day of the House vote, King told Mainebiz in a telephone interview that the Paycheck Protection Program Flexibility Act would put the Small Business Association bailout program on a needed "mid-course correction."

He said that would be particularly useful for the hospitality industry, among the sector hit hardest by the pandemic's economic fallout.

What's in the bill

Among other things, the bill would extend loans to businesses over a longer period of time and give owners more freedom in how they spend their bailout funds.

Specifically, the legislation allows forgiveness for expenses beyond the eight-week covered period, which hasn't been feasible for many businesses that have been barred from opening or have only been able to open with restrictions. Businesses that already have PPP loans will now be able to choose between using the loans in the initial eight weeks or extending the period for up to 24 weeks.

The bill also reduces restrictions limiting nonpayroll expenses to 25%, allowing them to use up to 40% of bailout funds to go to non-payroll expenses such as mortgage, rent and utilities.

Another provision removes the restriction that a company rehire employees by the end of June, which many companies are unable to do because employees are making more on unemployment than they would working.

To mitigate that unintended consequence, the deadline to rehire employees would be extended under the new law. It would also eliminate restrictions in new loans that limit terms to two years and ensure full access to payroll tax deferment for businesses that take PPP loans.

"The PPP has done good work so far," King tweeted after the Senate vote. "Now, I hope it can do even more."

He also expressed gratitude that Congress moved so quickly "to provide real relief, at a moment when local businesses truly need it."

'Make a tremendous difference'

Maine business owners welcomed the news.

"This pandemic has hit us particularly hard as a restaurant that was thriving,” said James Hatch, co-owner of Home Kitchen Cafe in Rockland, in a news release from King's office. “Extending the PPP loan to up to 24 weeks will make a tremendous difference for our business, as we will not be anywhere near full strength by June 30, 2020.

"Our servers, always in contact with customers old and new, don’t feel safe to resume their usual tasks until there is adequate testing and or a vaccine. As a business owner, it is incredibly important to end this pandemic with no loan from our PPP grant, and this legislation ... will help our business and others like it accomplish that goal.”

Kevin McGlynn, sales director at Mast Landing Brewing Co. in Westbrook, said the pandemic has also had a profound effect on his company's sales across the country and its distribution partners.

"Small businesses are the backbone of the U.S. economy and we desperately need the PPP to be more flexible for businesses like ours as well as all other small businesses participating in this program so we can make the best use of these funds for our businesses," he said in the release.

0 Comments