Landlords, banks working together to weather 'slow-moving tsunami'

Image / MEREDA

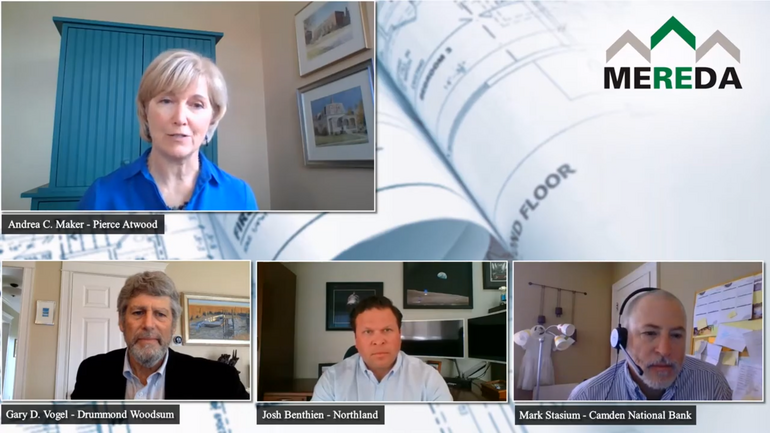

MEREDA held its first virtual Morning Menu panel Friday with, clockwise from top, Andrea Maker, of Pierce Atwood; Mark Stasium, of Camden National Bank; Josh Benthien, Northland LLC; Gary Vogel, of Drummund Woodsum and MEREDA president. The topic was commercial leasing during COVID-19.

Image / MEREDA

MEREDA held its first virtual Morning Menu panel Friday with, clockwise from top, Andrea Maker, of Pierce Atwood; Mark Stasium, of Camden National Bank; Josh Benthien, Northland LLC; Gary Vogel, of Drummund Woodsum and MEREDA president. The topic was commercial leasing during COVID-19.

Uncertainty may be the theme for 2020, but some things remain sure, including the importance of landlords, tenants and lenders working together in order to weather the storm, a panel of real estate industry experts agreed last week.

Commercial leasing during COVID-19 was the topic of the Maine Real Estate and Developers Association's first virtual Morning Menu forum last Friday. One of the takeaways: Communication about individual situations and the use of collaborative, creative approaches are the keys to helping tenants, landlords and lenders come out on the other side with the least damage.

“I think this is going to be, for many businesses and for many landlords, sort of a slow-moving kind of tsunami, where for many businesses it may take a long time for their revenues to recover,” said Gary Vogel, president of MEREDA, and a member of the panel. “It’s easy enough for us to deal with this for a couple of months, but for many of our tenants and many landlords, they may be dealing with the impact for a year or longer.”

Vogel was joined by Josh Benthien, CEO of Portland real estate and construction firm Northland Enterprises; Mark Stasium, senior vice president and commercial real estate lender at Camden National Bank; and moderater Andrea Maker, of Pierce Atwood, MEREDA’s legislative counsel.

More than 200 MEREDA members tuned in to the Vimeo live-stream. The connected relationship between tenants, landlords and lenders and how each part of the chain can affect the next was central to the discussion.

Commercial landlords and tenants

Benthien said that when COVID-19 restrictions began, the first move in the playbook, at least for national retail tenants, was to call the landlord and ask for three months rent-free.

While “we want tenants to survive, we just can’t say ‘OK, no one pays rent for three months,'" Benthien said.

He said Northland's response was to ask to see a commercial tenant's financials, so that a payment structure can be worked out.

Of the national tenants “some of them just say flat out ‘no, we’re not going to share that and we’ll just pay the rent,’” he said. “How long that lasts will be interesting."

Local tenants have been a lot more transparent, he said. “They’ve said ‘this is how it’s affecting us,’ and we’re able to say, ‘OK, this is what we’ll be able to provide.”

The conversation is necessary, because property owners then have to work with banks on their own mortgages. While the firm, which has 330,000 square feet of commercial property, has worked on lowering operating expenses, some, like security, have gone up. They’re trying to be creative and address tenants individually and as fairly as possible.

Vogel, an attorney at Drummond Woodsum, in Portland, said it’s vital that commercial landlords have written agreements with tenants about how COVID-19 rent relief will be repaid.

“The tenant doesn’t want to have a situation where they’re effectively in default and they just have a verbal acknowledgment from their landlord that ‘we’re going to work with you,’ but not have any arrangement that they know they can live with,” he said.

A typical agreement would be that a tenant pay back rent in installments, along with rent due, starting at a specific point, like 30 days after the business fully reopened.

The agreement also means landlords can plan their cash flow, Vogel said. “When a landlord has those agreements in place with their tenants, they’re in a much better position to discuss what they can do with their lenders."

The lending end

Stasium, of Camden National, said that lenders started hearing from landlords in March that tenants couldn’t pay rent. It started with hotels, then retail landlords. They didn’t have rent coming in, and needed payment relief.

The issue caused a quandary — normally debt relief requests, like forbearance on loan repayments, requires a “troubled debt restructure,” which is a regulatory classification. The classification comes with a lot of strings, and would be difficult to do in bulk.

“Fortunately, the regulatory agencies responded quickly,” he said. If lenders were providing COVID-19 relief, forbearance didn’t have to be classified TDR. The federal CARES Act made if official, suspending the classification until the end of 2020 or whenever the national emergency ends, whichever comes first.

A MEREDA survey of member lenders, shows that the nine that answered are working with commercial borrowers, Stasium said.

To “My bank’s response to date with requests for debt relief has been …” they responded:

- 33% said yes with no questions asked

- 67% did, subject to inquiry about the effects of COVID-19 on the borrower.

To “My bank has provided the following with respect to length of debt payment relief provided" they responded:

- None said they haven’t provided anything; also none said they've provided more than six months' relief;

- 67% said they provided relief up to three months;

- 33% said they provided it for three to six months.

To “My bank has generally provided debt relief as follows ...” they responded:

- None answered that they haven't provided relief;

- 11% said they’ve deferred payments, with the borrower paying interest;

- 33% said they’ve deferred payments, with interest accruing to be paid later;

- 55% have said the type of payment depends on the borrower’s situation.

To “If the impact of COVID-19 extends beyond the initial debt relief term and customers seek additional debt relief, we expect we will respond as follows,” they said:

- None won't provide any more relief; none also will provide further relief with no questions asked;

- 78% said they’d provide additional relief based on the situation and borrower’s cash flow;

- 22% said they’d consider further relief, but it could include credit enhancements by the borrower.

Stasium said that the final answer shows, “Lenders were certainly willing to help or wanting to help, but nobody knew how long this emergency is going to impact people.”

The survey was taken at the end of March and beginning of April. Lenders wondered, “Are things going to be back to normal in June, July, the fall? I think banks said ‘We don’t want to give you six months relief if things are going to be back to normal by July, so we’ll give you three months relief and if things are continuing to be an issue beyond that we’re going to have to get together to have another conversation."

As the situation continues to change, “The most important thing if you’re a borrower is communication,” he said. “Stay in close contact with lenders.”

He said lenders will want to discuss financial information, what’s going on with tenants as far as which ones are performing, what negotiations with them have resulted in, what the borrower’s cash flow is and more.

A slower post-COVID future

Stasium said the situation is having an impact on new loan opportunities, with some lenders not entertaining new requests because they’re inundated dealing with COVID-19 related loans.

“We’re all wondering what the impact’s going to be on new acquisitions, new developments,” he added. “I think you can expect that lenders will be looking at more conservative loan structures that we were say, 60 to 90 days ago.”

The lending and borrowing environment of the last several years “may get a little more conservative in in the terms that lenders are willing to offer.”

Benthien said that in talking to colleagues who have property in other states, landlords who operate in Maine are fortunate. “We’re lucky have the banks we do here,” he said. “They’re being very flexible and helpful.”

Maker agreed, saying, “I certainly do feel sense of community, that we are in this together.”

More from virtual MEREDA

The panel also discussed Payroll Protection Program loans in regard to tenants and landlords, as well as working with residential tenants in light of the state eviction ban.

“I think the last thing our members and landlords want to be doing is evicting tenants who are unable to pay as a result of the coronavirus,” Vogel said. “We’re really all in this together. Tenants, businesses are suffering, the impact is certainly felt by landlords, their lenders. So it’s really imperative to make this work for everyone.

“Just enabling landlords to evict tenants is not a solution,” he said. “We need the tenants to survive.”

The panel is available for viewing by clicking here. MEREDA officials said they hope to schedule more in the future.

0 Comments