Maine M&A experts predict deal momentum to pick up

After a relatively quiet year for mergers and acquisitions involving Maine companies last year, experts expect activity to pick up slowly in 2021.

After a relatively quiet year for mergers and acquisitions involving Maine companies last year, experts expect activity to pick up slowly in 2021.

Portland-based accounting firm BerryDunn kicked off 2021 by joining forces with a Connecticut peer, in what some experts predict will be a more active year for mergers and acquisitions involving Maine companies.

While most bets are on acquirers from out of state looking for buying opportunities in the Pine Tree State, advisers expect a gradual pickup in both directions.

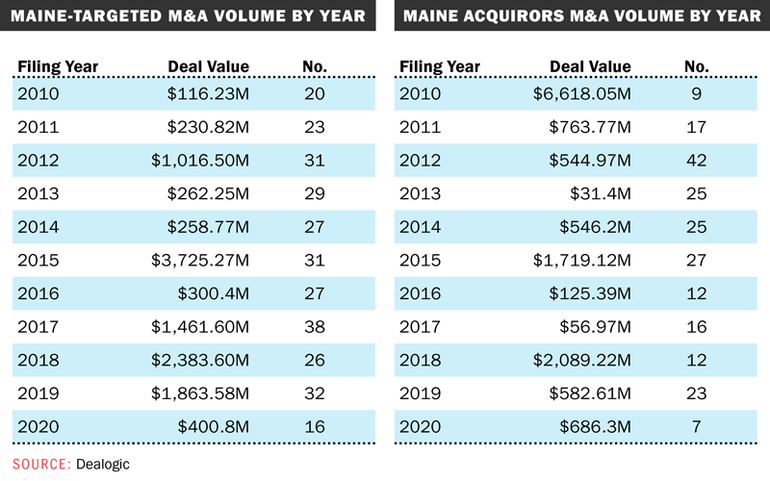

The predictions come after deal volume in and out of Maine declined sharply in 2020 during the onset of COVID-19, according to data compiled for Mainebiz by Dealogic.

Records show there were just seven deals by Maine acquirers in 2020, down from 23 in 2019, while the number of Maine-targeted deals dropped by half, from 32 in 2019 to 16 in 2020.

Deal value amounts trended in opposite directions, with $400.8 million worth of Maine-targeted mergers and acquisitions in 2020, significantly below $1.86 billion in 2019.

By contrast, Maine-based acquirers ran up a slightly higher tab, spending a combined $686.3 million in 2020 versus $582.6 million in 2019.

The biggest chunk of the 2020 dollar value total came from two acquisitions worth a combined $577 million by Portland-based financial technology firm WEX Inc. (NYSE: WEX), completed at a fraction of the original cost.

'With uncertainty comes opportunity'

What's the general outlook for M&A this year?

Pierce Atwood partner Chris Howard, a member of the Portland law firm's business group, expects an active year.

"Business that have been able to maintain a firm financial footing over the last nine months are looking to the world and saying, 'OK, this has been a challenging environment, but together with challenge and uncertainty comes opportunity,'" he told Mainebiz.

Noting that's driven in part by "crazy" low interest rates and valuations that have come back into manageable ranges, he said, "That has caused a lot of businesses that maybe didn't have an acquisition program or strategy to really think about growth through M&A."

While he expects Maine to continue to have more sellers than buyers, Howard said he also has some clients with acquisition ambitions.

"I'm working right now with a couple of solid Maine-based businesses that do not have regular acquisition programs that are looking to do out-of-state acquisitions," he said. "They want to grow their market in an environment where there might be opportunities."

While sectors such as hospitality and retail adversely affected by the pandemic offer current buying opportunities to interested suitors, companies in home goods manufacturing and lumber may be be looking to expand, either through investing in their own facilities or acquiring aligned facilities.

"It's a really varied environment on the whole," he said. But he also cautions that would-be acquirers should not drag their heels, saying, "These opportunities are going to be on the table for probably the next 12 months and not longer."

He also recommends that companies tread carefully, especially if they haven't made previous acquisitions, cautioning, "It's easy to get it wrong."

Restaurants 'on the market'

Murray Plumb & Murray's Chris Branson, a partner who heads the Portland law firm's business practice group, said that most of his clients are holding off on deals for the moment.

"They're all in a holding pattern for hundreds of different reasons, much of them COVID-related," 'he said. He said he can think of three deals last year affected the the pandemic, two of which didn't happen and one that had to be substantially renegotiated.

Today, Branson said, "my hunch is that there's probably opportunistic buying opportunities happening."

While he has not seen much activity yet on that front, he said, "I have a couple of restaurant businesses that are on the market that would go for bargain prices right now."

0 Comments