Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Maine's financial lost-and-found has $276M, and some of it may be yours

More Information

The state of Maine owes over a quarter-billion dollars to individuals and businesses — but despite the financial crisis, many Mainers don’t know they have money due.

The state’s Unclaimed Property Office, a sort of lost-and-found for financial assets, on Wednesday was ready to pay out a total of $276 million to the rightful owners. That sum can change daily, but is steadily increasing.

The money comes from a wide variety of sources. Bank accounts, stock shares and life insurance policies that have been lost or abandoned. Unpaid wages, uncashed checks, unredeemed refunds. The Unclaimed Property Office doesn’t handle things like real estate and cars, although it does sometimes deal with safe deposit box contents.

Like the public collections of odds and ends you might check for a misplaced umbrella, the office, overseen by Maine State Treasurer Henry Beck, is a go-to source for wayward assets. A state database of them is available for anyone to check for free by entering a few words at maineunclaimedproperty.gov.

Brad Hallowell, a finance administrator who lives in Waterville, has been reunited with stray checks from two previous jobs in recent years via the UPO. One check was for $50, the other was worth $300 to $400, Hallowell recalled.

“I’m sure I ended up spending them on something frivolous, but they were really a pleasant surprise,” he told Mainebiz.

Over the last fiscal year, which ended in June, the office paid 30,642 claims, breaking an all-time high by about 1,000, and returning $17.1 million. The average claim amount was $560, but one lucky Mainer received a check for $831,400.

“We’re very good at finding owners and paying things out quickly,” Beck said in an interview.

The Unclaimed Property Office is more than a public service, however; the office provides a revenue stream for the state of Maine.

During the 2020 fiscal year the state received $28.3 million in unclaimed assets, submitted by businesses and other “holders” that are legally required to remit them after a period of inactivity that ranges from one to three years. The UPO then starts tracking down owners.

Eventually, after paying claims, the state moves some of the remaining assets through a legal process called escheatment to the General Fund, where they help handle ongoing expenses.

"It's a revenue function, although it's not the primary function" of the UPO, Beck said.

But Maine acts only as an administrator of the assets and still remains liable for all of them. Some of the state's unclaimed assets have been sitting on the books since 1980.

"The liability is there forever," he said. "If you have something unclaimed from 50 years ago, it's still payable."

Fortunes to be found

Nationwide, it's estimated that states are holding between $60 billion and $80 billion in orphaned funds. Some states have more than others, and it's not just because of population size.

For example, Delaware, a state with under 1 million residents but where many companies are incorporated, takes in more than $400 million a year in unclaimed property revenue. It's the third-largest source of income for the state, and represents about 10% of its revenue stream, according to 2019 data.

In February, financial website SmartAsset estimated the value of unclaimed property in each state on a per capita basis. Although the calculations were rough, and it's difficult to make an apples-to-apples comparison, SmartAsset ranked Maine No. 10 in the U.S., with unclaimed property worth $151 per resident.

Using more current data, that ranking might move up to No. 5.

As governments grapple with the economic costs of the pandemic, some experts wonder if states will look to use more of their unclaimed property to cover expenses.

In November, the National Law Review wrote: "With the anticipated deficits caused by the pandemic, including decreased state income taxes and increased spending, it is anticipated that states will step up their enforcement of the escheatment laws."

In the wake of the 2008-2009 recession, the journal noted, states aggressively exercised their escheatment rights — increasing the amount of their holdings from $32.8 billion in 2010 to over $43 billion in 2013.

In Maine, Beck said he and the Unclaimed Property Office are becoming "a bit more aggressive" in enforcing the requirement for businesses to turn over unclaimed property to the state.

Still, the office is trying to accommodate the holders where it can.

"We make a lot of effort to educate holders about their obligation to comply, and we're willing to engage with them," Beck said. "But we're not the IRS or the FBI."

What was found at a Bates College lost-and-found

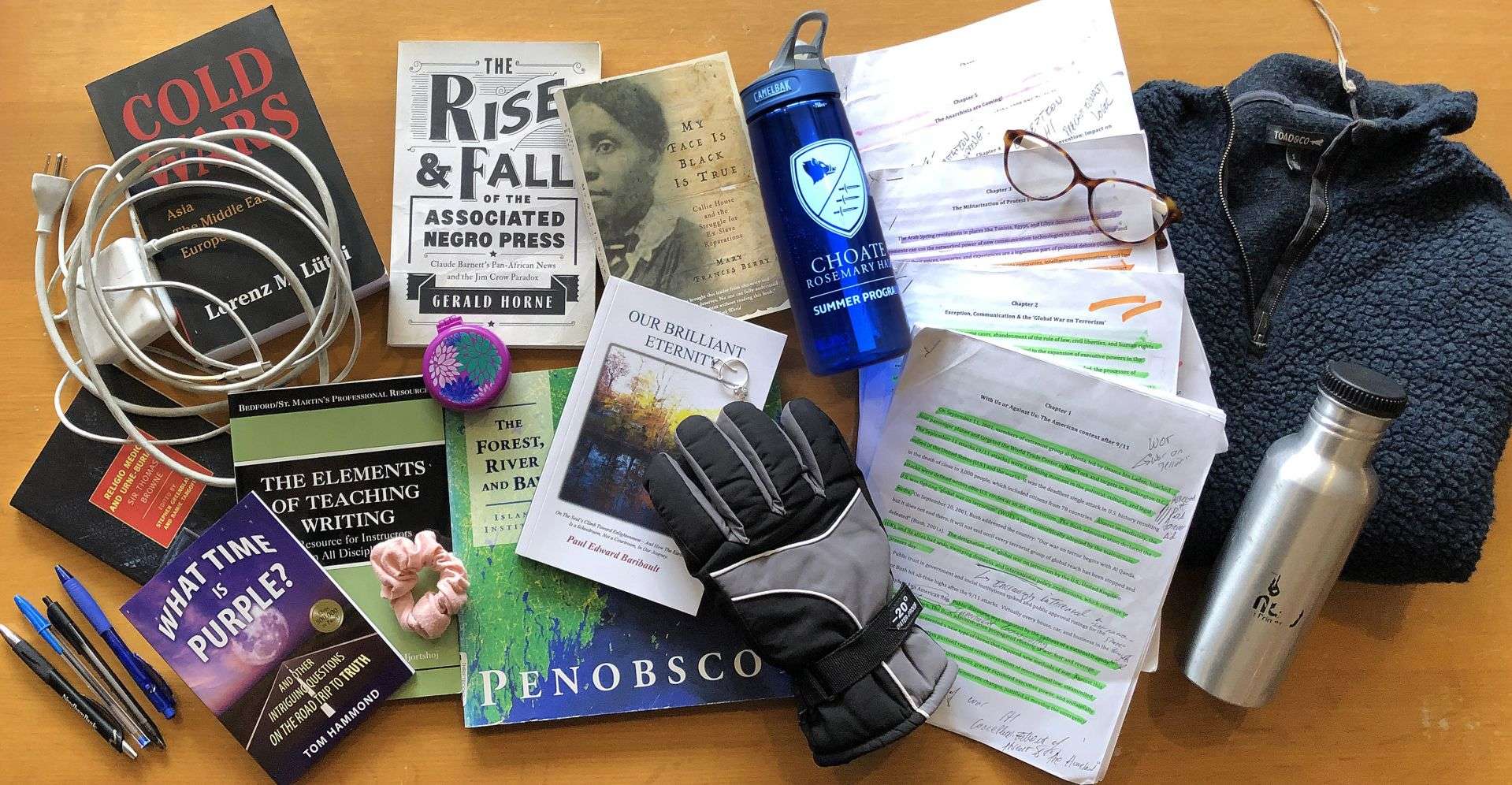

Lost-and-found departments provide an inside look at the life of the institutions they serve. The first municipal lost-and-found was established for Paris in 1805. At Bates College in Lewiston, staffer Jay Burns documented these 18 items inside the Ladd Library Lost-and-Found on Dec. 17.

- Quarter-zip hoodie by Toad&Co.

- Book: "Cold Wars: Asia, the Middle East, Europe" by Lorenz M Lüthi

- 4 pens, including a classic Bic Crystal and a pen from Needham (Mass.) Bank

- Book: "The Rise and Fall of the Associated Negro Press" by Gerald Horne

- Scrunchie

- Book: "My Face Is Black Is True: Callie House and the Struggle for Ex-Slave Reparations" by Mary Frances Berry

- Several water bottles, including a Camelbak Eddy style imprinted with “Choate Rosemary Hall Summer Programs"

- Several chapters of a senior thesis, heavily highlighted, focusing on the history of the global war on terror

- Book: "What Time Is Purple" by Tom Hammond

- Pop-up hair brush

- Book: "The Elements of Teaching Writing" by Katherine Gottschalk and Keith Hjortshoj

- One winter glove, no brand name visible

- Book: "Penobscot: The Forest, River, and Bay" by the Island Institute of Maine

- Eyeglasses by Longchamp

- One earring

- Apple device charger

- Book: "Religio Medici and Urne-Buriall" by Sir Thomas Browne

- Book: "Our Brilliant Eternity" by Paul Baribault

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments