Obama's tax plan's affect on Maine businesses

In our Nov. 17 edition, Mainebiz presented a tax impact story based on President-elect Barack Obama’s proposed tax plan. This is a follow-up, focusing on corporate income tax filings.

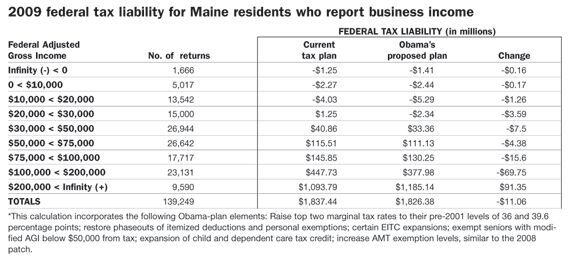

According to a preliminary analysis by Maine Revenue Services for Mainebiz, Maine small business owners who report more than $200,000 in income would see their taxes rise, while those with less income would get a break under Obama’s tax plan, as outlined during his campaign.

For businesses and sole proprietors filing under Schedule C, Partnerships and S-Corporations in the highest tax bracket would see their tax liability rise from $1.09 billion to $1.18 billion, an increase of $91.3 million.

But those reporting income between $100,000 and $200,000 would see a significant cut, from $447 million to $378 million, for a reduction of $70 million.

While 140,000 state tax returns include some business income or royalty payments, the bulk of the reported income comes from Partnerships and S-Corporations. Some 23,000 small businesses report in the $100,000-$200,000 range, while 9,600 report more than $200,000.

Overall, businesses would see a very modest reduction in their tax liability, from $1.87 billion to $1.86 billion, an $11 million cut.

The Maine Revenue Service analysis includes promised changes in the alternative minimum tax, restored itemized deductions and personal exemptions, and expansion of child and dependent care credit. It excludes proposed credits for payroll taxes, retirement savings, and college tuition.

Douglas Rooks

Comments