Another $25M added to Maine unemployment trust fund

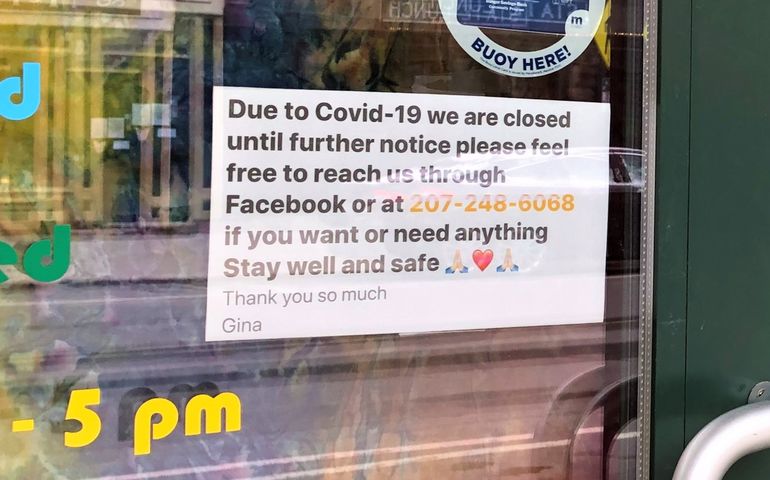

Photo / Maureen Milliken

The state has added an additional $25 million into the unemployment trust fund to avoid increases in payments into the fund by businesses in 2021, as well as to provide benefits to workers unemployed because of the COVID-19 pandemic.

Photo / Maureen Milliken

The state has added an additional $25 million into the unemployment trust fund to avoid increases in payments into the fund by businesses in 2021, as well as to provide benefits to workers unemployed because of the COVID-19 pandemic.

More Information

Another $25 million has been added to the state's unemployment insurance trust fund, a move expected to "significantly reduce" the anticipated employer tax increase next year and ensure benefits to the unemployed.

The money is in addition to $270 million the Mills administration added to the fund in June, after the load of unemployment claims caused by business shutdowns during the COVID-19 pandemic far exceeded the amount of money available. The two allocations come from the $1.25 billion the state received from the federal CARES Act in March.

The Maine Department of Labor estimates that employer unemployment taxes in 2021 likely would have more than doubled without the infusion, a news release from Gov. Janet Mills' office said.

"This action by Gov. Mills will maintain the solvency of our crucial unemployment insurance program without overburdening employers,” said Laura Fortman, commissioner of the Maine Department of Labor. “The challenges of COVID-19 have made it more obvious than ever before that we must ensure benefits are available for workers in times of need.”

Some 45,000 employers in Maine pay into the trust fund, which is funded through employer taxes. The amount of tax employers pay is determined by a rate that's based in large part on what the trust fund balance is on Sept. 30 and its ratio to previous years.

The $300 million dollars added to the fund is about 25% of the federal money awarded to the state under the CARES Act. The infusion of $25 million into the fund brings the trust fund’s balance closer to parity with previous years, Mills said, thereby minimizing the impact on employer’s unemployment insurance taxes.

“Maine businesses and workers are already confronting unprecedented economic hardships caused by the pandemic,” Mills said in the news release. “While Congress has not provided enough direct aid to states to prevent an increase in unemployment taxes next year, we will put every available resource we can towards protecting Maine people from feeling its effects.”

The Maine Department of Labor paid more than $1.57 billion in benefits between March 15 and Sept. 26, including more than $433 million in state money, with the rest coming from federal programs. The labor department has also paid out more than $78 million through the FEMA Lost Wage Assistance program.

The official tax rate will be calculated by late October, and each individual employer’s tax rate will be calculated in December. As of Sept, 28, 19 other states have had to borrow $33.4 billion from the federal government to pay benefits since the start of the pandemic.

In addition to the nearly $300 million in federal relief money, Mills earlier this year signed into law emergency legislation that waived fault and froze rate increases for any employer forced to lay off or furlough an employee as a result of COVID-19, while also expanding eligibility for unemployment insurance to individuals whose employment has been impacted by COVID-19.

0 Comments