Banking on women: Maine banks get more strategic about gender balance on their boards

Photo / Tim Greenway

Jeanne Hulit is president and CEO of Maine Community Bank. She is one of four women on the bank’s 13-member board.

Photo / Tim Greenway

Jeanne Hulit is president and CEO of Maine Community Bank. She is one of four women on the bank’s 13-member board.

Norway Savings Bank’s first female president and CEO recently became its first female board chair, with plans to serve on the board well past retirement.

Patricia Weigel, who has been at the helm of the western Maine-based mutual bank since 2011, recently stepped down as president but will stay on as CEO until she retires in December 2021. While she grooms newly promoted President Dan Walsh for the CEO job, Weigel says she will stay on the board as long as she can, cognizant of being a role model for younger women.

“I take the responsibility seriously,” says Weigel, whose 40-year banking career began as an entry-level teller. “Younger women are watching, and I want to make sure that I’m continuing to pave the way for other women who follow.”

That includes bringing greater diversity to the board, which is currently made up of two women and nine men. “We don’t have a target in mind necessarily,” Weigel says, “but we do have some retirements coming up in a few years, so of course we’re starting to proactively think about what that will look like and potentially bringing in more females is definitely on the radar.”

Norway Savings isn’t the only Maine bank taking a more strategic approach to board diversity — gender and otherwise — not just to better reflect their local customer base and employees, but because it also makes good business sense. There’s even mathematical proof that banks with a “critical level” of diversity on their boards perform better, as shown in a 2019 Federal Reserve staff report.

Maine’s two female bank CEOs

Among Maine-based banks, Weigel is the only female CEO among the top 10 by market share and one of only two women at the helm of the top 25 in terms of assets.

The other is Jeanne Hulit of Maine Community Bank, who feels just as strongly about blazing a trail for younger peers.

“I don’t feel it’s a burden. I feel like it’s an honor,” says Hulit, who led this year’s merger of Biddeford Savings and Mechanics Savings banks into divisions of Maine Community Bank, with a merged board. “It’s an opportunity to dispel a lot of preconceived notions that people may have about women in leadership.”

In banking for more than 25 years, Hulit says she had no female mentors when she started, and that the women in senior roles at that time were mainly those who didn’t have children and devoted themselves entirely to their careers.

“My peers and I coming up together as working women and working moms mentored each other,” she recalls. “Now we are sharing our experience with the next generation.” Noting that Maine Community Bank’s last two board openings were filled by women before her arrival, Hulit plans to leave future vacancies unfilled for now to keep the board size manageable.

Longer term when there are spots to fill, she says it will be important to have a diverse board that’s more reflective of the bank’s customers and the industry’s changing workforce, now around 75% to 85% female though men still dominate in leadership roles.

“The first thing you want is the right skill set,” she says, “but if you have an equal pool of candidates, it’s helpful to have gender diversity.”

Hulit’s advice to young women in banking with leadership ambitions: Seek out board opportunities at nonprofit organizations focused on economic growth as she has done at groups including the Maine International Trade Center and the University of Southern Maine Board of Visitors, both of whose boards she chaired.

“That is a way to learn about your community and your state,” Hulit says. “Bring your finance expertise to the table – they’re always looking for bankers. You’ll be adding a valuable service to them and developing your skills as leaders.”

Based on data for the industry as a whole, those that break through the glass ceiling to lead banks or their boards of directors will find it’s lonely at the top.

Lonely at the top

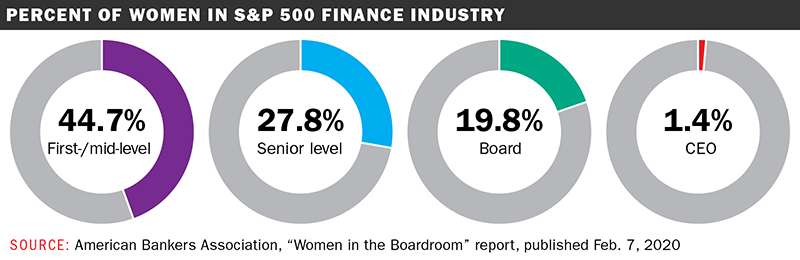

A report by the American Bankers Association published in February shows that although women represent more than half the population and degree-holding employees, and control the majority of household buying power, they are consistently under-represented on corporate boards and in senior executive roles.

In the financial industry, it found that women are still struggling to reach parity with men at the highest levels of leadership. At S&P 500 financial firms, women make up less than 20% of board members and only 1.4% of CEOs. The same report found that most female CEOs lead banks with less than $1 billion in assets.

Other research, by McKinsey & Co. and LeanIn.org in their “Women in the Workplace 2020” report, shows the female talent pool in banking shrinking from 53% at the entry level to 26% for the C-suite. The drop-off is more dramatic in asset management and institutional investing, from 43% at the entry level to 19% for the C-suite.

More generally on corporate America, the authors conclude that while the representation of women had been trending in the right direction at the start of 2020, pandemic-related disruptions could erase gains made in the past five years amid signs of women leaving the workforce at higher rates than men.

Statewide situation

Though there are no Maine-specific statistics on female representation on bank boards and leadership roles, Maine Bankers Association President and CEO Chris Pinkham says senior management began changing dramatically in the 1990s with the expansion of bank powers and the realization that management needed bench strength at the top.

“The natural choice was to promote from within, and that led to significant growth in women leading departments and having a large C-suite presence at many Maine banks today,” he says. But he notes that boards are different given historically long terms for members, leaving few yearly openings and low turnover.

“With the retirement of Boomers as employees,” Pinkham says, “we are also seeing retirement of board members, and the trend has been to fill recent vacancies with a more diverse population including women.” He says it’s up to each bank’s board to select community leaders and experts in areas such as law and accounting, and that the trend in recent years is toward a younger and more diverse group. Partly for that reason, he sees no need for mandatory gender quotas on bank boards.

Joann Bisson, president and CEO of Augusta-based Trademark Federal Credit Union and board chair of the Maine Credit Union League, says the same of credit unions, where women make up more than a third of board directors at 54 institutions.

At her own, five out of nine board members are women though she says that wasn’t by design, adding: “It was really about the skill sets, and we’re fortunate to have strong female leaders interested in serving on the board.”

Boardroom diversity plus inclusion

Of the three largest Maine-based banks, women make up an average of 31% of the boards, 10 of the 32 total board seats. Maine's largest bank, Bangor Savings, has three women on its 10-member board; Camden National has four women on its 10-member board; and Bar Harbor Bank & Trust has three women on its 12-member board.

At Gorham Savings Bank, Katherine Coster is one of three women on the nine-person board of directors she has chaired since 2018. She credits the bank with prizing gender diversity on the board early on, and says that having women in the mix benefits the quality of communication and questioning.

“Any time you have different points of view,” she says, “it moves the thinking away from groupthink to, ‘That’s an interesting idea. How can we see things differently?’” She also notes that it’s not enough to have women around the table, but to include them in the conversation, saying, “Diversity doesn’t get you anywhere without inclusion.”

At Machias Savings Bank, LuAnn Ballesteros has a similar observation as the only woman on an eight-member board where she does not at all feel like a token.

“It’s one thing to have a seat at the table,” she says. “It’s another having your opinion and your words accepted. That’s the Holy Grail.”

Bangor Savings Bank Board Vice Chair Gena Canning feels equally supported, both by the woman she replaced and the two other current female board members: “I feel it’s really important for women to support one another,” she says. “We’ve got a lot of ground to catch up on in terms of getting women in leadership here in Maine and across the country.”

0 Comments