Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

IDEXX beats expectations on Q1 results, sending shares higher on Nasdaq

IDEXX Laboratories, Inc. (NASDAQ: IDXX), the Westbrook-based maker of veterinary diagnostic products, posted better-than-expected first-quarter results on Wednesday, sending shares more than 2% higher on the Nasdaq exchange.

First-quarter earnings were $1.17 per diluted share, exceeding the Seeking Alpha analysts' consensus forecast by 11 cents. Earnings per share represent 16% growth on a reported basis and 27% on a comparable constant currency basis.

The company said the results reflected continued strong revenue gains and a stronger-than-expected gain in operating margins, amid strong revenue growth in its Companion Animal Group Diagnostics division s well as delayed timing of project spending.

IDEXX shares were up 2.36% in morning trading at $237.48, outperforming the 0.40% uptick in the Nasdaq composite index and giving the stock an equity value of $19.9 billion.

While maintaining its full-year revenue outlook, IDEXX raised its earnings guidance range by 10 cents a share to a range of $4.76 to $4.88, reflected increased expectations for operating margin improvement and upside from lower projected interest expense and updated effective tax rate projections.

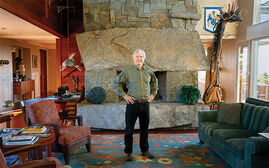

“Our strong business performance continued in the first quarter, sustaining high organic growth in CAG [companion animal group] Diagnostics' recurring revenues,” said Jonathan Ayers, IDEXX’s chairman and CEO in a statement.

He added: “With great runway ahead and robust start to the year, we are well-positioned to execute our unique innovation-based and multi-modality strategy, enabled by our expanded global commercial capability, as we continue to deliver outstanding financial results aligned with our long-term goals.”

About IDEXX

IDEXX Laboratories, Inc. is a member of the Standard & Poor's 500 Index and is a leader in pet healthcare innovation, serving practicing veterinarians around the world with a broad range of diagnostic and IT-based products and services. Headquartered in Westbrook, it employs more than 8,000 poeple and offers products to customers in more than 175 countries.

Mainebiz web partners

Related Content

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments