Maine's two largest airports on pace to have record years — but eager to grow more

Day's Travel Bureau in Augusta is situated about halfway between Maine's two largest airports, Portland International Jetport and Bangor International Airport. Jeff Day's grandfather founded the agency long before air travel became the norm and sold tickets for the RMS Queen Mary ocean liner from Boston to Britain.

Day says he books the greatest percentage of air travel out of Portland because of more flights, better times and sometimes “considerably better” pricing, but also gets a lot of Bangor-based business clients using their hometown airport. For those booking off-season trips out of Bangor three or four months in advance, he says there are plenty of bargains.

“Sometimes you can find really good flights,” he says.

Both airports are on course to surpass record 2017 passenger numbers amid a global travel surge that's prompting a wave of investment. The International Air Transport Association projects a near doubling of worldwide passengers from 2017 to 2036 amid a pickup in the global economy and lower airfares.

“It's a great time to fly overall,” says Adam Twidell, CEO of PrivateFly, a global booking platform for on-demand private charter flights owned by Cleveland-based Directional Aviation. “We're seeing huge investments into development and research, and a consistent growth in the numbers of passengers flying.”

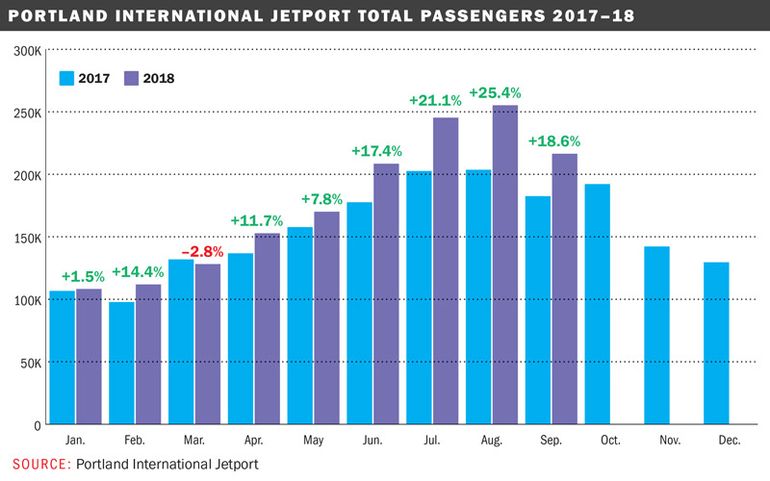

Out of Maine's 75 public-use airports and seaplane bases, the Jetport and Bangor International are the largest. The Jetport saw a 4.2% rise in passengers last year, to 1.8 million, while Bangor International surpassed half a million for the first time for a double-digit jump to 546,264 passengers.

The two facilities compete with each other and with regional peers in Boston, Manchester (N.H.), Rhode Island, Burlington (Vt.) and Hartford (Conn.), with an economic impact that goes well beyond their immediate surroundings — over $1 billion alone from the Jetport, which airport Director Paul Bradbury likens to a small city run as a business. Each airport is owned and operated by its respective city.

Bradbury started at the Jetport 26 years ago as engineering and facilities manager and became airport director in 2008, while his Bangor counterpart, Tony Caruso, was appointed in 2012 after more than a decade as assistant director. Caruso is also an FAA-licensed private pilot.

Jetport's 'connectivity'

Bradbury says the Jetport is a reflection of the region's vitality, and that there's a reason that companies like IDEXX, Unum, Texas Instruments and WEX are all a stone's throw away.

“What do we provide? It's connectivity to the world and having every major Eastern Seaboard hub connected from a small metropolitan statistical area,” he says one morning in his second-floor office, stacked with oversized charts and maps and jars of the clear recycled de-icing fluid the Jetport has pioneered and produces at its Inland Technologies plant.

The Washington, D.C., and New York metro areas are the Jetport's biggest markets, served by American (to LaGuardia and Reagan National), Delta (to JFK and LaGuardia), JetBlue (to JFK) and Southwest (to Baltimore-Washington).

“It's not just one flight a day to one airport in New York,” Bradbury emphasizes. “It's every airport multiple times a day.”

While most carriers have been adding capacity at the Jetport, JetBlue has been cutting back, so Bradbury wasn't surprised with its switch to a seasonal service starting in January as part of a network-wide adjustment. Jetport data show that JetBlue's share of passengers departing Portland will go down only slightly next year, while American will lead the pack with 29.34% of scheduled seats.

Bradbury says that having no single carrier above 30% ensures stability and a nice, even pie, though he says there may be opportunities for the existing carriers to add destinations, like perhaps American adding destinations in its home state of Texas. He's also been surprised to see price competition among carriers, like between American and United to Chicago, and was pleased with JetBlue's decision to stay in Portland.

JetBlue spokesman Philip Stewart says the carrier remains committed to Portland, where it does not plan to eliminate positions.

“Portland is a customer favorite destination and sees a strong surge in travel during the warmer months of the year,” Stewart says.

JetBlue will add service in the busy travel season. Summer service will start next spring, though the airline has not yet announced a start date or number of daily flights.

Offering a mix of carriers

Speaking more generally, Bradbury says the Jetport offers an “optimal” service mix of Southwest, the largest domestic carrier; all three global alliances; and newcomer Frontier, the Denver-based low-cost carrier.

“There are Midwestern metropolitan statistical areas of our size that would be ecstatic to have the level of air service we have,” Bradbury says.

Frontier Airlines, which came to Portland in July, now flies to Denver, Raleigh-Durham, N.C., and Orlando, Fla., and will start other Florida flights, to Tampa and Fort Myers, in mid-November.

“For a pretty large Northeastern catchment market to not have mainline service to Florida was interesting,” says Daniel Schurz, Frontier senior vice president, commercial. “What we saw in the market was an opportunity to serve Florida.”

Florida is also important to Elite Airways, a Portland-based carrier offering chartered and scheduled services throughout the U.S., Canada, Mexico, the Caribbean and South America. It offers scheduled service from the Jetport to Florida's Orlando Melbourne International, Sarasota-Bradenton and Vero Beach airports.

Elite started scheduled service to Florida around four years ago and company president John Pearsall is also open to flying out of Bangor. “Once we can figure out where to go out of there, we'll do it,” he says.

American, Delta and United all fly out of both Portland and Bangor.

American, which flies out of both Maine airports, added connections between the Jetport and LaGuardia in April, and between Bangor and O'Hare in June.

“We think it's important to serve small and large cities,” says spokeswoman Nichelle Tait.

Drumming up more business in Bangor

Like Bradbury, Bangor International's Caruso is on a mission to drum up more business.

“We've been working really hard with our current airlines on adding capacity and frequency to the market, and to our market's credit, the folks here have responded well,” he said by phone before heading to an international cargo trade show in Toronto to court potential new partners in that segment.

He would also like to get more commercial and general-aviation business, but notes that it can be a long process to lure carriers, like the three years between his first pitch to low-cost airline Allegiant in early 2004 and its arrival in 2007.

“Some carriers we've been talking to longer than that unfortunately haven't come into the market,” he says.

Allegiant flies from Bangor to two smaller Florida airports, Orlando Sanford International and St. Pete-Clearwater International, and spokeswoman Hilarie Grey says both routes are doing well. Because of demand, it's adding frequencies for spring, and is on pace for a 10% jump in outbound passengers from 2017-18, she adds.

“Allegiant's business model is built around offering access to leisure destinations for people who might not otherwise be able to fly,” she says. “The Bangor routes are really prototypical examples of that philosophy at work.”

Bangor taxiway revamp, Jetport customs plan

To accommodate more passengers flying in and out of Maine, Bangor International embarked on a federally funded $6.4 million taxiway revamp this summer, while the Jetport is finishing a $1.45 million project to install 30,000 feet of photovoltaic solar panels on its garage roof to help trim electricity costs, about six years after a $75 million terminal expansion.

On a more ambitious note, Bradbury would like to add customs facilities at the Jetport, which would open up possibilities to fly internationally again — in the past there were flights to Toronto — to places like Reykjavik, Iceland, or the Caribbean, including on low-cost carriers.

Bradbury estimates an outlay of around $7.5 million to $10 million for the undertaking, ideally if the FAA approves an increase in the so-called Passenger Facility Charge from $4.50 to $8.00 though that's not yet happened. If the money were available today, Bradbury says everything could be ready in six months since there is already space on the first floor.

“It won't be a panacea on the business front,” he says, “but non-stop international is another opportunity for us.”

Comments