MEREDA: Despite early pandemic drop, Maine's real estate activity grew in 2020

Screenshot / MEREDA

From left, Charles Colgan, Drew Sigfridson, Shannon Richards, Craig Young, Cheri Bonawitz and Joe Dasco provided real estate insights during Thursday morning's MEREDA spring conference.

Screenshot / MEREDA

From left, Charles Colgan, Drew Sigfridson, Shannon Richards, Craig Young, Cheri Bonawitz and Joe Dasco provided real estate insights during Thursday morning's MEREDA spring conference.

Sharp growth in residential sales and relative stability in the construction field during 2020 helped Maine's real estate industry weather a difficult year, experts said at a Maine Real Estate & Development Association conference on Thursday.

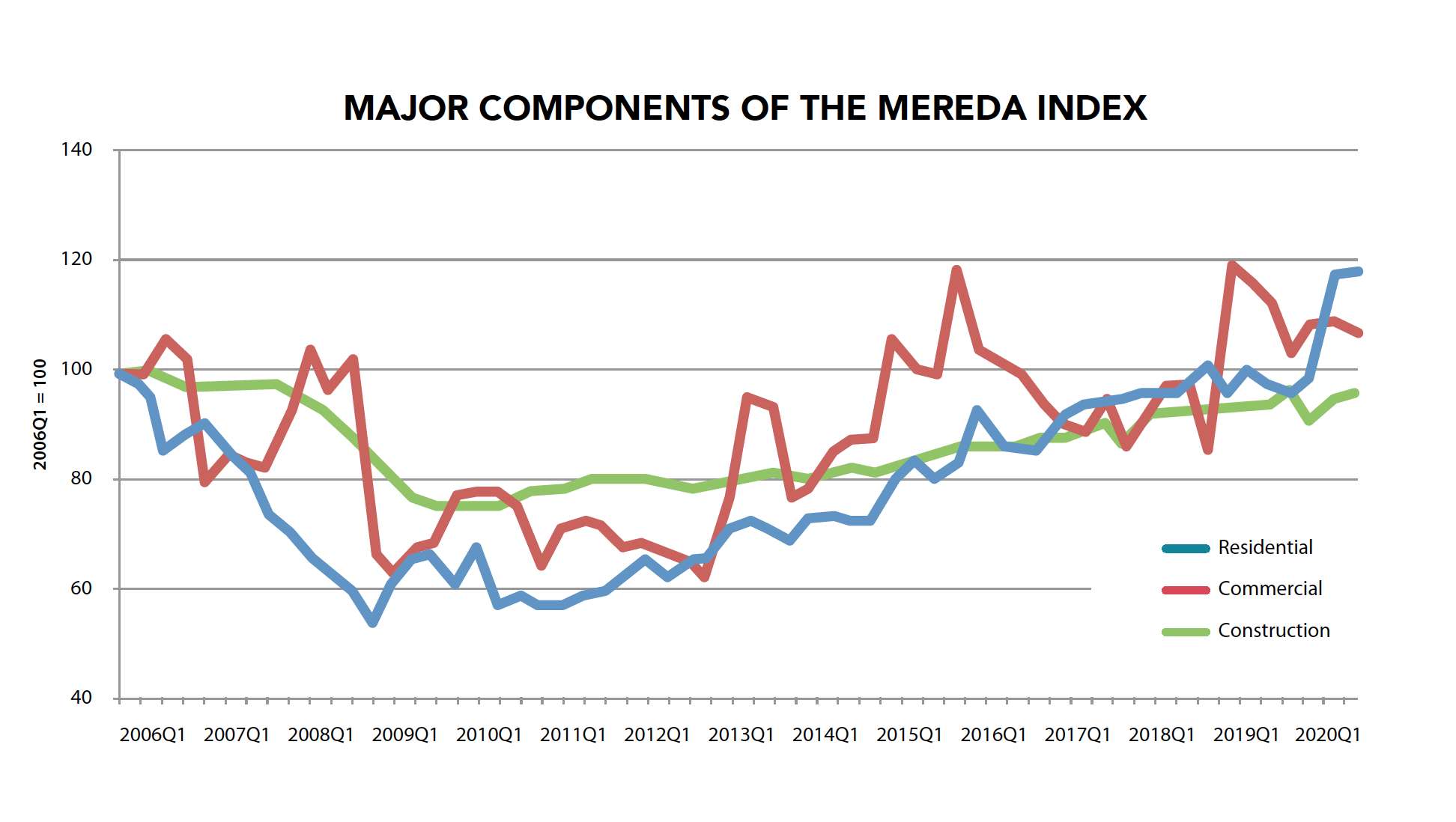

Those factors all contributed to the rise in the “MEREDA Index,” a measure of real estate activity designed to track changes in Maine’s real estate markets.

The index is a composite of seasonally adjusted measures reflecting new development and transactions involving existing properties and it covers both the commercial and residential markets statewide.

MEREDA unveiled the 2021 index Thursday morning at its spring conference.

The index is based on an analysis by economist Charles Colgan, professor emeritus of public policy and planning at the University of Southern Maine’s Muskie School of Public Service.

“The MEREDA Index is the leading way our industry tracks changes in Maine’s real estate markets — commercial and residential, as well as construction employment,” Josh Fifield, president of MEREDA and a vice president at Clark Insurance, said in a news release.

“It’s an extremely valuable report because MEREDA includes the ‘feet on the street’ perspective of our contributors as well as the economic analysis from Dr. Charles Colgan.”

The 2.8% rise in the latest Index appears relatively modest, barely ahead of the 2.2% by which the Index rose in 2019 compared with 2018. But the performance of the real estate sector in 2020 was quite remarkable compared with what was happening in the rest of the Maine economy due to the pandemic.

Average rise

Despite a drop in the index of 4% during the first half of the year, as the economy began a sharp decline, the index shot upward in the second half of the year by 8.6%, and Q4 was up 5.1% over the same quarter in 2019.

That resulted in average growth for the year by 2.8% over the annual average of 2019.

The 2020 index was 113.31, up from 105.911 in 2019.

“The real estate sector did pretty well in a period in which for the most part the economy as a whole was contracting severely,” said Colgan, who presented discussions regarding the index’s three components — residential, commercial and construction. “The rest of our story will be why that’s the case.”

Residential

Residential real estate activity in 2020 “was the hottest year in recent history,” said Colgan.

The residential index comprises four components: residential permits, mortgage originations for new purchases (excluding second mortgages), median price of homes, and sales of existing units.

The residential index, said Colgan, tracked up rapidly in Q3 and Q4 and on average was at its highest level ever, reaching almost 20% above pre-recession level and above the last few years of activity.

Colgan referred to residential as “the headline story about real estate in 2020,” due to record sales.

“It was a very dramatic story in the midst of what was the for the economy a very dramatic year,” he said. “But it was one of the few bright spots in the whole year.”

The index for the number of units sold in 2020 was up 9.5% in 2020 over 2019. The median sales price rose 13%, while permits for new construction grew by 16%.

The only part of the residential index that fell in 2020 was mortgage originations — by 13.6%.

The divergence between units sold and mortgage originations is unusual and may be related to anecdotal evidence of a large number of out-of-state buyers entering the Maine housing market in response to the pandemic and these buyers might have financed their purchases with equity taken out of their other homes, said Colgan.

“It was a very interesting phenomenon to see the existing units grow so fast while mortgage originations dropped,” he said. “Those things tend to move together.”

Low inventory and strong demand generated bidding wars and multiple offers above asking price for single-family houses. But that wasn’t the case with condominiums which largely serve empty-nesters looking to downsize and live in a walkable and safe community, as well as young professionals realizing that with low interest rates, they can own a highly appointed condominium with amenities for the same monthly payment as they shell out for rent.

Due to the pandemic, the residential sector is also starting to see increased demand from young professionals who are working remotely and looking to escape the high-cost larger cities, such as San Francisco, New York and Boston, and choosing Maine as their new home base.

The sector has experienced a continuation of the same challenges it’s faced for the past several years: higher construction costs, higher material costs and a shortage of skilled labor.

Joe Dasco of Reger Dasco Properties said his company’s large Hobson’s Landing project — a 196,000-square-foot development of residential and retail space being built in the Old Port neighborhood of Portland — indicated strong interest in new residential units.

Construction is wrapping up and residents are moving in, he said.

“So it was a happy ending to what we thought would be a very difficult year,” Dasco said.

Up to early March 2020, pre-sales at Hobson’s Landing were steady. From March to early June, though, interest dropped off.

“Then slowly people started to feel comfortable getting out and showings started happening,” he said.

Sales were strong by the end of 2020, he said.

Dasco said about 30% of buyers are from out-of-state. Some have ties to Maine, others are looking to call Maine their new home. The rest of the of buyers are local, either moving from the suburbs to get into the urban lifestyle, with a strong uptick in professionals who are using technology to work anywhere they want.

Commercial

Commercial real estate didn’t enjoy the same good fortune, marking a change from several years of stability or modest growth.

“Can a world in which no one goes to the office and no one goes to stores still be a place in which commercial real estate is sold?” asked Colgan. “The answer is, Yes, it can.”

The commercial index is comprised of several components — number of transactions, square footage of lease and sale transactions, and sale price and lease rates per square foot.

The sector’s results were not nearly the spectacular growth of the residential sector.

“But it was actually pretty steady in 2020 over 2019,” Colgan said.

Commercial activity is typically more volatile than residential, especially in a smaller economy like Maine’s, where activity in one large building can skew the index, said Colgan.

“The commercial sector, in the COVID world, has done not too badly for a number of reasons,” said Colgan.

Those reasons include construction and transactions that were already in process long before the pandemic hit.

In general the best-performing part of the commercial sector was in sales.

“The sale price per square foot went up even as the lease rate was going down somewhat,” Colgan said. “That’s what you would expect from an economic situation like the pandemic” in which long-term commitments continued to move forward.

Throughout the pandemic, the market was very active in certain sectors and suffered setbacks in others.

The number of sales and leasing transactions was down 3.5% on an annual average basis compared with 2019, and the square footage of transactions declined by 29.3%.

Lease rental rates on a square foot basis fell 2.5% but average sales prices per square foot increased by 5.7%.

The unique circumstances of 2020, with a mass exodus from offices in a shift to remote working along with the shutdowns for extended periods of a variety of retail goods and services establishments, were reflected in the commercial market. Office lease transactions fell from 127 in 2019 to 102 in 2020, a 20% drop.

Retail leasing also fell by 12%.

But industrial transactions in 2020 grew significantly and returned to the same levels as in 2018.

The effect of the ending of the pandemic in 2021 on the office and retail market will be one of the key issues for the commercial sector in the future, said Colgan.

Office space

At the start of the pandemic, most of Maine was working from home. As the year wore on, a number of workers began to return to their offices, while a large faction of people continued to work from home. The impact on leasing of both large and small vacant office space has yet to be determined.

But there were promising signs that there still is a desire to maintain a connection with the normal workplace. That included a number of significant office sales and leases signed in 2020; including the office ease of Berry Dunn for 87,906 square feet at 2211 Congress St.

In the retail market, a number of Old Port retailers closed, but many others managed to hang on.

Retail, restaurant

Retail and restaurant space remain uncertain.

The Maine Mall experienced a number of retail closures which might continue until people are more comfortable shopping in a mall environment. However, several of the larger vacancies were filled in 2020 by furniture retailers whose sales have increased dramatically during the pandemic.

Wedding businesses, concert halls, movies, gyms and larger indoor spaces were hard hit, but other retailers benefited greatly over the past year — typically those that offered any type of home improvements. Many restaurants pivoted to curbside or takeout service to offset some of their losses, while there was a boom for grocery stores, liquor stores and retailers selling home and outdoor recreation items.

Industrial

The industrial market is on fire, with very low vacancy rates that continued throughout 2020.

The legalization of cannabis growers and retail sales continued to affect the lack of industrial availability throughout the state. Also, the continued growth of the life science sector and craft brewing is also filling potential vacancies.

Construction

The construction index, based on construction employment, provides something of a bridge between the past and the future, said Colgan.

“It represents the past because it represents plans and decisions made long before construction employment got started on a building,” he said. “It represents the future because it describes the amount of capacity in a physical space that will be available in the future that people will live in, shop in, and produce goods and services.”

The construction employment index was up just over half a percent in 2020 over 2019. There was a sharp dip in the second quarter as the shutdowns took hold and the rules about safe working were being worked out.

But employment quickly recovered in the second half of the year to pre-pandemic levels.

Construction employment has shown relative stability to slight growth for several years, which the pandemic briefly, but only briefly interrupted.

The residential and industrial construction markets were hot but were going at a premium, with 2020 driving up costs for building materials, lease rates and purchase prices.

The industrial market remained hotter-than-ever, driven by the need for shipping, warehousing and manufacturing space. That need created a trend in new construction.

Overall, construction showed a very slight decline that was statistically insignificant, with solid growth occurring in the second half of 2020.

If it hadn’t been for the pandemic, construction employment for 2020 almost certainly would have recovered to levels before the great recession, he added.

However, because construction is largely the result of decisions made a year or more in the past, the consequences of the pandemic through the coming decade are uncertain, Colgan said.

For example, it’s unclear how much demand there will be for office space, and for what type of offices, moving into the future, he said. Also unclear is to what extent space that was vacated by business bankruptcies will be sufficient to meet demand.

“While 2020 showed a fairly robust set of trends, the future of all the real estate elements are open to large changes,” he said.

2021 forecast

Looking toward the future, Colgan said he expected the 2021 residential market to remain robust, which in turn will send a signal to the construction industry that more supply is needed.

The commercial side, though, represents a much tighter contest between space left vacant by the pandemic on the retail side and the evolving nature of work on the office side.

“I do expect sales, and almost certainly lease prices, will probably rebound, but not a lot,” he said. “I think there are an awful lot of uncertainties in the market on the whole.”

Construction will likely be strong, he continued.

“We might exceed our highest construction total employment ever,” which was 32,000 jobs in the middle-2000s and could be 35,000 jobs in the coming decade, he predicted.

The construction industry, though, is experiencing restrictions from soaring materials costs and workforce shortages. It’s unclear how those will pan out.

“I’m generally optimistic, but I have some really nagging questions,” he said.

0 Comments