Financial services firms roll out digital video ads in Maine and beyond

Photo / Tim Greenway

Leeann Leahy, left, CEO of VIA Agency, and Najla Frayha, senior vice president and chief marketing officer at Unum, at VIA’s Portland offices.

Photo / Tim Greenway

Leeann Leahy, left, CEO of VIA Agency, and Najla Frayha, senior vice president and chief marketing officer at Unum, at VIA’s Portland offices.

More Information

Nalja Frayha, Unum’s Portland-based senior vice president and chief marketing officer, readily admits the employee benefits provider operates in a “boring” industry.

That perhaps was all the more reason to get creative in a new national advertising campaign with the VIA Agency, the Portland group behind L.L.Bean’s “Be An Outsider” campaign.

“We’ve got U,” launched for Unum in February, seeks to reassure employers that their employees need not worry about benefits no matter what they’re doing—whether savoring outdoor activities, cycling through city traffic, having a baby or flipping a skillet in a restaurant kitchen. Unum is named only at the very end of the 51-second spot, along with “We’ve got U.” There are also 15-second vignettes in the series, which is exclusively online.

“You use TV when you are trying to reach millions of eyeballs, but in this case we are targeting 400,000 decision makers several times a day,” Frayha explains. “When they’re at work, on their laptop researching new benefits options, on mobile between meetings, checking social channels, after work on their tablet catching up on news and entertainment, we will be there. It’s about exposure, it’s not about broad reach.”

Unum joins a growing list of financial firms—from credit unions to full-service banks—doing online video marketing. While some collaborate with outside agencies like Unum with VIA and Norway Savings Bank with Ethos, of Westbrook, others are staffing up in-house.

Digital’s growing appeal

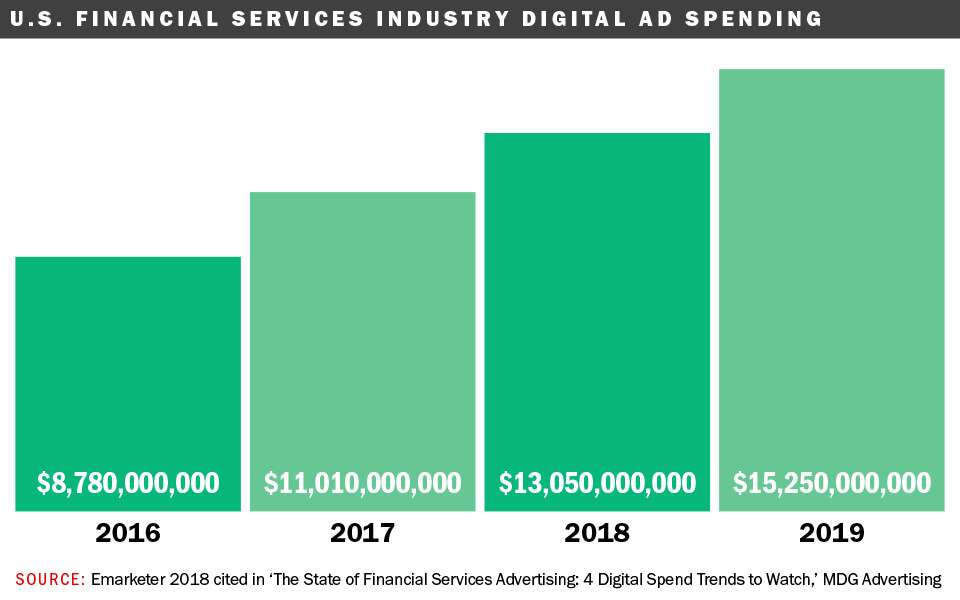

While ad spending on TV still eclipses online video, digital is gathering pace as advertisers seek to capitalize on how technology is changing the way people get their news and entertainment, shop, bank and do business.

One study, by video company Wyzowl, found that the average consumer watches more than 90 minutes of online video content per day, with 15% averaging over three hours; video marketing is rising rapidly among brands and marketers; and YouTube is the most-used video marketing channel.

Another report, by Deloitte, forecasts that while TV ad spending will stay flat between 2018 and 2022, digital video ad spending will nearly double over the same period to $50.6 billion — potentially overtaking TV if the trend holds.

The authors note that while consumer giants like Procter & Gamble built their brands in the mid-1990s with families arguing over the TV remote, today they’re developing customer profiles and online advertising content targeting specific consumer groups.

Facebook and Google, with their global platforms and sophisticated targeting and measurement capabilities, are believed to account more than half the world’s digital ad revenue, up from 25% in 2014.

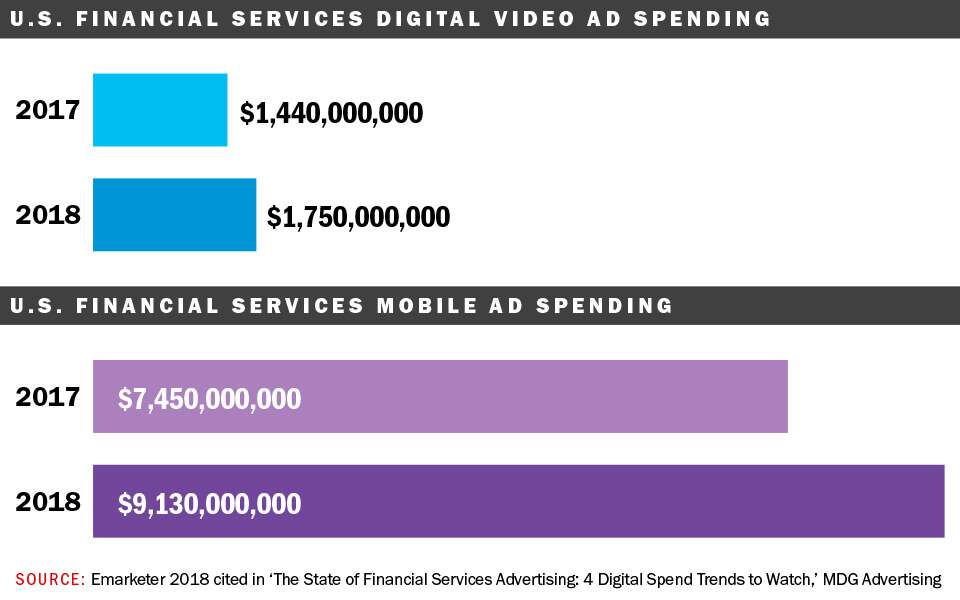

Though it’s not unusual for larger banks and insurers to spend heavily on prime-time TV ad blasts — think Geico lizard and Farmers Insurance squirrel mishaps — that’s less common for smaller players with less to spend and more to gain from digital’s targeted reach. Among financial service providers who opt for digital, there’s a growing preference for mobile ads, in part to reach younger consumers.

“If you’re an established bank looking to appeal to an older demographic, you’ll do more TV. But those that are trying to appeal to a younger audience are more likely to be online,” says Nancy Roberts, marketing program coordinator at Husson University in Bangor. “My students, who are getting their first bank accounts, don’t have a television, they’re streaming everything. More digital is happening in part because many banks are trying to get that new account.”

Meredith Strang Burgess, president and CEO of Burgess Advertising & Marketing in Falmouth, has a similar observation, saying: “You can be so specific with digital and literally target your buy to reach 20-to-34 olds that live within a specific zip code. It’s a lot less expensive than TV, and you can track it in real time and tweak as you go along. What people don’t appreciate is that it takes time to monitor a campaign.”

Social media is an important part of that, a no-cost multiplier to spread the word. Unum’s “We’ve got U” saw more than 200,000 social media shares in the first week alone just through employees, who were also the starting point for the brand revamp conversation going back more than two years.

“From our perspective, there is no better endorsement than an excited employee base getting behind an idea and championing it,” says VIA’s CEO Leeann Leahy, noting that the ads grab attention in the critical opening seconds with an unusually bold, confident statement from a benefits provider.

“It takes a lot of confidence for a brand to say, ‘We don’t want you to worry about us,’” she says, appreciative of the creative license from the client. “That’s fun to get to play in.”

In general, Husson’s Roberts says she’s noticed more financial firms telling stories in unexpected ways and opting for reputational advertising rather than around a specific product.

One example is Norway Savings Bank’s “Live Your Life in Color” campaign that runs on both TV and digital.

Patricia Weigel, Norway Savings’ president and CEO, says the long-running campaign aims to reflect that its customers come from all walks of life — and that Norway Savings is there to help them reach all their goals.

“It is an emotional connection and also reflects our culture of fun, and our pursuit of high achievement, in everything we do,” she says.

Credit unions

Credit unions in Maine have been quick to embrace digital video advertising, including one being set up to lend to farmers and food entrepreneurs.

To introduce the brand as they set out to raise capital for the Maine Harvest Credit Project, founders Sam May and Scott Budde enlisted Black Fly Media of Portland. It produced videos featuring the people the future credit union is meant to serve — an art house-like reel of real people toiling on their farms and in the fields, as well as the Maine Harvest team explaining their intentions.

“We’re trying to show there’s a human element behind the banking,” says Diana Nelson, a principal with Black Fly Media. “A picture is worth a thousand words but video is more effective than a photo and some text.” While the longer ad sits on Maine Harvest’s home page, the shorter spots are ideal for sharing on social media and for pitches to the press. “Most people watch videos for 15 or 20 seconds,” she notes, “so you’ve got to keep it short.” The visual part is even more important on Facebook, where 80% of users watch videos without sound.

Among Maine’s established credit unions big on digital marketing, the 39,000-member Town & Country hasn’t used TV in two years, according to marketing manager Jessica Rice. One new digital piece is a 14-second spot touting online banking services in a few words and still images.

“We don’t really have a set amount of videos we wish to produce, but each year we think about what our needs are and base our video planning around that,” she says, while her PR and communications colleague Jon Paradise adds that “the focus definitely is on doing more.”

Machias Savings

While the 16-branch Machias Savings Bank finds TV to be effective in rural markets, it’s now leaning more heavily on online video messaging.

“We’re producing about one quality video every month, and we definitely want to increase that,” says content creation and strategy manager Cody Chiasson, adding that the team is constantly changing its strategy based on feedback from customers and employees. “That’s the reality of the new world we live in.”

Unusually for a bank of its size, it also employs a trained videographer, Yury Nabokov, a Husson grad who oversees innovation and digital strategy.

The bank’s continuous push into different media includes an interview-based podcast set to launch in April.

Without giving away details, Nabokov says it will bring value not just to customers, but all the people “who make Maine what it is.”

0 Comments