Real Estate Insider notebook: Buying or renting, Maine is still tight home market

New data from TexasRealEstateSource.com shows that Maine has the nation’s second-lowest vacancy rate, behind Massachusetts.

New data from TexasRealEstateSource.com shows that Maine has the nation’s second-lowest vacancy rate, behind Massachusetts.

Lack of inventory is still the story with Maine residential real estate. On the sales side, the number of homes sold has declined, but median sales prices for single family homes have remained high. On the rental side, vacancy rates are among the lowest in the nation, according to one report.

Maine leads states with the lowest vacancy rates

It’s no secret that Maine’s vacancy rate for rentals is very low. Places are hard to come by.

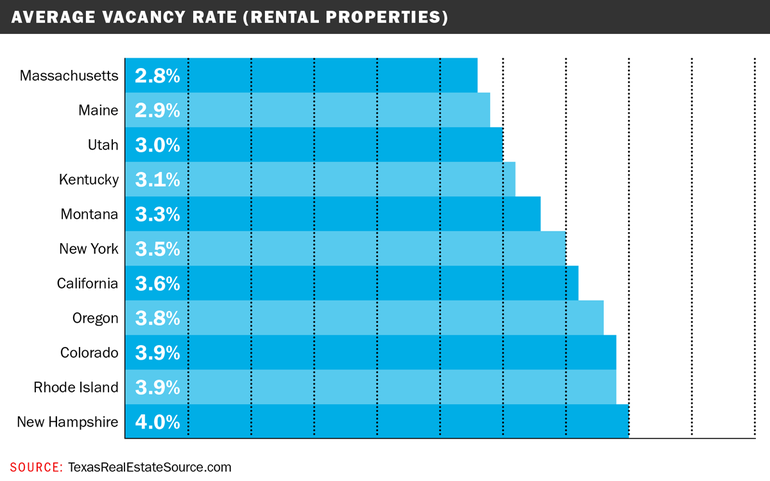

New data from TexasRealEstateSource.com shows that Maine has the nation’s second-lowest vacancy rate, behind Massachusetts.

Maine’s vacancy rate for rental properties is 2.9%. It is sandwiched between No. 1 Massachusetts, at 2.8%, and Utah, at 3.0%.

The report looked at U.S. housing data, honing in on rental properties.

It also looked at the average vacancy rate for homeowner-occupied properties. On that list, Maine and Tennessee tied for first place, with a vacancy rate of 0.2%, followed by Colorado and Virginia, at 0.4%. (New Hampshire was in the top 10, with a homeowner vacancy rate of 0.5%.)

“What can be gathered from this data is the fact that rental properties have a larger percentage of vacancies than homeowner properties, with the percentage of vacant rental properties being more than three times higher in certain states,” TexasRealEstateSource.com said. “It’s also interesting to see that there isn’t necessarily a concentration of states where most properties are lived in, with the top ten featuring states from all over the US.”

On sales side, median sales price barely budges

Sales of single-family homes in Maine continue to be affected by rising mortgage interest rates and a smaller number of available homes for sale.

Maine Listings said this week that sales of single-family homes declined by 34.99% in January, compared to January 2022, with higher interest rates and lack of inventory being factors.

Yet the median sales price for homes sold in January was $325,000, an increase of 11.21% from $292,250 a year ago and right on par with the prior month. The median home price peaked in June 2022 at $360,825, and has come down since, but not at the same rate as the sales numbers.

“The sales numbers for January are impacted by the scarce for-sale inventory, recent upward adjustments to mortgage interest rates, and the end of year holiday season,” said Carmen McPhail, president of the Maine Association of Realtors and associate broker at United Country Lifestyle Properties of Maine with offices in Lincoln, Bangor and Lubec.

Higher interest rates are obviously a factor. But lack of inventory is also part of the story. There were 2,100 homes on the market in January, compared to 5,800 in the pre-pandemic days of January 2020, the Maine Association of Realtors said.

“In most communities across Maine, buyers need more for-sale housing inventory,” said McPhail.

Nationwide, sales declined by 36.1% and the median sales price was $363,100 in January, virtually unchanged from a year ago, up just 0.7%. In the Northeast, sales dropped 35.9% in January and the median sales price barely budged, up 0.3% to $383,000.

Southern Maine still fetching higher prices

In Cumberland County, home sales declined by 29.73% in January. The median sales price was $450,000, which is up from $425,000 in January 2022, when the market was still surging.

York County is the only other market in Maine where the median sales price is above $400,000. In January, it was $440,000, up from $410,000 a year earlier. Sales were also off sharply, though, down by 36.28%.

For more information on individual counties, visit the Maine Association of Realtors website.

Many of the factors discussed here were topics at the MEREDA Real Estate Forecast Conference last month.

0 Comments