Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Recession worries wane in JPMorgan Chase barometer

File photo / Tim Greenway

Michael Griffin of JPMorgan Chase leads a three-person commercial banking team based in Portland.

File photo / Tim Greenway

Michael Griffin of JPMorgan Chase leads a three-person commercial banking team based in Portland.

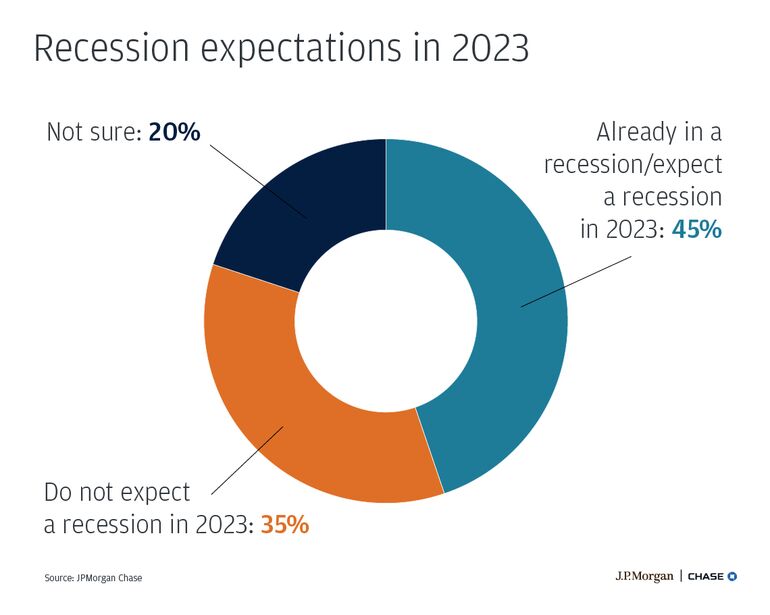

Courtesy / JPMorgan Chase, "2023 Midway Business Leaders Outlook."

Just under half (45%) of business leaders surveyed by JPMorgan Chase anticipate a recession before year-end of believe the economy is already in one, down from 65% with those expectations six months ago.

Courtesy / JPMorgan Chase, "2023 Midway Business Leaders Outlook."

Just under half (45%) of business leaders surveyed by JPMorgan Chase anticipate a recession before year-end of believe the economy is already in one, down from 65% with those expectations six months ago.

U.S. business leaders are growing less fearful of a recession, a survey by JPMorgan Chase shows.

Out of 625 executives polled between for the bank's mid-year outlook, less than half (45%) anticipate a recession this year or believe the economy is already in one, down from 65% with those expectations six months ago. The executives were polled between June 14 and July 5.

The moderated recession fears come as the majority of executives surveyed remain pessimistic or neutral in their economic outlook albeit slightly more optimistic about the global or national economy than at the start of 2023.

As for business challenges, nearly eight in 10 respondents (79%) said their cost of doing business had risen in the past six months, compared with 91% at the start of the year, while 75% said they are likely to continue to raise prices to mitigate costs.

In addition, nearly seven in 10 leaders (68%) want the U.S. Federal Reserve to pause interest rate rises in the current economic landscape.

Just last week, the Fed raised the target range for its main interest rate by 0.25%, to a rate in the 5.25%-5.50% range, and left the door open to further increases.

Maine readout

Michael Griffin, who leads JP Morgan Chase’s mid-market commercial banking team in Portland, said the findings were in line with what the trio has heard from leaders of mid-sized businesses in Maine over the last few months.

Asked what sectors in Maine are poised to weather a possible recession, he pointed to both forest products and life sciences.

"The forest-products sector appears poised to capitalize on new markets for wood products through its adoption of bio-based manufacturing and value-added wood products, including ones produced from sawmill by-products," he said.

In addition, "the local life sciences sector continues to experience robust growth and job opportunities, with many companies gaining recognition throughout the country and even globally."

At the other end of the spectrum, “Certain economic sectors that are more sensitive to changes in interest rates, such as housing, are more vulnerable in the current economic climate and may already consider themselves to be in a recession,” he said.

Griffin also said that Maine businesses face many of the same cost-related challenges as their peers nationwide. Those include costs of retaining and hiring employees, raw materials and capital due to frequent interest rate rises, and a few challenges “unique to the state” including high retail electricity costs, he said.

“Local small businesses also often bear indirect costs that impact their ability to find quality employees, such as rising housing and child care costs,” he added.

Mainebiz web partners

Related Content

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments