Riding out the storm: Amid economic uncertainty, Maine banks keep calm and carry on

Photo / Tim Greenway

Dan Walsh, president and CEO of Norway Savings Bank, is bullish on banks’ ability to weather the current turbulence.

Photo / Tim Greenway

Dan Walsh, president and CEO of Norway Savings Bank, is bullish on banks’ ability to weather the current turbulence.

In March 2023, the sudden collapse of three U.S. banks in quick succession — California’s Silvergate and Silicon Valley banks and New York-based Signature Bank — roiled financial markets and stoked fears over the durability of small, regional lenders.

Today, troubles at New York Community Bank are sparking fresh concerns about regional banks nationwide. The worries are centered on lenders that are heavily exposed to chunks of the estimated $2.2 trillion in commercial real estate debt set to mature by 2028 — and needing to be refinanced at higher interest rates.

Even in smaller, more conservative markets like Maine, whose community lenders pride themselves on their diversified portfolios, cautious approach and relationship banking, turbulence in commercial real estate “should be front and center for banks,” says Mark Williams, a finance lecturer at Boston University’s Questrom School of Business.

Banks should consider “battening down the hatches” by, for example, reducing real estate lending and demanding extra collateral, he says.

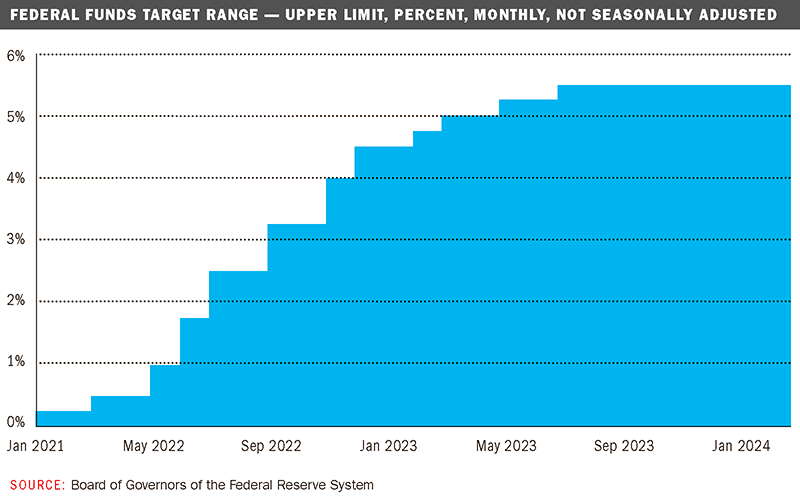

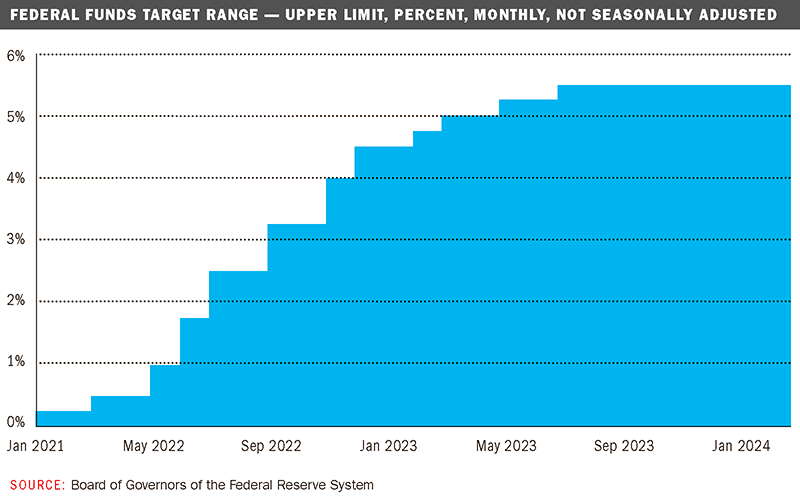

Like banks across the country, Maine banks are getting impatient for the Federal Reserve to cut interest rates after 11 increases starting in March 2022 pushed up the Fed’s main rate to a range of 5.25% to 5.5%, up from a range of 0.25% to 0.5%. Central bankers tightened monetary policy to tame inflation, which was a byproduct of the growing economy and heightened consumer spending amid supply-chain bottlenecks following the worst days of the pandemic.

“The Fed is really stressing the banking industry,” says Andrew Silsby, president and CEO of Augusta-based Kennebec Savings Bank. “The economic environment is really quite difficult, but I haven’t quite figured out whether we’re through the storm or in the eye of the storm.”

While central bankers on March 20 reaffirmed the likelihood of three rate reductions this year, the timing remains anyone’s guess. Markets have dialed back expectations for rate cuts, now betting that the Fed won’t start trimming borrowing costs until July.

For banks, higher interest rates can cut both ways. On the one hand, they can boost banks’ earnings from lending to consumer and commercial borrowers. However, if rates are too high for too long, that can strain the financials of current borrowers and dissuade new ones, hurting banks’ bottom line.

“We’re not losing money, but we’re not as profitable as we historically have been to do a normal amount of business,” says Dan Walsh, president and CEO of Norway Savings Bank. Deposits at Norway Savings fell 9.1% in 2023 to $1.48 billion at year-end, excluding deposits via third-party brokers, according to Maine Bankers Association data.

“We went from an environment where banks were awash in cash to where we are right now,” Walsh says.

Bullish on Maine banks’ ability to weather the current turbulence, he adds: “We are blessed with a lot of great banks in this market. It’s just unfortunate that our reputation gets sullied by the SVBs, the Signatures, the NYCBs.”

New York Community Bancorp Inc. (NYSE: NYCB) — owner of Flagstar Bank, one of the largest regional banks in the country — set off alarm bells on Wall Street in late January, when it posted a surprise fourth-quarter loss of $260 million. NYCB also slashed its quarterly dividend by 71% and boosted loan-loss provisions to $552 million from $62 million the previous quarter “to address weakness in the office sector, potential repricing risk in the multi-family portfolio, and an increase in classified assets.”

The bank’s shares have since lost about two-thirds of their value.

Commercial real estate in flux

While it remains to be seen whether a $1 billion equity infusion from private investors will be enough to keep NYCB afloat, the bank’s roller-coaster ride is adding to questions about the health of smaller, regional banks nationwide with large commercial property loan portfolios.

In December, Fitch Ratings cited commercial real estate as a growing concern for U.S. banks amid expected difficulties in refinancing certain office properties underwritten when interest rates were much lower, particularly in larger central business districts.

“This will ultimately increase [commercial real estate] credit costs for the banking industry,” Fitch said.

Because banks with less than $100 billion in assets have higher commercial real estate concentrations than their larger peers, losses in the category could result in the failure of a moderate number of smaller banks, Fitch warned in its report.

A separate study, by researchers at the Cambridge, Mass.-based National Bureau of Economic Research, found that if distress in the commercial real estate sector prompted half of all uninsured depositors to withdraw their funds, as many as 67 smaller banks with aggregate assets as high as $29 billion could become insolvent. And in a scenario where all uninsured depositors withdraw their funds, as many as 385 additional banks with aggregate assets as high as $500 billion could fail, according to the think tank report.

In early March, Fed Chair Jerome Powell told lawmakers that “there will be bank failures” due to commercial real estate exposure, “but this is not the bigger banks. It’s more smaller and medium-sized banks that have these issues.” However, “we’re working with them, we’re getting through it. I think it’s manageable.”

Maine is not Manhattan

While the pandemic-fueled shift to remote and hybrid work is creating big downtown office-tower vacancies in Manhattan and other demographic hotspots, occupancy rates remain strong in Maine and the Portland area, which bodes well for real estate lending.

“The scary headlines about the pending collapse of big city office markets like San Francisco, New York and Chicago simply don’t translate to Portland,” says Justin Lamontagne, partner and designated broker with the Dunham Group. “I don’t anticipate any direct pain in our downtown due to pending office vacancies.”

Echoing that point, Nate Stevens of the Boulos Co. expects a decline in office vacancy rates this year, “and possibly even leveling out or a decrease in the sublease rate as well.”

“In relation to lending, there’s has been a strong demand for owner-occupier office buildings,” he adds, “and I feel this demand will only increase if or when interest rates come down in 2024.”

Given Maine’s steady and growing property values over the last several years, Maine Bankers Association President Jim Roche says he’s not bothered by the Massachusetts think tank worst-case warning of up to 385 bank failures.

“The risk of this scenario in Maine, with extreme CRE distress, is quite low,” he says. “This was an academic study theorizing about a situation whose applicability to Maine is very limited.”

He adds that “we’re following headlines closely, but banks in Maine are strong.”

Gerard Cassidy, RBC Capital Markets’ Portland-based head of U.S. equity strategy and large-cap banking analyst, has similar confidence in Maine’s community banks. “Nothing is ever crisis-proof,” he says, but “as long as you’ve got good people running community banks without taking excessive risks and they have a strong base of deposits under $250,000, the banks are going to be very resilient.”

Maine’s big banks

In Maine, the bank with the biggest market share is Canada’s TD Bank (NYSE: TD), with around 13.4% of the state’s deposit base as of June 30, 2023, according to FDIC quarterly data.

The Toronto-based bank lends to a variety of industries in Maine from retail to forestry, according to Don Baker, TD Bank’s commercial market president for northern New England, TD Bank’s Maine deposits stood at $5.72 billion on June 30, 2023, a 0.2% uptick over the previous year, which Baker partly attributes to a blend of strength and scale with “the personalized feel of a regional bank.”

His outlook for the banking sector in 2024: With lower rates in the offing, “it is reasonable to expect that companies that were holding off on expansions, M&A deals or other investments will take on new credit to fuel those plans … We are also likely to see companies deploy some of the capital they’ve been holding as liquid assets.”

At Bangor Savings, the largest Maine-based bank and No. 2 in terms of market share, non-brokered deposits fell 10.8% in 2023 to around $5 billion, while No. 3 Camden National saw a 3.31% decrease last year.

Combined deposits at 23 commercial banks declined 4% in 2023, with only five institutions out of the 23 seeing increases, Maine Bankers Association data show.

Blaming a challenging “interest rate environment and well-publicized bank failures,” Camden National (Nasdaq: CAC) posted a 13% drop in fourth-quarter net income and earnings on Jan. 31. As of the end of 2023, commercial real estate loans made up 40% of the total — a level that President and CEO Simon Griffiths deems “comfortable.”

“Our portfolio is as diverse as the needs of the business customers we serve and is favorable in all concentration aspects, and we do not expect that to change,” Griffiths says. He also notes that the bank’s level of maturing commercial real estate loans is generally consistent from year to year, and that the majority of those loans will refinance with Camden National Bank.

Camden National shares declined 13.5% in the year to March 20, underperforming the 12.1% rise in the KRE Index that charts the stock market performance of U.S. regional banks. Over the same period, the broader S&P 500 stock index rose 32%.

“Similar to other community banks, our stock price has decreased due to uncertain macro-environmental factors,” Griffiths says. “Although our stock price is not where we would like it to be, we have a strong foundation, strong liquidity and a strong deposit base, which gives us confidence in our strategic path forward.”

At Bangor Savings, a mutual institution owned by its depositors, commercial real estate loans made up 30% of the total in 2023, down from 34% in 2022.

While the bank declined to say whether it expects to further reduce that percentage, spokeswoman Jaclyn Fish points to a diversified deposit base and loan portfolio, managed liquidity and long-term focus, and notes that the bank adapts quickly when needed.

“The bank remains well-prepared to navigate into the future with resilience and integrity,” she says.

Smaller banks

Among Maine’s smaller regional banks, First National Bank — owned by Damariscotta-based First Bancorp (Nasdaq: FNLC) — posted a 24.3% decline in 2023 net income and a 9.3.% jump in deposits. The bank has also raised its allowance for loan losses to 1.13% of total loans at the end of the fourth quarter, up from 0.87% a year earlier and slightly above 1.12% at the end of the previous quarter.

Concerning the bank’s loan portfolio, Tony McKim, the bank’s president and CEO, says that “we have stuck to the industries we know,” including tourism, hotels and restaurants, “as well as lending to seasoned borrowers … while staying away from, for the most part, commercial office space.”

He also underscores that “Maine banks know their communities and customers — not that the others don’t, but many of us have been around since the mid to late 1800s and take that heritage quite seriously.”

Elsewhere in rural Maine, Skowhegan Savings Bank CEO David Cyr says his bank has “very little change” to this year’s loan-loss provisions in light of a solid, diversified portfolio and “takes a conservative approach by setting aside a higher amount of reserves than the average Maine bank.”

He also says that his bank’s commercial real estate loans “aren’t typically structured with balloon payments, so our borrowers aren’t necessarily impacted during trying economic times.”

Back at Kennebec Savings in Augusta, Silsby says that although Maine banks have not seen an uptick in delays on loan repayments, that could quickly change, noting, “Everything is good until it’s not.”

On the Fed’s strategy to bring inflation down to its 2% target, Silsby says: “They are making good progress toward that goal, but it is a painful process for consumers, businesses and the banks.”

0 Comments