'Frothy' economy seen driving Maine M&A activity in 2022

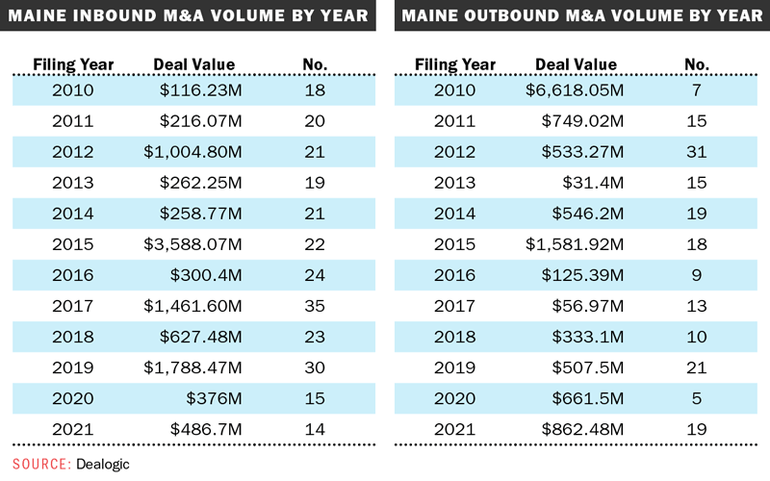

Data compiled by Dealogic for Mainebiz show Maine inbound and outbound M&A volume going back to 2010.

Data compiled by Dealogic for Mainebiz show Maine inbound and outbound M&A volume going back to 2010.

After last year's pickup in mergers and acquisitions involving Maine companies, experts predict continued momentum in 2022, in a myriad of sectors from health care to hospitality.

The bullish sentiment comes after an increase in both inbound and outbound deal activity, as reflected in data compiled for Mainebiz by Dealogic, a global financial markets platform headquartered in London.

Records show that the number of mergers and acquisitions initiated by Maine companies with out-of-state peers jumped from five transactions in 2020 to 19 in 2021, while the value of those transactions rose by 30% to $862.48 million in 2021.

During the same period, the value of so-called inbound deals, initiated by out-of-state companies joining with Maine peers, rose by 29% to $486.7 million. But the number of deals stayed relatively flat — indicating a higher average value per deal.

Maine-based corporate advisors expect strong traction again in 2022.

"With the economy being as frothy as it is right now, companies are trying to figure out whether to buy or do something else with their capital," said Jason Howe, a Portland-based partner in Preti Flaherty's business and real estate practice groups.

For companies thinking of buying, he recommends doing so sooner rather than later, given financial market volatility. "If they wait much longer, then it will be harder to get appraisals and go through the due diligence process," he told Mainebiz.

Howe said he's currently seeing more acquisitions than mergers, and expects to see that trend continue in sectors including manufacturing and hotels, especially waterfront locations and with owners nearing retirement age.

"A couple of hotel chains I work with are very bullish about the opportunities out there right now, and they are acquiring ... I would expect that to continue."

'Strong activity by Maine standards'

Similarly, Verrill partner Christopher Smith said that while his firm tends to observe stronger deal activity in Massachusetts and Connecticut, "we see — and hope to continue to see — strong activity by Maine standards for at least the near term."

Smith attributes the scenario to a couple of reasons. Those include aging business owners wanting to sell a family business, or growing businesses looking to strategic acquisitions to as the best way to expand their labor forces and/or customer bases.

"There's a lot of money out there, on the part of both investors and lenders, looking for a place to go," he said, "and therefore opportunities on both the buy- and sell-sides."

As for the market volatility factor, Smith said the "fit" between purchaser and target may be at least as important as timing. "Some of the most successful transactions that we see are ones where the acquirers take their time and do things right," he added.

However, he said that a general sense of economic uncertainty, including high inflation rates and a sense of an economic bubble of sorts may prompt some businesses to move up their transaction timelines.

"If — and that's always a big if — things stay on the current trajectory, it could be a busy year," he said.

At regional level, Smith said he's seeing significant M&A activity in manufacturing, technology, health care and veterinary and other services.

"Maine will participate in some of this, and also might see continued consolidation in banking and investment advisory services."

Portland IT firm to keep acquiring

Among Maine companies that were active acquirers in 2021 is Portland-based outsourcing and consulting firm Logically IT, which has made 10 acquisitions since 2019.

This week, Logically CEO Michelle Accardi, said the company plans to stay active on the deal front this year as well.

"While there is much uncertainty in the world around the pandemic, inflation, security risks and a myriad of other issues, one thing remains clear to Logically — we are in the right space to help customers secure and transform their businesses in order to keep pace with changing consumer and business demands," she told Mainebiz.

"During 2022 and beyond," she added, "we will continue to grow, invest and acquire quality managed service providers that can help us continue to lead the industry in providing the best service for our customers in the communities we serve across the United States."

0 Comments