Northeast construction industry predicts strong 2021, despite price hikes, delays

The construction industry in the Northeast has been strong through the pandemic — in part driven by the surging home building and renovation market — but there have also been price spikes and delays that are likely to continue, according to a white paper published this week by Consigli Construction.

The Massachusetts-based company, which has an office in Portland, released the report this week as an update to a June analysis of the effect of the pandemic on material and labor supply in the industry. The initial report queried 250 vendors and contractors, and the update surveyed another 200.

Peter Capone, director of purchasing for Consigli, said contractors are confident 2021 will be a good year, but there's also a shade of uncertainty driven by the political and economic climate and the continuing effects of the pandemic. He said that although subcontractors are reporting a healthy backlog and bidding on projects is high, most are actively seeking to book work for 2021 and 2022 because of the uncertainty.

After mandated shutdowns throughout the Northeast when the pandemic took hold in March, construction companies returned to work in late spring and early summer, and have been able to maintain current manpower demands, the survey found.

Combined with political uncertainty and the effect of tariffs, the pandemic months have caused price increases and slower delivery times of everything from HVAC and electrical components to custom fabricated materials to flooring, with increases in some of those areas expected to continue.

Capone said that there's potential for the construction market to trend back towards pre-COVID-19 levels of activity once a vaccine is developed, which will also drive up the cost of building in general.

Of the subcontractors surveyed, 93% are confident that they have the ability to hire additional staff if there's a surge in construction next year.

In general, "Based on the reported work backlog and other feedback, I’m optimistic that 2021 will be a good year for our industry," he said.

Residential buying, building surge

The single-family home building and renovation surge "has created the constant and heightened demand for materials in the new home market," Capone told Mainebiz. "COVID-19 dramatically altered the work environment across the nation. Employees, now working remotely, have been adapting to the new flexibility, moving from densely populated cities to the suburbs, taking advantage of low mortgage rates and less costly alternatives to living in the cities."

The lumber and carpentry industry has boomed this year, with costs up 100% since Jan. 1, according to the study.

Capone said that the residential construction industry will slow down as winter sets in, and things should settle down by Dec. 1.

The surge in residential construction, particularly home renovations, is partly driven by the surge in home sales in the state, Tom Cole, president of the Maine Association of Realtors, told Mainebiz last month. Maine single-family home sales, despite a strong dip in late spring, are on a trend to match 2019's record year.

"When someone buys a house, they have work done," he said, whether it's a kitchen overhaul, a new roof, painting or an addition. Lack of inventory is also boosting the new home industry, and have a big multiplier ripple.

"We need these people," Cole said. The economic activity in the real estate industry "is not just about sales, but about new construction, it's necessary and driving the economy for the state."

Risks to watch

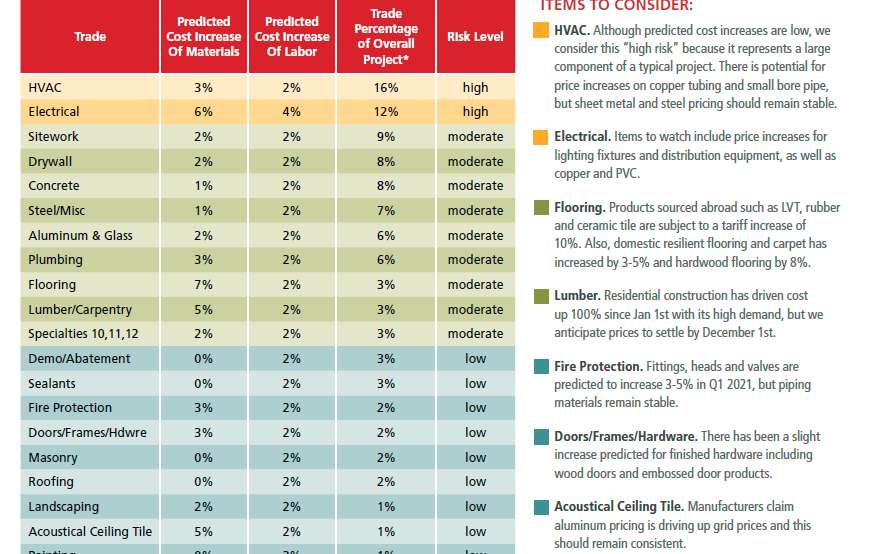

When the first study was published, June 12, the biggest takeaways were moderate price increases with spikes predicted, and minimal delays. Four months later, the update drilled down on what the risk of price and labor hikes is for individual materials and trades.

While materials delays have plagued some developers, more than half of those responding to the survey — 56% — said they haven't experienced significant delays. Of those experiencing delays, 23% say they've been one or two weeks on top of what's already anticipated, and 21% said three to four weeks.

That said, there are risks to watch for as economic and political uncertainty could increase delays in coming months, the report said. The biggest materials and labor price increases are expected in HVAC and electrical, where price increases won't be high, but since they are a big part of most construction projects, increases will be felt.

Risks to watch for, according to the analysis, include the following.

Glass and aluminum. "Small to mid-sized regional insulated and float glass suppliers appear to have struggled with COVID-19 and the result has been weak performance and unreliable deliveries," the study says. Delays have been two to four weeks greater than typical lead times. The study advises subcontractors to stick to larger national manufacturers to ensure schedule compliance.

Lumber. With high demand, the typical off-the-shelf items are running two to four weeks for delivery, the study says. That includes pressure-treated materials, kiln-dried materials, oriented strand board and plywood, and structural framing materials. "Suppliers should catch up as we move into the winter and residential building slows," the study says.

Distribution and transportation issues. Materials that were typically running four weeks after approvals are now running six to seven weeks for delivery, the study says. "Suppliers are having distribution and transportation issues with materials sitting on loading docks waiting for trucking companies weeks prior to shipment. This issue appears to be affecting delivery of flooring and other finished products."

Electrical lighting/gear/PVC. The report recommends adding three weeks to the typical four-week lead time for switchgear and distribution equipment, and four weeks to the typical lighting lead time, which typically varies from six to 12 weeks. PVC lead times have increased by two weeks.

Custom fabricated materials. All custom materials sourced domestically or from oversees continue to be an issue, and contracctors should expect an additional four to six weeks on top of the typical lead times. "This affects all trades, but in particular, HVAC, electrical, plumbing and flooring," it says. "When applicable, consider standard products."

Planning, keeping an eye on COVID-19

Capone said that as long as delay possibilities are identified early, managing materials with longer lead times shouldn't be an issue. "This comes along with properly defining and implementing early procurement of materials, and diligently tracking orders through the manufacturing cycle until shipped and received on sites," he said.

Disruptions to shipping company’s resource allocation because of the pandemic are still being felt.

"Stay at home work orders, precautionary restrictions and increase in the demand for shipping services in other sectors are still causing many delays," he said. As with the June report, shortening the supply chain by buying locally should be considered. "Although regional suppliers are showing signs of stress due to increased demand for their products," Capone said.

Consigli had some bumps because of COVID-19 protocols, but has successfully implemented them on all the company's project sites, large and small, he said. Besides Portland and Massachusetts, the company has offices in New York, Connecticut and Washington, D.C.

"Minor delays have obviously occurred," because loss of efficiency and stop work orders by local governments. "But with the help and support of our subcontractor partners, all of our projects are back in full swing and on track," he said. "Incorporating protocols into our schedules and managing these schedules has to remain a focus."

Mainebiz web partners

Its not that there is a shortage of trucks to deliver product, the trucking companies dont want to pay the low rates.

1 Comments